Martin & Co get more Xperience in London.

Martin & Co, the AIM-listed estate agency franchisor, announced the purchase of all four of the Xperience franchise estate agency brands, comprising CJ Hole, Parkers, Whitegates and in London and the South-East, Ellis & Co. They paid £6m to acquire Whitegates Estate Agency Ltd and Legal & General Franchising Ltd from Legal & General.

The enlarged group will consist of 283 offices and over 43,000 managed rental properties.

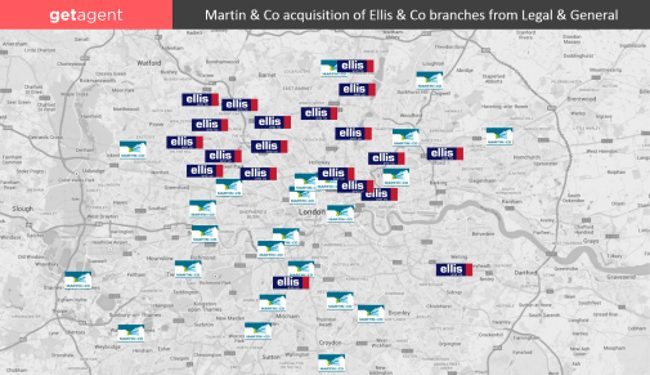

The Ellis & Co brand adds 21 franchise offices to the existing 26 Martin & Co offices in London. Only two of the new offices overlap with existing ‘franchise areas’.

According to GetAgent, the estate agent comparison site, Ellis & Co have listed 572 properties in London over the past 6 months. Martin & Co’s combined London branches listed 358 properties for sale over the same 6 month period.

Known primarily as a lettings agent, the company introduced estate agency services in 2012, alongside a rebrand.

The acquisition of mostly estate agency offices from Legal & General gives the enlarged franchise group a stronger foothold in the current property sales boom being experienced since 2009.

Alongside other estate agency stocks like Foxtons and Countrywide, Martin & Co has been trading at 12 months lows in October, with the share price going as low as 100p. However the acquisition news has boosted the share price to 125p with a wide spread of 122-128p, giving the company a market capitalisation of £25m and a price-to-earnings ratio of 35.7.

Franchisees, in addition to start-up support costs, pay 9% plus VAT to Martin & Co. There is clear scope for Martin & Co to extract cost savings from the deal. What will be interesting is if the group decide to unite the offices in London under one brand, or continue to operate two different names.

Also of note, Xperience Group had signed up to the upcoming Agents’ Mutual portal. Will that deal be honoured? And will Martin & Co commit all their branches to OnTheMarket.com?

Financial background

The Xperience business has seen little top-line turnover growth in 18 years, however profit grew sharply from £170k in 2000 to £525k by 2007. However, they suffered in the wake of the credit crunch alongside the general decline in the property market, posting an £87k profit the year after.

The extent of the UK property market recovery is clear in these financial results: while the dire situation of 2007-08 is no longer prevalent, we’ll never see pre-crash volumes of home sales again.

From 89 agency franchise branches, Xperience recorded a pre-tax profit of £341,167 on turnover of £1,187,362 in the year ending 31 December 2013,according to filings with Companies House.

This compares with Martin & Co earning £1.6m pre-tax profit (excluding exceptional items) on turnover of £3.7m over the same 12 month period ending 31 December 2013.

An FT article at the time of Martin & Co’s floatation reported: “The agency has a 1.7 per cent share of the overall letting market in the UK. Although this figure is small, it is the largest business in the sector, underlining how fragmented the market is.”)