Benham & Reeves Market Index Review

September 13, 2019

Property market shows signs of life but asking price expectations remain out of kilter with wider market conditions

The latest Market Index Review report by lettings and sales agent, Benham and Reeves, has looked at the current state of UK and London property prices based on aggregated data from the four leading house price indices (Halifax, Nationwide, Rightmove and the Land Registry), as well as the current reality gap between the mortgage approval prices of home buyers, the asking price expectation of sellers and the reality of sold prices in current market conditions.

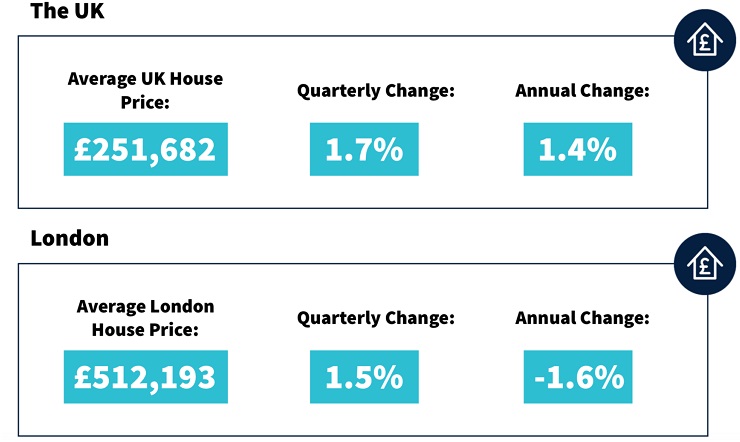

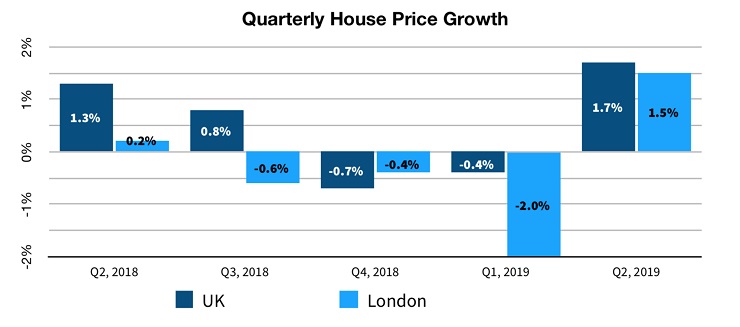

- The latest report shows that based on date from Nationwide, Halifax, Rightmove and the Land Registry, the current UK house price during the second quarter of this year is £251,682, up 1.7% quarterly and 1.4% annually – the first quarterly increase since Q3, 2018.

- In London, the current average price is £512,193, up 1.5% annually and the first quarterly increase since Q2, 2018, although prices are still down -1.6% annually.

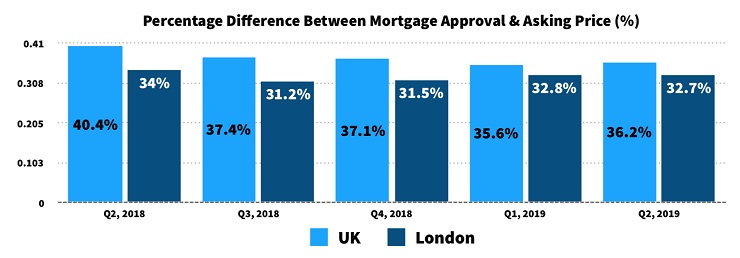

- When looking at the price buyers are securing at the mortgage approval stage compared to the asking price expectations of home sellers, there is a 36.2% gap across the UK and a 32.7% gap in the capital.

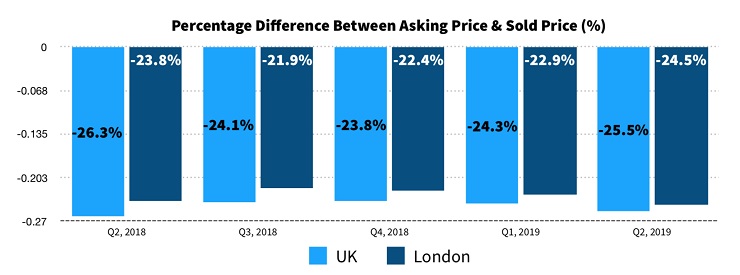

- When looking at the final stages of the property selling process, UK buyers are paying -25.5% less on average than the average asking price, while in London, buyers are paying -24.5% less than the average asking price in the capital.

You May Also Enjoy

Why 2026 is the Best Year to Invest in Dominican Republic Land

If you’re eyeing Caribbean real estate, 2026 offers an exceptional window to invest in Dominican Republic land. The country has emerged as the fastest-growing Caribbean economy, creating ideal conditions for land investors. Tax incentives, infrastructure projects, and rising international interest are converging at just the right moment. Whether you’re searching for beach land for sale…

Read More Property expert on how to bag the BEST mortgage deal in today’s market

Finding a good mortgage deal in today’s market demands more than just comparing rates. While the average 2-year and 5-year fixed mortgage rates have gone down this year, they’re still higher than rates pre-pandemic. This means those in their current homes will have to pay more than they once were each month, and new buyers…

Read More Halloween Named the UK’s Most Popular Moving Day of 2025

Halloween was the most popular day to move house in 2025, breaking the long-standing trend of summer being the busiest time for home moves. We analysed the data and spoke to industry experts to understand why the peak moving day has shifted and why it fell on an international holiday. Compare My Move reviewed more than 170,000 house moves made in 2025 and…

Read More Industry Response to Halifax House Price Index

Industry response to the Halifax House Price Index December 2025 The latest index shows that: – On a monthly basis, house prices fell by 0.6% between November and December of last year. Annually, house prices were up 0.3% versus this time last year, although this annual rate of growth had slowed from 0.7% the previous…

Read More Halifax House Price Index December 2025

House prices in December 2025 were 0.3% higher compared to the same month a year earlier. UK house prices dipped in December • House prices dipped by -0.6% in December, following a -0.1% fall in November • Average property price is now £297,755, the lowest since June • Annual growth slowed to +0.3%, down from…

Read More Homebuyer demand returns following Autumn Budget

New research from Property DriveBuy reveals that Bristol, Tyne & Wear, and South Yorkshire emerged as the UK’s most in-demand areas of the housing market following the Autumn Budget, with as many as 61% of homes listed for sale successfully securing a buyer in Q4 2025. Property Drivebuy analysed residential listings data across the nation…

Read More