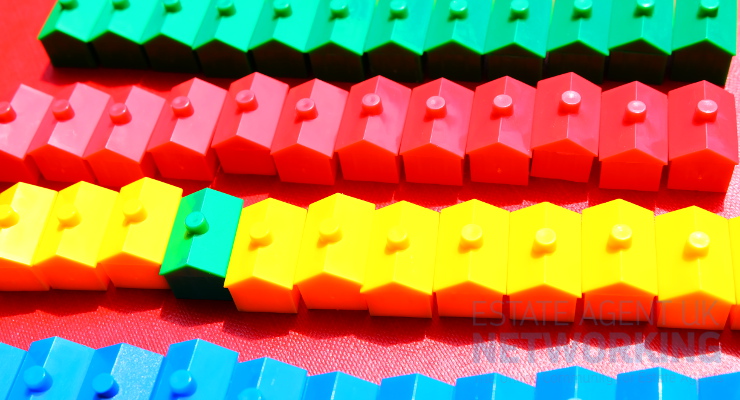

Housing delivery up with a 24% increase in affordable homes

The latest data from Homes England shows that between April and September of this year there were: –

- 16,955 housing starts and 14,792 completions delivered by schemes managed by Homes England (Excluding London).

- Starts are at their highest for 10 years, however completions have dropped year on year although they remain at their second highest levels since 2011.

- 73% of starts were for affordable homes, up 24% year on year.

- 10,295 completions were delivered as affordable homes, 70% of the total. Although this is a reduction of 7% year on year.

Please find comment below from new home specialists, Stone Real Estate.

Founder and CEO of Stone Real Estate, Michael Stone, commented:

“Good news on the face of it with a commendable number of homes being delivered, with the majority of these being affordable.

While the devil in the detail is a slight drop in completions, the level of homes being delivered is still some of the highest in the last 10 years.

Wider market trends suggest that with such a positive uplift in the number of homes started, the knock-on effect will be yet a further increase in the level of homes being delivered early next year, despite who takes the keys to number 10.”