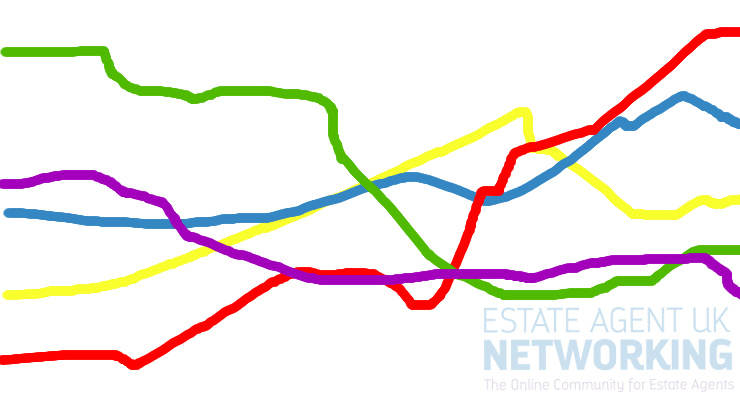

The investment recovery timeline – Which market bounces back the quickest?

Leading peer to peer lending platform, Sourced Capital, has looked at which investment options could recover the quickest in the wake of the current pandemic as markets across the board are currently, or are predicted, to take a hit.

Soured Capital looked at the decline seen in the most recent recession across real estate, oil, precious metals, a number of market indices and four of the top companies based on market cap.

Sourced Capital then looked at how long it took each category to return to its pre-crash peak to see which could provide the quickest return in a post-pandemic market, and which will take slightly longer to return to health.

Investors today have a wide choice of where to place their / their clients money from those out to buy amd shares to those looking at real estate / land investments.

See the full data table here.

Oil (No recovery)

When it comes to what not to invest in, then based on previous data oil is the one to steer clear from. Peaking at $126.32 per barrel of Brent crude and $126.94 per barrel of WTI crude, prices halved to $61.87 and $62.44 a barrel respectively by the end of the last recession and are yet to recover.

Company shares (12-18 months)

The good news for big business is that the likes of Microsoft, Apple, Amazon and Alphabet (Google) saw some of the quickest recovery times, and while share prices dropped across all but one, they took between 12 and 18 months to recover to their pre-recession peaks.

Precious metals (18 months)

Gold bucked the trend during the last recession and actually increased in value while silver dropped from $16.92 per ounce to $13.83. However, it took just 18 months to recover to its pre-crash peak.

Market Indices (33-81 months)

When it comes to the main market indices, recovery times tend to be more erratic, with the Dax 30 Index seeing 33 months to return to its pre-crash peak, followed by the FTSE 100 at 36 months. Across the board, they average 52 months, however, the CAC 40 took 81 months to recover back to its pre-recession peak.

Property (39-72 months)

It took UK property prices 72 months to exceed their pre-crash peak of £183,082, having fallen to a low of £157,806 at the end of the last recession. However, property investment is all about location and in London, this recovery time fell to just 39 months with the market returning to form far quicker.