Breaking Property News – 14/09/2023

Daily bite-sized proptech and property news in partnership with Proptech-X.

Facilio – breaking technological barriers to excel in a competitive Facilities Management arena

Prabhu Ramachandran is the CEO & Co-founder of proptech company Facilio Inc. which offers cloud software solutions to manage the built environment. Headquartered in New York City with offices in Dubai, London, Chennai, Australia & Singapore, Facilio is a global company backed by leading investors including Accel Partners, Tiger Global Management, Dragoneer Investment, and Brookfield.

Here Prabhu gives his thoughts and oversight on the changing landscape of facility management as it moves from analogue to digital,

‘Remember when IT was a humble back office function, typically depicted in movies and TV as the team that sits in a dark and dingy basement office covered in wires and servers? Something changed the face of IT, which was essentially a back-office accounting resource, and what it meant to a company–bringing it from the basement to the executive’s table, transforming it from a cost centre to a strategic lever.

The thing that changed was technology, advances facilitated the digitization of core business processes like financial asset management, accounting, order processing, production scheduling, and more, proving the ability of IT to align with strategic business objectives and significantly impact costs and capability.

Similarly, the finance and accounting departments earned a seat at the table by integrating advanced technologies to revolutionize how financial data is processed, analysed, and utilized to support strategic decision-making. Parallel to the finance/IT functions, technological innovations have revolutionized how facilities are managed, enhancing efficiency, customer experience, sustainability, and cost-effectiveness while elevating the role of facilities management in supporting broader organizational goals.

Beyond service delivery at cost: The evolving role of FM

Traditionally, the cost factor was the north star metric for facilities management companies (FMs). However, organizations began to recognize the significant business value and insight the efficient management of their facilities could represent for their operations, with technology as an enabler for this paradigm shift.

From the 1960s, when the first CMMS was developed by the U.S. Navy, to now, when more advanced technologies like integrating IoT sensors, real-time data analytics, and predictive maintenance, technology has profoundly impacted FM. The transformation was already underway, and the COVID-19 pandemic forced FMs to accelerate this transformation to adapt to increasingly complex building needs post-pandemic.

Today, there is a lot of pressure on FMs to find new and innovative ways to deliver exceptional customer experience and agile responses to the rapidly evolving needs of facilities across various service lines.

Beneath the obvious: What’s weighing FMs down today?

A recent report found that the worldwide facilities management market was worth $42.2 billion in 2021 and is expected to reach $76.3 billion by 2026, growing at 12.6% from 2021 to 2026. In such a competitive market, offering only lower costs than the competition is rarely enough. FM leaders should think about creating effective operational strategies that support differentiation and unlock business value from intuitive insights.

The biggest hurdles on the path to enabling these new expectations of FMs are:

- Resolving internal inefficiencies to unify people, processes, and systems across service lines to deliver business insights to various stakeholders and go from being just another FM vendor to an indispensable business partner.

- Centralizing all FM functions to deliver an integrated FM experience with customer experience, demand-based agile response, flexibility, and scalability at its heart.

- Enabling scalability with platforms that allow adding new features to the existing tech stack rather than purchasing new solutions that warrant arduous integrations.

- Facilitating hassle-free addition of new service lines to accommodate evolving O&M needs with exceptional service delivery and expanding into new verticals with quick and efficient project kick-offs.

To stay competitive, FM service providers must adopt forward-thinking technologies to become strategic partners who actively contribute to wellness, decarbonization, and net-zero goals.

Fusing technology and strategy for greater business impact

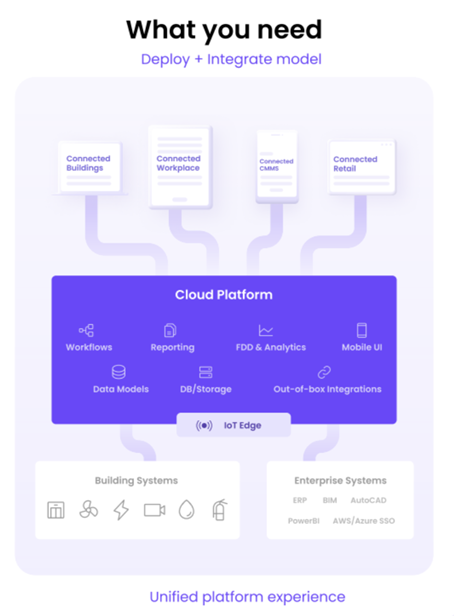

If executed correctly, an integrated FM system could help FMs realize outcomes like: Shift to a holistic approach and rationalize the existing tech stack to manage all operations from a single pane of glass, Quick deployments for new clients with standard requirements in existing service lines and Lower development efforts and faster time to market for clients/service lines with custom use cases.

Plus the ability to; Monitor key metrics and performance indicators in real time, Gain visibility and actionable insights into operations across client portfolios, Enable teams with the ability to respond quickly to property management needs and effectively collaborate across devices, Seamlessly support adding new business lines and digital initiatives and Standardize service delivery and orchestrate all business processes from one scalable, robust SaaS infrastructure

Time for an automated approach

Traditional FM software creates friction and silos, forcing property operators to work within the confines of predefined workflows, hindering their ability to provide customized, truly customer-centric experiences. They need a cloud-based solution that expands the boundaries of operations software beyond work orders and maintenance to automate processes, enable stakeholder engagement, and drive connected efficiency—all in one place. This allows customers to easily fill gaps in their tech stack, gain immediate value, and eventually transition from point solutions to seamless, interoperable modules.

Enable agile response for reactive maintenance

The unpredictability of reactive maintenance directly affects customer satisfaction, resolution time, and operational struggles like managing assets and inventories against the workload, unplanned costs, and technician availability. To deliver truly agile demand-responsiveness, it is imperative that reactive maintenance be automated.

The good news is that automating reactive maintenance isn’t an oxymoron–not with a Connected CMMS like Facilio, which caters to all stakeholders and centralizes building operations by integrating people, systems, and processes. This way, everything from budget approvals, purchase orders, vendor communication, work orders, and resolution time benchmarks sits on a single platform.

Bridge in-house and contracted operations with a unified platform

FMs are in a similar place, where they know the cost of everything but are unable to deliver value from their services, credit to the siloed systems legacy CaFM create, forcing property operators to manage workflows instead of facilities, hindering their ability to offer customer-centric services and optimal building performance. Further, incompatible systems break the flow of O&M information and render valuable data inaccessible across the board.

FMs need an integrated O&M platform that presents opportunities to optimize portfolio-wide performance by becoming a single ecosystem to manage in-house and contracted operations, powering multiple applications to enable growth and expand to newer verticals and service lines. The seamless interoperability would enable the orchestration and automation of end-to-end operations and business processes, enabling you to improve service quality and gain complete operational visibility through a single pane of glass.

Charting a course from conventional to extraordinary FM

As the FM market continues to grow, it is not enough to focus solely on cost; the true measure of success lies in how effectively FMs can integrate strategy and technology to deliver exceptional experiences, align with organizational goals, and contribute to a sustainable future. By breaking down silos, embracing automation, and adopting forward-thinking solutions, FM service providers can transcend traditional boundaries and become invaluable partners driving success, innovation, and excellence across diverse verticals.

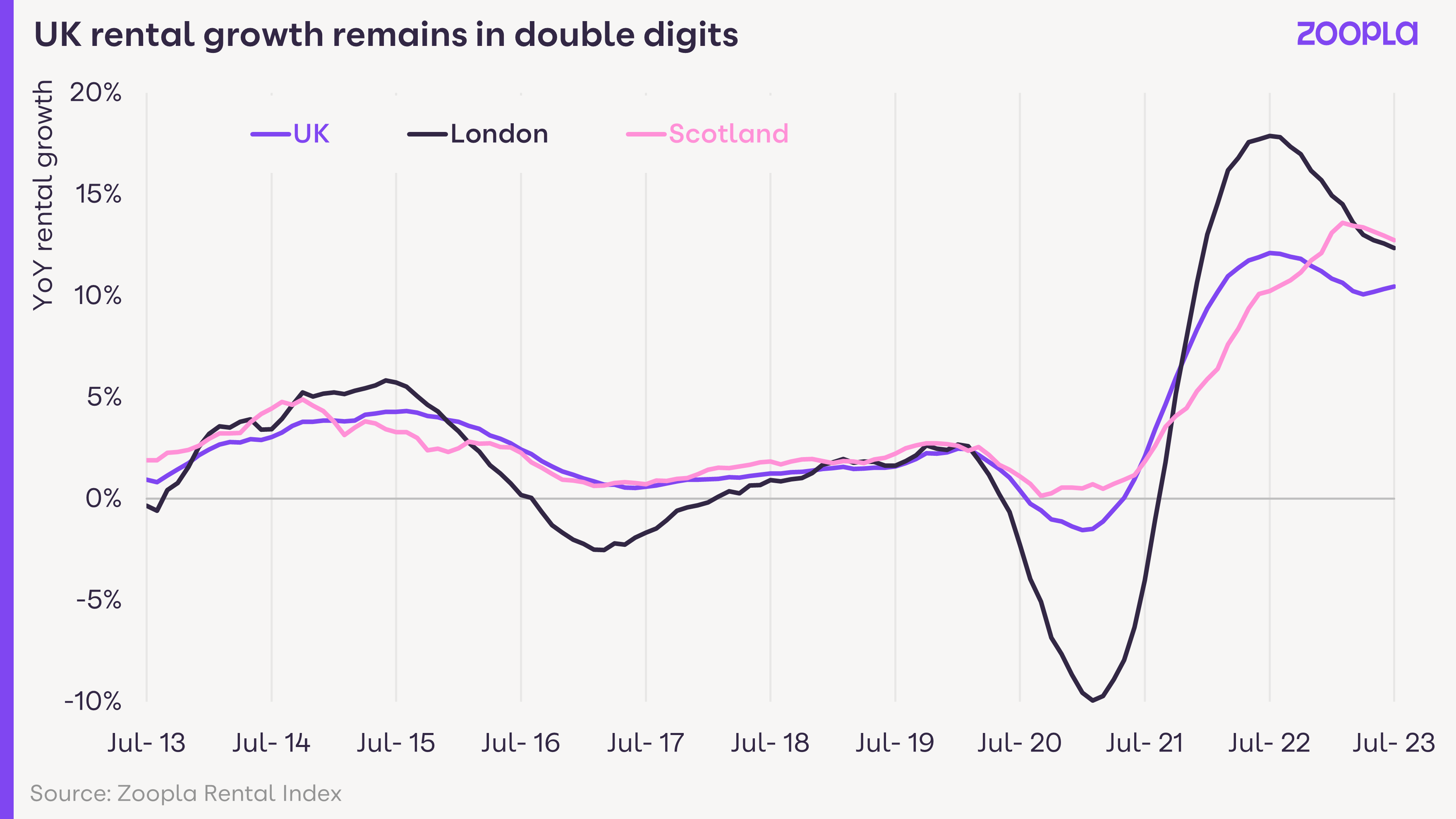

Zoopla says 18-months of double-digit rental inflation

Demand for rented homes is slowing off a very high base but rental supply remains low, keeping an upward pressure on rents. Demand for rented homes is 20% lower than a year ago but still 51% above the 5-year average.

The number of homes for rent is 20% higher than a year ago but remains 30% below average for this time of year. This supply/demand mismatch is an established feature of the rental market across all regions and countries of the UK. Annual UK rental growth is currently 10.5%, down from 12.1% a year ago as demand moderates and supply slowly improves. Rental growth has been running in double digits for 18 months. Average rents have increased by £110 per month over the last year – an annual increase of £1,320.

Over the last 3 years, rents for new lets are up by an average of £2,772 per year, compounding cost-of-living pressures for renters. The affordability of renting will have an increasingly important impact on rental growth in the coming months.

+12.7%Annual rental inflation in Scotland – the highest in the UK

Scotland registers highest rental growth

Annual rental growth ranges from 4.2% in Northern Ireland to 12.7% in Scotland, which has overtaken London as the area with the fastest rental growth. Rents for new lets in Scottish cities are 15.6% higher in Edinburgh and Dundee and up 13.7% in Glasgow.

The introduction of rent controls in September 2022 is a key factor here. These have capped increases in rents for existing tenancies at 3% a year. As properties become vacant, landlords can reset the rent to the full market rate. This means landlords are seeking to maximise the rent for new tenancies to cover increased costs and allow for the fact that future rent increases will be capped over the life of the tenancy. This has added extra impetus for rental growth in Scotland versus other parts of the UK.

Persistent supply/demand mismatch

The rental market remains stuck in a period of low supply and high demand. Growing rental supply is the most efficient and sustainable way to reduce rental growth. However, levels of home building and net new investment by private landlords is falling and set to remain weak into 2024 due to the impact of higher borrowing costs.

New investment from corporate landlords via ‘build-to-rent’ is a bright spot, boosting supply in many city centres. However, rental levels set by corporate landlords are above-average and not at a scale to impact the wider market. Many existing renters will also try to avoid moving and paying a higher rent, delivering a further drag on available supply. The net result is that the average estate agent has less than 10 homes to rent compared to a pre-pandemic average of 16.5 homes.

Demand for rented homes continues to be driven by multiple factors. The strength of the labour market and job creation is a key driver of rental demand, as is record levels of immigration. This was particularly apparent a year ago as international borders re-opened with an influx of overseas students returning to study in the UK. The number of renters chasing each property for rent spiked to a record high over the summer of 2022.

Demand has risen again this year, tracking the seasonal trend, but is now 20% lower than a year ago. Rental demand is also boosted by higher mortgage rates, which have increased the cost of buying, keeping more would-be buyers in the rented sector. Mortgage repayments for a first-time buyer are more expensive than rental costs at 5.5% mortgage rates. The greatest impact of this is being seen across southern England.

The net result of these trends is that the current supply/demand imbalance shows no sign of reversing as we move into 2024. Rental growth in the near term is set to be shaped more by the affordability of renting, and how renters adapt to higher rents, than major shifts in supply and/or demand.

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X