WEEKLY NEWS ROUND UP – 27/10/23

A roundup of the week’s top property and proptech news stories in partnership with Proptech-X

CoStar Group looks to acquire OnTheMarket and topple Rightmove

Backed by Costar Group’s fortress balance sheet, the acquisition seeks to create number one UK property portal by combining the strengths of leading commercial property site, CoStar, with OnTheMarket’s large network of agents, and Homes.com, a leading U.S. residential portal.

PRESS RELEASE WASHINGTON – October 2023 — CoStar Group, Inc. (NASDAQ: CSGP), a leading global provider of online real estate marketplaces, information, and analytics, announced a proposal today to acquire OnTheMarket, the third most visited residential property portal in the United Kingdom, for £1.10 per share in cash or approximately £100 million.

OnTheMarket was founded by agents in 2013 to provide a competitive alternative to the existing UK property portals. Since then, it has successfully developed a large network of agents and property listings by taking an agent-friendly approach. Today, OnTheMarket has over 13,000 agent advertisers and attracts high intent leads at a fraction of the cost of other UK portals.

CoStar Group, is an S&P 500 and NASDAQ 100 company and is a leading global operator of property portals. CoStar’s websites drew approximately 280 million visits in September, roughly twice the monthly visits reported by Rightmove . CoStar Group operates one of the most successful and heavily trafficked residential portal networks in the U.S. with 240 million visits to Homes.com and Apartments.com in September1. CoStar Group has operated the top commercial property information, analytics and news site, CoStar, for two decades, as well as LoopNet, the leading commercial property portal in the UK.

CoStar Group collects information in approximately 190 countries, has clients in over 135 countries, and operates 28 property portals, investing billions creating the best consumer website experiences. CoStar Group is a proven product and technology market leader, backed by almost 1,200 software developers who work with the industry’s best content, data, and research to continually build new tools that improve the efficiency of property markets and serve hundreds of millions of users every month.

‘The benefits to agents can be seen in direct time and cost savings, as tlyfe removes the time and money spent on traditional tenant sourcing and referencing methods. Because tenants pre-qualify and reference themselves providing you with verified and certified documents, so agents can skip unnecessary viewings and focus on closing deals with confidence.

Chesterons UK acquired by Proptech Emeria

Proptech – Property technology – the digital transformation of real estate – it is quite a simple formula – instead of trying to sell into and then retrofit piece by piece new operating models and software into disengaged estate agencies, we will see many more proptechs like Emeria scoop up established, analogue agency players and leverage the true profit line through the roof. A pattern we will see more and more of as Covid-19 proved that ‘property’ the plan, build, sale, lease and management of real estate assets is perfectly aligned to the efficiencies of a digital rather than human model.

Why this sale at this time? Well at the moment many Proptech players such as Emeria (already operating across a number of property asset verticals and in a number of countries) are hungry for new clients, they have the deliverable state of the art digital solutions, but it is often a go slow war of attrition to generate new sticky users.

But by buying an agency you then have your own business that you can convert using the technology your company owns. So in many ways you do not just acquire an agency you are buying a distribution hub for all your services, this is a strategic way to grow in a down global economic market. Re-inventing established agency brands and equiping them to trade profitably in a digital age.

Ascendix thought leadership on real estate software and commercial real estate trends

Wes Snow CEO of Ascendix shares once again more thoughts and analysis, giving his personal overview on real estate software and commercial real estate technologies that simplify workflows and soften the challenges in adopting great products. He also dives into the latest Commercial Real Estate technology trends to help you strategize and adopt the latest technology before it becomes mainstream.

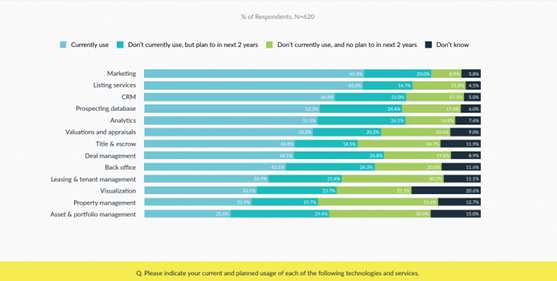

Here then is some comprehensive thought leadership from Wes Snow CEO of Ascendix, ‘Today, when technology is conquering the world and makes people’s lives easier it is impossible to believe that many commercial real estate brokers are still using Excel spreadsheets, google docs, and other unautomated resources. In fact, only 25.6% of brokers utilize technology for asset and portfolio management, and slightly more – 31.9% – for property management.

Source: 2022 DNA of CRE report by Buildout

As a result, property professionals spend most of their time editing, writing, and managing data instead of closing the deals. Fortunately, the real estate industry has not been left behind in the technological revolution. Numerous advanced technologies and software solutions are available to streamline the work processes of landlords and tenants, making their workflow more efficient and fruitful.

What are the benefits of Commercial Real Estate Technology for Brokers?

While some brokers tend to stick to the old-fashioned ways to contact landlords and tenants, others are effectively leveraging various CRE technologies to make their work process effective and fruitful. Here are some statistics highlighting how CRE technology helps brokers save time.