Breaking Property News – 09/02/24

Daily bite-sized proptech and property news in partnership with Proptech-X.

Ascendix – Traditional property search and what’s wrong with it?

I have spent every day for the past seven-years pushing for the digital transformation of real estate, digitising analogue legacy systems, so it is great to see Ascendix shining a spotlight on all that is wrong about the usual clunky property consumer search journey, and how to fix it. The following excellent analysis was written by Ascendix’s Yana Yarotska.

‘Property search is usually a hard task requiring plenty of effort, research, and time. To accomplish this, the majority of modern rental marketplaces offer keyword search in combination with filters and Geo-search. But if future tenants are not sure about what exactly they want, or are just browsing, these search approaches simply do not work.

Imagine if users could talk to the search bar, just like they talk to ChatGPT, and get results that fully match their needs. It would be like having a conversation with a friend who understands exactly what they’re looking for. AI-powered search and Natural Language Processing algorithms do just that. In our article, we explore how this process happens, and investigate AI search from the perspective of a customer and the technology behind it.

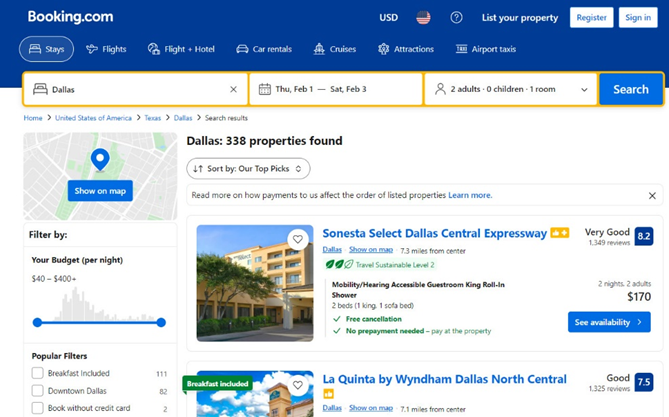

Most real estate portals and booking websites employ a combination of keyword and faceted search (filters and sorting), e.g., Booking.com or Airbnb, with the addition of Geo-search. While filtering involves toggling through property criteria, keyword search aims to precisely match user queries with website content, akin to using a book index.

Traditional Filter Search | Source: Booking.com

Despite being straightforward and familiar to users, these search algorithms may not always be effective in the real estate context. For keyword search, for example, obvious drawbacks are:

Lack of context. Keyword search rarely has the ability to understand the context, leading to potential misinterpretations of the query, and, therefore, irrelevant results. For instance, the real estate term ‘flat‘ may refer to an apartment, a characteristic, or informal pricing, leading to potentially irrelevant results.

InventoryBase – a Landlords guide to better tenant retention

In the ever-evolving property landscape, one fundamental truth remains – tenant retention is the cornerstone of any successful property business. Landlords who can recognise the value inherent in keeping their tenants content and committed for the long term will undoubtedly enjoy a much more profitable and sustainable property business.

Tenant retention isn’t just about maintaining occupancy rates, it’s about fostering an environment where both landlords and tenants thrive, and there are many compelling reasons why tenant retention should be at the forefront of every landlord’s strategy.

As seasoned landlords and property managers will attest, the benefits of tenant retention extend far beyond avoiding the hassles that come with vacancy turnover. Whether it’s to boost financial stability, reduce operational costs or foster a more harmonious living environment, we’ll explore 15 ideas for landlords to boost tenant retention in 2024.

Why is tenant retention important? Happy tenants equal a happy landlord. Tenant retention can save landlords money and is easier than having to regularly find suitable new people to occupy a property for rent. Tenant retention also delivers a steady, more predictable flow of income while at the same time reducing the myriad expenses associated with vacancies, screening new tenants, and marketing a property.

As the costs associated with letting out even one property are often considerable, securing a reliable tenancy becomes a landlord’s strongest asset when they own multiple residences. A vacant property ultimately means that the landlord is losing out on rental income. With mortgage responsibilities to meet, it can soon feel like a nightmare to have a property unoccupied. Tenant retention is also vital for financial peace of mind and business viability, bypassing negative consequences like missed payments and fees.

Tlyfe App ends the rental lottery for tenants

Adam Pigott CEO asks tenants, ‘Are you queuing for a viewing? Fed up with the rental lottery? Then it is time to get acquainted with tlyfe, the smart App that simplifies your renting experience and sets you apart from the crowd.’

Adam further comments, that if tenants download tlyfe, they get to, ‘Fast track to the front of the queue with the pre-qualification feature. Build a positive credit history by linking their rental payments to the Apps credit score builder. View and manage their TDS protected tenancy deposit for maximum piece of mind. Also tenants can store their important documents in the vault and access helpful supporting guidance via the information hub’.

Going into more detail Adam explains that tlyfe is a tenant centric way to navigate the increasingly choppy rental waters, where scarcity of inventory is making it even harder for tenants to find that next home to live in. Though the App is for tenants, it also was built very much to satisfy the needs of landlords and letting agents in the sense that serves as a trusted way of proving a tenant is ready and able to take up a tenancy, which of course cuts down on the administration and profiling of potential tenants.

Prior to developing tlyfe with Openbrix founder Shahad Choudhury (pictured), Adam spent many years in the lettings industry first in corporate agency then looking after and building his own lettings ’empire’ so he and the team fully understand what ‘excellent’ looks like and needs to be when designing the tlyfe App. Adam further comments,