Petitions to Wind Up Company of c/o Cream Group #CreamClub.

- Taken from online sources, not confirmed and not of the opinion / speculation of Estate Agent Networking:

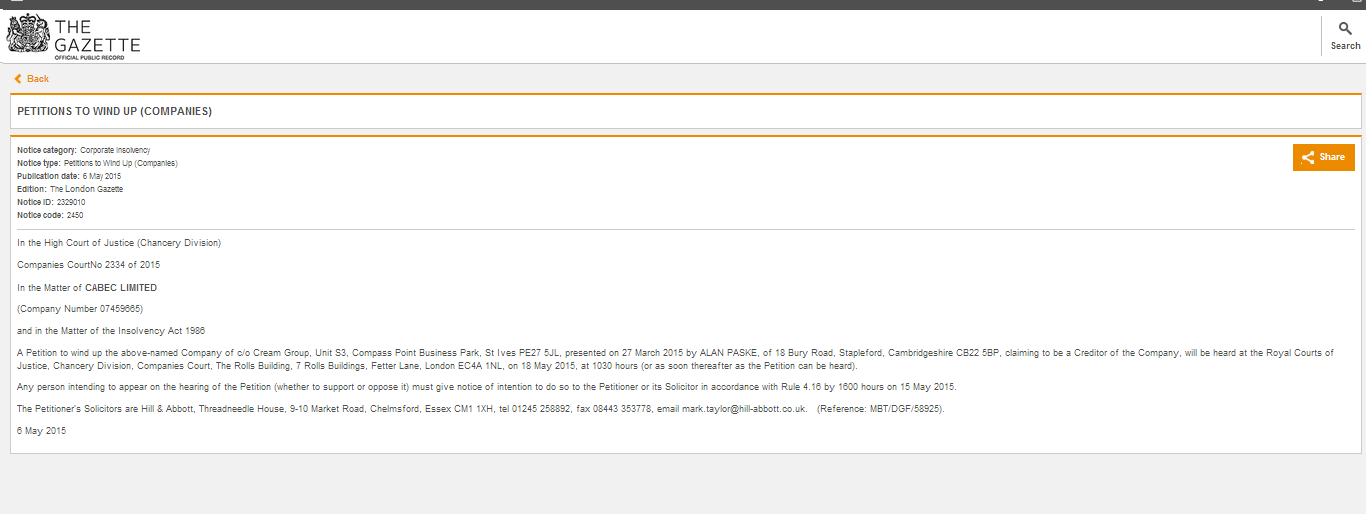

- Notice category:

- Corporate Insolvency

- Notice type:

- Petitions to Wind Up (Companies)

- Publication date:

- Edition:

- The London Gazette

- Notice ID:

- 2329010

- Notice code:

- 2450

In the High Court of Justice (Chancery Division)

Companies CourtNo 2334 of 2015

In the Matter of CABEC LIMITED

(Company Number 07459665)

and in the Matter of the Insolvency Act 1986

A Petition to wind up the above-named Company of c/o Cream Group, Unit S3, Compass Point Business Park, St Ives PE27 5JL, presented on 27 March 2015 by ALAN PASKE, of 18 Bury Road, Stapleford, Cambridgeshire CB22 5BP, claiming to be a Creditor of the Company, will be heard at the Royal Courts of Justice, Chancery Division, Companies Court, The Rolls Building, 7 Rolls Buildings, Fetter Lane, London EC4A 1NL, on 18 May 2015, at1030 hours (or as soon thereafter as the Petition can be heard).

Any person intending to appear on the hearing of the Petition (whether to support or oppose it) must give notice of intention to do so to the Petitioner or its Solicitor in accordance with Rule 4.16 by 1600 hours on 15 May 2015.

The Petitioner’s Solicitors are Hill & Abbott, Threadneedle House, 9-10 Market Road, Chelmsford, Essex CM1 1XH, tel 01245 258892, fax 08443 353778, email mark.taylor@hill-abbott.co.uk. (Reference: MBT/DGF/58925).

6 May 2015

Link to Official Public Record – Petitions to Wind Up: https://m.thegazette.co.uk/notice/2329010

Online Blog sharing comments towards Mr Craig Cook of Cream Group: https://creamclubthetruth.wordpress.com/