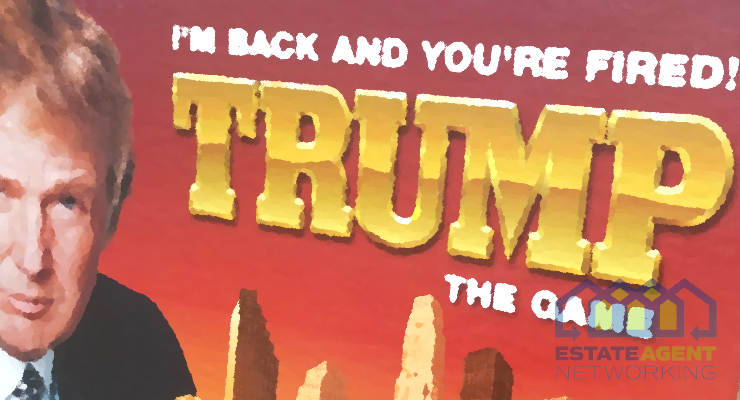

Why President Donald Trump could be good for House Prices:

As we wave goodbye to Biden, and what many saw as a painful and at times comical four years of leadership, the USA is looking to come back stronger than ever with President Donald Trump in charge again and a team behind him that sure look like they mean business.

Though it has only been less than one month since the Republicans took back charge of decisions, and there is a mighty job to be done in order to tackle and undo many issues, prices still very much remain the heated topic for many. I’m sure most will have heard of egg prices in the USA hitting the headlines like toilet rolls hit the UK headlines during the government lockdowns for covid:

“Egg prices increased 15.2% from December to January, according to the Consumer Price Index, and the average cost of one dozen Grade A large eggs in December across the U.S. was $4.95—up slightly from $4.15 in December.” source Forbes

Interest rates were at 0.75% when Trump took power in January 2017 and he left them at 0.25% in January 2021 when Biden took over. In January 2025, at the end of the Biden term, the interest rate was up to 4.5%. Source quoted fxempire

For the American people, President Trump is quoted as saying he will demand that interest rates “drop immediately” while lowering energy costs and slashing corporate taxes and regulations. So far he is keeping all his promises to his voters, and though a drop in interest rates may not be the best for those hoping to see house value increases, for the average home owner still under a mortgage, it will be a welcome break on what has been an inflation filled recent period. President Trump has also been quoted in saying that price reductions will not be immediate and for the American people to have a little patience, but that patience is undoubtedly quite fragile at present so the countdown timer will already be ticking away in many people’s minds.

There are for sure plenty who are still very much anti President Trump, this has been seen from varied marches and gatherings in the USA opposing his selection. Confidence within 77,284,118 who voted for Trump in November 2024 might be high, though for the 74,999,166 who voted for Harris there will be much concern and for some, even fear. Trump return sparks real estate gold rush in DC as rich and powerful race to buy up remaining luxury homes with Elon Musk’s DOGE investigation a reason being thrown about as to why some are fleeing investigations (with their money) – Some people do not feel safe under a Trump leadership.

Will there be a short term dip in house prices within the USA and as per the old adage, when the USA sneezes the UK catches a cold, we see a similar fate on home shores a couple of years after? Some will say that as the leadership of the USA now differs immensely to that of the UK, and Starmer in charge with highly challenged ideologies for control of the country and it’s economies, that in fact what happens across the pond will have little effect on the UK (assuming Labour carry out a full term).

There is already rumblings between global leaders with Vice President Vance only recently putting the EU in it’s place (at the Munich Security Conference) and remarking on poor leaderships and declining freedoms, there will for sure be a widening gap between relationships of our near neighbours on the continent and that of the Stars and Stripes. In his speech, Vance openly criticized the leadership of the European Union for what he described as backsliding on freedom of speech and democracy. Currently Starmer is far more focused on relationships with the EU over that of the USA, we might be more advised to take a peek at what is happening across mainland Europe over what President Trump and team are accomplishing for their people. Though with growing rumours of a 100% tax on non-EU residents purchases of property there may be a negative effect looming especially as some markets are propped up by holiday / second home purchases from abroad – Spain is planning a radical fix for its housing crisis: A 100% tax on non-EU buyers. The desired goal might be to reduce house prices and affordability for their local residents, which is certainly a positive agenda, but with increasing migration numbers and unmet new build quotas, it might be simply a means to an undesired ending.

Good for House Prices can obviously be taken in many ways. House price increases is good for some as are house price declines good for others. Many will probably sit with myself and personally be hoping for house price stability as once you are in the housing market (with one property) then it is rather irrelevant if house prices dip or increase slightly.

As I write this article I would like to refer to the good for house prices being a slight reduction. This I feel is better for many countries as house prices are simply beyond the reach for many and no end of working and saving allows for people to catch up with house price inflation which can be taken as being out of control.

As President Trump, and especially the team at DOGE, meticulously go through the spending of the government and varied departments, there could be a big slow down on the rich getting richer and we see more assets being sold (as per the increased luxury real estate listings in Washington DC area). With the illegal immigration problem also being tackled in the USA, this might again relieve the stress / demand on property and more vacant property will be listed for sale and for rental – As we all know, it is about supply and demand so this could mean that property prices see a correction of some kind on average. In the UK, great pressure is on housing, especially south of the country and landlords and property sellers have been in the prime position for many years with any scaremongering of house price crashes quickly fading – Starmer has no plans to stop immigration to the UK and new home build figures remain beneath promised quotas. New home warranty and insurance provider the National House Building Council (NHBC) recorded 124,144 new home completions last year, marking a 7% fall compared with 133,611 in 2023 (source msn.com). It really depends on if Starmer caves in under pressure to follow the direction of the USA, this could mean house price stability or even decreases… if things carry on as they are, even with a touch more added to interest rates and ever increasing inflation on all we do, then the pressure on housing can only mean strong stability or continue growth year on year.