Are you Zoned out of Affording Property in London?

It is a feisty old topic to discuss with many opinions which makes for interesting read on the varied news channels online – Property prices in London.

Betting on the UK house price scene, yes that is right betting agencies gives odd on prices going up or down not only which horse will win the 3:15 at Kempton Park, now predicts falls in property prices. The Gentleman’s Bookmaker, Star Sports Bet, are giving odds on for house prices to fall in 2016, check out their page here. Decrease in prices is 8/11 on and a drop of 5% or more is 6/1.

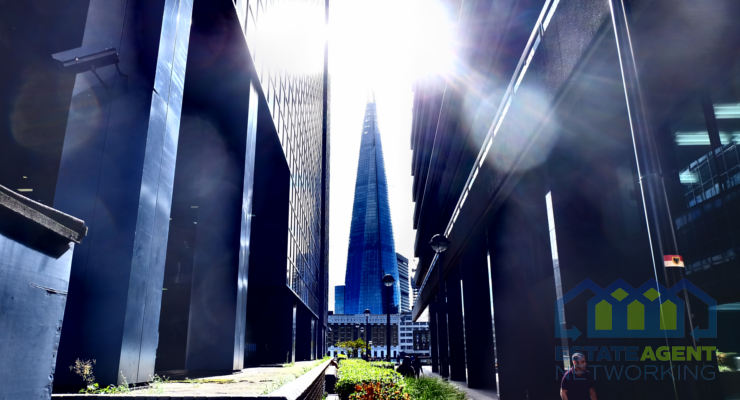

Online Estate Agent, eMoov, shared a very useful Property Price map themed on the London Underground regions, highlighting most locations within the zones 1-4 are averaging £1 million plus. Barking, Dagenham and Becontree showed to be the cheapest places to purchase in the zone 1-4 area at a price of £237,377 (I can remember looking at a property in this location nearly 20 years ago at £33,000)!

Though prices are not only high in the usual places such as Green Park, Mayfair, Park Lane as we have always known, ie as per Monopoly Board days, other locations of London are equally expensive especially comparing what locations look like. A recent news story though by International Business Times says that prices are in fact dropping in London, especially those that are for the rich and famous whereas the lower priced region, the outer regions, are motoring in valuation are they are seen as investment opportunities.

A write up in the Independant by Chris Blackhurst states that London Property prices will fall and are currently at the midnight hour state. An interesting read that runs through why the time will soon be upon us that the plug could be pulled from the London property market.

So, are prices too high? Is Buy To Let about to collapse and flood the market with property that brings house prices down, a total swap around of current market conditions where new valuations are like gold dust to Estate Agents? Will there be a level out of property in London, outer regions growing and inner locations falling? Is London just too expensive for today’s current financial climate?