Benham & Reeves Market Index Review

September 13, 2019

Property market shows signs of life but asking price expectations remain out of kilter with wider market conditions

The latest Market Index Review report by lettings and sales agent, Benham and Reeves, has looked at the current state of UK and London property prices based on aggregated data from the four leading house price indices (Halifax, Nationwide, Rightmove and the Land Registry), as well as the current reality gap between the mortgage approval prices of home buyers, the asking price expectation of sellers and the reality of sold prices in current market conditions.

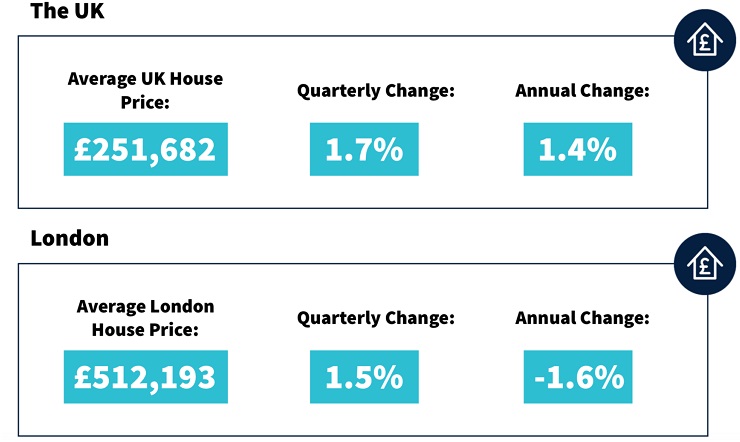

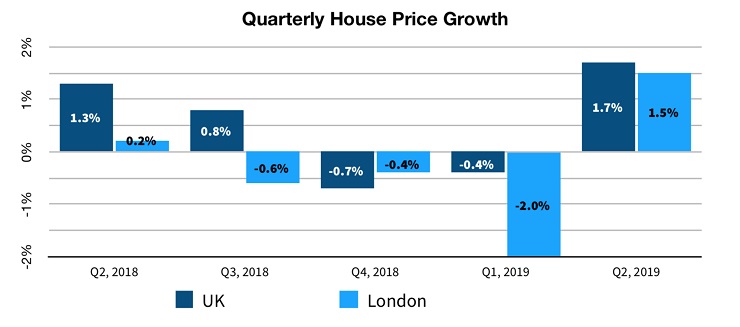

- The latest report shows that based on date from Nationwide, Halifax, Rightmove and the Land Registry, the current UK house price during the second quarter of this year is £251,682, up 1.7% quarterly and 1.4% annually – the first quarterly increase since Q3, 2018.

- In London, the current average price is £512,193, up 1.5% annually and the first quarterly increase since Q2, 2018, although prices are still down -1.6% annually.

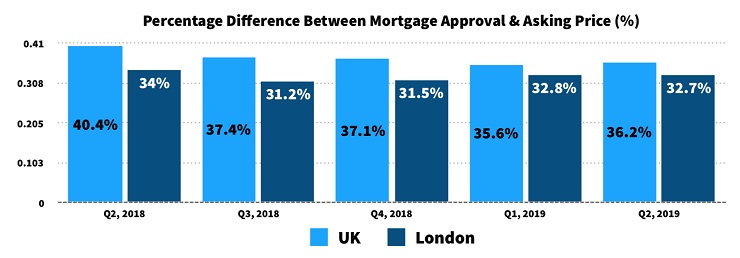

- When looking at the price buyers are securing at the mortgage approval stage compared to the asking price expectations of home sellers, there is a 36.2% gap across the UK and a 32.7% gap in the capital.

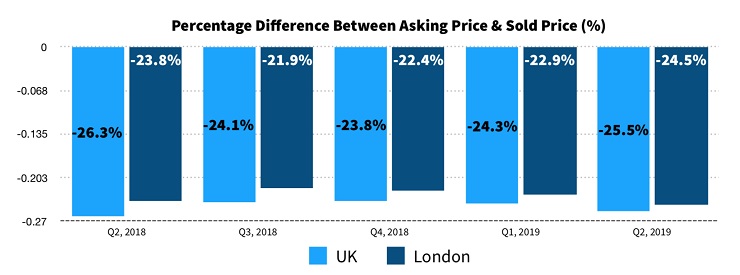

- When looking at the final stages of the property selling process, UK buyers are paying -25.5% less on average than the average asking price, while in London, buyers are paying -24.5% less than the average asking price in the capital.

You May Also Enjoy

Volume doubles as property market sees strong return of new applicants

Foxtons Lettings Market Index – January 2026 Demand rebounded sharply from December, with registrations up 93% month on month and new renters per instruction up 11% compared to December, reflecting a seasonal uplift in activity at the start of the year. New renters per new instruction fell 12% year on year, indicating that competitive pressure…

Read More Property valuation leads to agents up 50% on last year

The launch of a new valuation product and AI optimisations to the existing product suite led to a significant uplift in valuation leads for agents from Rightmove in January. Valuation leads grew by 50% in January 2026 compared to the same period last year. The launch of Online Agent Valuation towards the end of 2025 helps connect…

Read More Worst areas for landlord eviction waiting times

The latest research industry insight from LegalforLandlords has highlighted where the longest and shortest wait times are when it comes to court hearing dates for landlords who are trying to repossess their properties, with the most overstretched courts found in the likes of Birmingham, Croydon, and Slough. Having analysed internal data on wait times for…

Read More 726,000 rented homes could remain non-decent by 2035

And that’s without holding them to the updated standard outlined in the recent DHS consultation A new consultation on the Decent Homes Standard (DHS) has suggested that all rented homes, private and social, must meet an updated, more stringent standard by 2035. However, new research from Inventory Base reveals that if the current rate of…

Read More UK House Price Index for December 2025

The latest UK House Price Index shows that: The average monthly rate of house price growth in December was -0.7%. Average UK house price annual inflation was 2.4% in the 12 months to December 2025. As a result, the average UK house price currently sits at £270,000. Here are some thoughts from the Industry.…

Read More 10 things all tenants need to know when renting now

The Renters’ Rights Act 2025 received Royal Assent on 27th October 2025 and will introduce major reforms to private renting in England. The first raft of measures affecting tenants will come into force on 1st May this year. So, whether you currently have a tenancy agreement or are planning to rent this year, here are…

Read More