Breaking Property News – 01/05/24

Daily bite-sized proptech and property news in partnership with Proptech-X.

Fine & Country relaunches Masterclass Series for 2024 to support network in winning more business

Set to take place in both London and Huddersfield, Fine & Country will be hosting informative and engaging Masterclass sessions again this year, sharing insight from property experts on creating strategies to help agents dominate the prime property market in their respective regions, all while maintaining competitive fees and upfront marketing contributions.

The first guest speaker announced is Sarah Tuer, Director at Fine & Country Newcastle and Northumberland, who will join National Business Development Manager, Gaven Swan, in delivering a practical session, delving into the opportunities available at each touch point and how various factors can impact the success of the interaction and critically, the eventual price negotiated for a client. The inaugural session of the 2024 Masterclass Series, with Tuer and Swan, is scheduled for Tuesday 21st May in Huddersfield, followed by a London session the next day.

A proactive member of the network, Tuer is a four-time winner at the Fine & Country Property Awards 2022-2023, for Best Park Lane Associate, Best Newcomer and the North East Regional Award. Tuer will offer immense insight into how she has achieved such success as a Fine & Country agent. Drawing on her previous experience as a buying agent, Tuer will share the tips and methods she has used to increase her buyer-to-viewing ratio and how this has resulted in an increased number of offers and sales agreed.

Nicky Stevenson, Managing Director of Fine & Country, said: “Building on the success of our previous Masterclass sessions, agents within our network will again have the privilege of learning from top agents within the brand who have excelled in their respective prime property markets. Our network is fortunate to include agents willing to divulge the secrets of their success, fostering a community of learning and growth within the prime sector. This collaboration only serves to strengthen the Fine & Country brand.

“We are thrilled to host this series, offering agents an invaluable platform to exchange best practices that will empower them to make greater strides within their markets. This series exemplifies our commitment to providing our network with opportunities to learn and gain insights from established professionals who have revolutionised their market sectors. The tried-and-true methodologies unveiled at the Masterclass Series will further equip our agents to expand their businesses, establishing them as the preferred choice for premium estate agency services within the upper quartile of their respective markets.”

Nationwide announce April sees slowing in annual house price growth

UK house prices fell 0.4% month on month in April, Annual rate of change slowed to 0.6%, from 1.6% in March. Commenting on the figures, Robert Gardner, Nationwide’s Chief Economist, said: “UK house prices fell by 0.4% in April, after taking account of seasonal effects. This resulted in a slowing in the annual rate of house price growth to 0.6% in April, from 1.6% the previous month.

“The slowdown likely reflects ongoing affordability pressures, with longer term interest rates rising in recent months, reversing the steep fall seen around the turn of the year. House prices are now around 4% below the all-time highs recorded in the summer of 2022, after taking account of seasonal effects.

Cost of living pressures and higher rates hold back would-be first-time buyers “Recent research carried out by Censuswide on behalf of Nationwide found that nearly half (49%) of prospective first-time buyers (those looking to buy in the next five years) have delayed their plans over the past year[1].

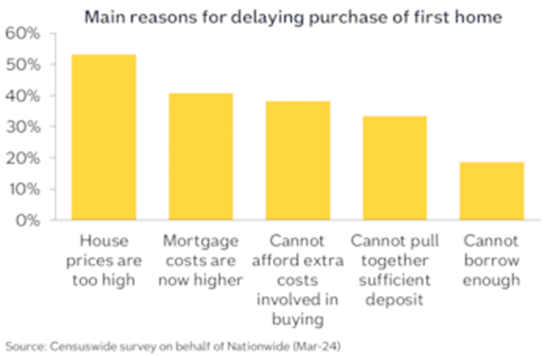

“Among this group, the most commonly cited reason for delaying their purchase is that house prices are too high (53%), but it is also notable that 41% said that higher mortgage costs were preventing them from buying (see chart below).

Main reasons for delaying purchase “Coupled with this, 84% of prospective first-time buyers said that the cost of living has affected their plans to buy, for example through having less money each month to save for a deposit. Around two thirds (67%) of respondents currently have between £0 and £10,000 saved towards a deposit. With a 10% deposit on a typical first-time buyer property currently around £22,000, it is not surprising to find that c.60% of prospective buyers have yet to save more than a quarter of their target deposit.

“Interestingly, 55% of respondents said they would be willing to buy in another part of the country where house prices are cheaper, or where they could buy a bigger property. Inevitably, there is a lot of variation in how far people would be willing to move, but half said they would move more than 30 miles from their current location.

“Buying a property in a less expensive area appears to be the most common compromise that prospective buyers will make. Around a third (32%) said they would consider a smaller property than they wanted, while 28% would go for a property that needed work doing.

Compromises to buy first home “Amongst recent first-time buyers (those who have bought their first home in the last five years), 38% said they ended up compromising on the property they purchased. Among this group, nearly 40% bought a property to do up (rather than ‘turn key’ ready) while 34% bought in a different area.”

Source – https://www.nationwidehousepriceindex.co.uk/reports/

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X