Breaking Property News – 08/04/24

Daily bite-sized proptech and property news in partnership with Proptech-X.

Locrating discusses integration of in-depth school data into agents’ websites

In the latest tech episode of The Home Stretch podcast, host and Brand Director at nurtur.group, Ben Sellers is joined by Lewis and Erica Tandy, the Co-Founders of Locrating, a data driven schools information source that can be embedded into an estate agent’s website. With the recent legislation changes to Material Information, Locrating is making it as easy as possible for potential buyers to find a vast amount of information on schools in the area, as well as broadband speed and other key information.

Starting the business 14 years ago, the idea for the platform that provides in-depth information on the local schools in an area was born out the couple’s own experience when they wanted to move out of London with their two small children. The couple had previously never lived outside of the capital, and they had no knowledge of the schools outside of London or types of areas that would be suitable for a young family.

Commenting on the experience, Lewis Tandy says, “Of course when looking for a property to move to, schools were one of the biggest factors. We had printed off Ofsted reports and maps and had dozens of tabs open in the browser and were painstakingly going through the information. We thought that there must be a better way of doing this, a technological solution – but we couldn’t find one.”

“So, I decided to do some coding and put something together that would help us. I created a map and downloaded the data from the Ofsted website, adding the schools to the map. I colour-coded them by their Ofsted rating so that we could see the ones that were outstanding and then we were able to look around the map and see the potential places we might want to move to.”

The concept developed from there with Lewis adding more information about schools to the tool. “Because I had built it as a website, it was publicly available and friends and were also using it and found it helpful. Through word of mouth the traffic to the website kept increasing and it took off from there,” says Lewis.

Ben Sellers replies, saying, “That is often what technology is, it is scratching an itch and solving a problem. Some of the best ideas often come out of these kinds of things. I think what has also been amazing is how you have stayed focused and honed in on the concept making it the best it could possibly be. Over time you have also added in some powerful plugins which have elevated the tool and made it great.”

In response, Lewis comments, “Like you said, we had a problem that we needed solved and that was what we were focused on. We weren’t necessarily trying to build a company but wanted to find a place for ourselves to live, but in doing so found a gap in the market.”

Adding to that, Erica notes, “We had the Locrating website, which was such a useful tool, but I was still having to have estate agents’ websites open to find properties in the areas that matched the schools. It made sense for this feature to be in the same place and integrated into estate agents’ websites.” The couple reached out to a local estate agent to see whether they would be interested in integrating the system into their website, which they did. This meant having a working version of the plugin on a live estate agency website.

The three go on to discuss the evolution of the business and making major headway into the property sector, as well as upcoming developments to the platform to include additional information such as flood risk and mobile phone signal availability. To hear the full conversation visit The Home Stretch podcast.

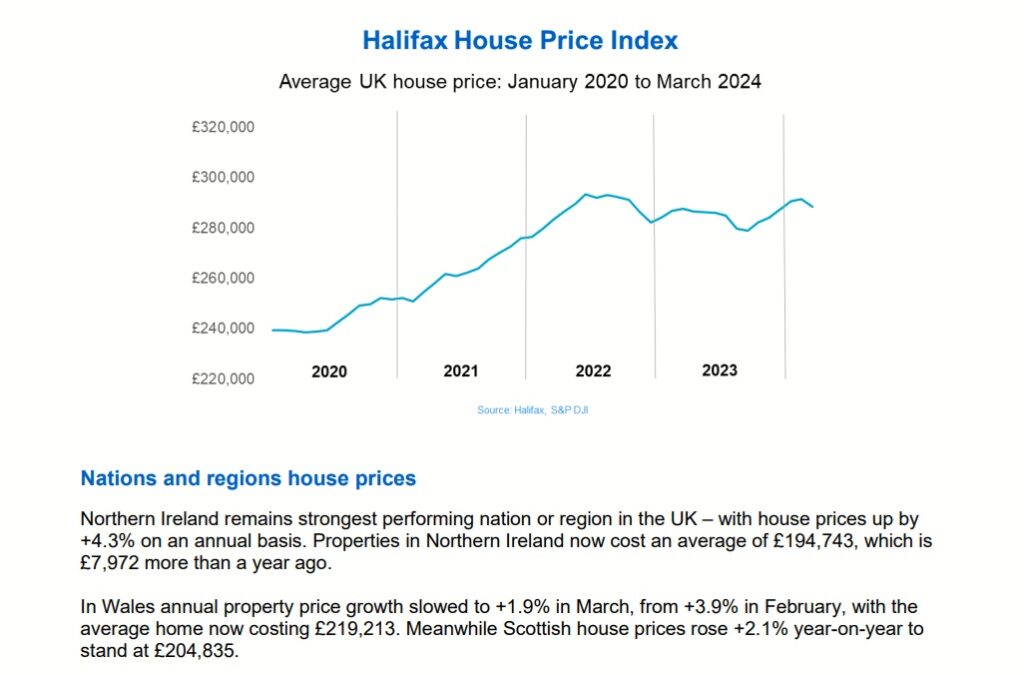

Halifax House Price Index says average House prices declined by 1%

According to the latest HHPI March 2024 report, “UK house prices grew in March on a quarterly basis, by +2.0%, with annual growth slowing to +0.3%, from 1.6% in February. Also compared to last month, the price of a UK property fell -1.0% or £2,908 in cash terms, with the average property now costing £288,430. And average house price £288,430 Monthly change -1.0% Quarterly change +2.0% Annual change +0.3%

Kim Kinnaird, Director, Halifax Mortgages, said: “That a monthly fall should occur following five consecutive months of growth is not entirely unexpected particularly in view of the reset the market has been going through since interest rates began to rise sharply in 2022. Despite this house prices have shown surprising resilience in the face of significantly higher borrowing costs.

“Affordability constraints continue to be a challenge for prospective buyers, while existing homeowners on cheaper fixed-term deals are yet to feel the full effect of higher interest rates. This means the housing market is still to fully adjust, with sellers likely to be pricing their properties accordingly.

“Financial markets have also become less optimistic about the degree and timing of Base Rate cuts, as core inflation proves stickier than generally expected. This has stalled the decline in mortgage rates that had helped to drive market activity around the turn of the year.

“The broader picture is that house prices are up year-on-year, reflecting the opposing forces of an easing cost of living squeeze – now that pay growth is outpacing general inflation – and relatively high interest rates. Taking a slightly longer-term view, prices haven’t changed much over the past couple of years, moving in a narrow range since the spring of 2022, and are still almost £50,000 above pre-pandemic levels.

“Looking ahead, that trend is likely to continue. Underlying demand is positive, as greater numbers of people buy homes, demonstrated by recent rises in mortgage approvals across the industry and underpinned by a strong labour market. And with rental costs rising at record rates, home ownership continues to be an attractive option for those who can make the sums work.

“However, the housing market remains sensitive to the scale and pace of interest rate changes, and with only a modest improvement in affordability on the horizon, this will likely limit the scope for significant house price increases this year.”

Source – the Halifax house price index The Halifax House Price Index is the UK’s longest running monthly house price series with data covering the whole country going back to January 1983. From this data, a “standardised” house price is calculated and property price movements on a like-for-like basis (including seasonal adjustments) are analysed over time. The annual change figure is calculated by comparing the current month non-seasonally adjusted figure with the same month a year earlier.

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X