BREAKING PROPERTY NEWS – 16/11/2022

Daily bite-sized proptech and property news in partnership with Proptech-X.

Streamlining the tenancy conclusion process for a better customer experience

The Guild of Property Professionals CEO, Iain McKenzie, recently spoke to Kristjan Byfield, Co-Founder of base property specialists and The Depositary, about streamlining the lettings process and improving the tenancy experience.

Wanting to start a business with the customer experience at heart, Byfield and his business partner An Deckers established base property specialists, with an ethos of offering the best customer service. An ethos that has seen the business become one of the most highly acclaimed lettings agents in the UK based on independent customer review sites.

Lettings and property management has always been at the core of the business, which led to Byfield and Deckers establishing The Depositary. “Essentially for agents, The Depositary streamlines the tenancy conclusion process. Everything that happens after notice is served though to a deposit refund and/or dispute we try and automate as much as we can. This includes data migration via API with our integrated partner network- of which there are currently seven, with at least another five in the pipeline. On average an agent will spend three-to-four-man hours per tenancy undertaking that process, however, agents using our platform typically do that in about 15 minutes, so about a 90-95% reduction in admin,” says Byfield.

He adds that from a consumer perspective, the aim of The Depositary was to vastly improve the tenant experience, which Byfield believes is often the worst experience within the lettings journey. “We wanted to give tenants clarity and an understanding of what was involved in the process. Often, in a tenant’s mind, the process is: they give notice, move out and then get their deposit back – simple. As lettings agents know, it is often not that simple and there are a lot of mechanics and stages involved in the process that tenants might not be aware of, so we wanted to help provide that guidance and transparency,” Byfield comments. “We also wanted to help speed the process up. The average deposit refund in the UK is around 22 days, our objective for our clients was to bring that down to 10 days or less, currently we average around 14 days, so a third faster than the national average.”

Looking at their plans going forward, Byfield says that he is a huge advocate of proptech in the sector and wants to continue to develop solutions that will help agents. “When it comes to proptech there are so many products available, so as an agent it is important to firstly understand the problems you are trying to solve before finding the products that will help you do that. From a supplier’s perspective, it also takes time to reinvent the business and develop products that will truly transform the sector,” he adds. “Agents should treat proptech as a new member of staff, you wouldn’t hire someone and have them quietly slink into the role without letting people know who they are and what their role is within the business. It is the same with proptech, it is there is make a change, but no proptech is going to switch on and transform your business overnight. The right proptech adopted in the right way can transform a business, but you have to make the right selection and have to make that commitment to embed it, as well as the discipline to come back to it every six months or every year to see if it is still the best solution because good products with evolve.”

McKenzie comments, “I like the analogy of proptech being a member of staff. Carrying on with that analogy, if you hired a member of staff and inducted them and trained them and they started doing well after a given period, you wouldn’t not talk to them for six or twelve months, would you?”

Byfield agrees, saying: “Exactly, you would come back to them and ask what’s next? How can you get that extra two or three percentage extra performance. In terms of proptech, it would be a setting or feature that perhaps currently isn’t being utilised to its full capacity. Alternately there could have been a better product developed within the time frame that goes far beyond what the current product does. It is important to keep investigating, keep investing and keep evolving. And that’s what we plan to do as a supplier, keep evolving to ensure we are providing our clients with the best possible solutions and products we can.”

Stock Levels Recover as Home Prices Take a Seasonal Dip

The UK stock of unsold property on the market is well on the way to recovery following the unprecedented buying frenzy that depleted agents’ portfolios by around 50% in the wake of the COVID lockdowns, according to Home.co.uk’s Asking Price Index for November.

While there is still some way to go before stock levels return to the 10-year average, buyers can benefit from a growing choice of property for sale and be reassured that vendors now have less bargaining power than they did. Moreover, higher stock levels naturally put downward pressure on price growth which is vital for a resumption of more normal market conditions.

The market still retains much momentum despite the headwinds of higher mortgage rates and economic turmoil. Both the median and mean time on market for unsold property in England and Wales are less than they were a year ago. Of course, some slowing is inevitable over the winter months and we can expect next year’s market to proceed at a more leisurely pace. However, we expect demand to remain significant, especially given the new nil-rate stamp duty rate for properties under £250K.

UK property is still very attractively priced in US dollar terms and yield-hungry international investors will be drawn to the extremely buoyant rental market. London will be of particular interest due to soaring rents and the opportunity for significant capital gains. The fact that the median price of a two-bedroom flat in London is currently 10% less than it was in 2015 indicates that there is considerable room for growth.

Meanwhile, inflation continues to erode home prices insidiously. In real terms, growth is currently around -10%, effectively correcting overinflated home prices without adversely affecting banks’ balance sheets. Concomitantly, the fact that real mortgage rates are significantly negative is a distinct peculiarity of this market.

Whilst there are some initial indications that rents are stabilising across several regions, they continue to soar in London due to scarcity. The wild rise in rents that started in the more central boroughs has now mapped out to the outlying administrative areas. Greater London has currently a mere seventeen thousand properties to let. Five years ago, there were around forty-five thousand advertised as available for rent.

Mortgage rates are now beginning to stabilise following the chaos triggered by Truss’s ill-conceived mini-budget. Sunak’s appointment seems to a have soothed the financial markets for the time being, but more such crises are to be expected given the levels of government debt and systematic economic woes.

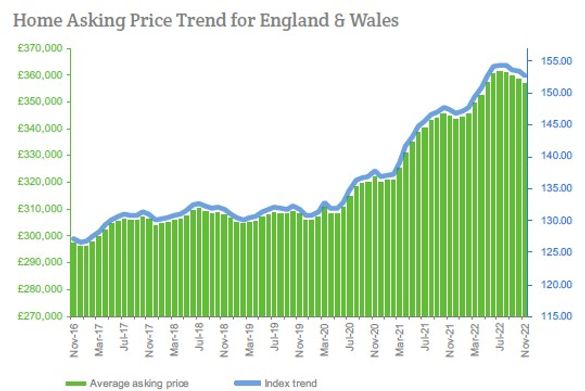

The annualised mix-adjusted average asking price growth across England and Wales is now at 3.6%; in November 2021, the annualised rate of increase of home prices was 6.9%. Incidentally, that was the month when real asking price growth went negative.

Headlines

- Total sales stock in England and Wales increased again for a ninth consecutive month since the all-time low set in February, although the current total remains around 100,000 short of the 10-year average.

- Asking prices across England and Wales slid for a third consecutive month (by 0.5%), bringing the year-on-year rise to 3.6%, consistent with seasonal expectations.

- Stock of unsold property has increased by 39.3% over the last twelve months.

- By contrast, the stock of unsold property in Greater London has only increased by 3.5%.

- The Typical Time on Market (median) for unsold property in England and Wales rose a seasonal three days to 70 days since last month, but is 10 days less than in November 2021, despite pricier mortgages.

- The East Midlands is the first region to indicate a year-on-year increase in Typical Time on Market (five days), heralding a return to more normal market conditions in the wake of the buying frenzy post-lockdown.

- The supply of new instructions was just 6% higher last month compared to October 2021 and 22% less than in October 2020, despite a rise in repossessions.

- North West and Welsh property markets now lead in annualised regional price growth (equal at 7.1%).

- Monetary inflation continues to remain very high at 14.3% (RPI ex. housing), making current real growth around -10% year-on-year. Moreover, despite rising mortgage costs, the real mortgage interest rate remains negative (around -8%).1

- London rents continue to defy gravity. Renewed demand has decimated supply and this is driving annualised rental growth to a breathtaking rate of 26%.

- The current new growth leaders in asking rents are the boroughs of Newham, Hounslow and Merton (+47.5%, +43.7% and +35.4% annualised respectively).

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X