Breaking Property News – 17/04/24

Daily bite-sized proptech and property news in partnership with Proptech-X.

CEO Adam Pigott on tour in Norfolk with tlyfe App

Full disclosure CEO Adam Pigott and his team are one of my earliest clients, so it is always a pleasure to hear what they have been getting up to. And this week they were at a Propertymark conference in Norfolk, where Adam no doubt in his ‘tango’ polar shirt was wowing the delegates with the virtues and upside of supporting the use of the tlyfe App.

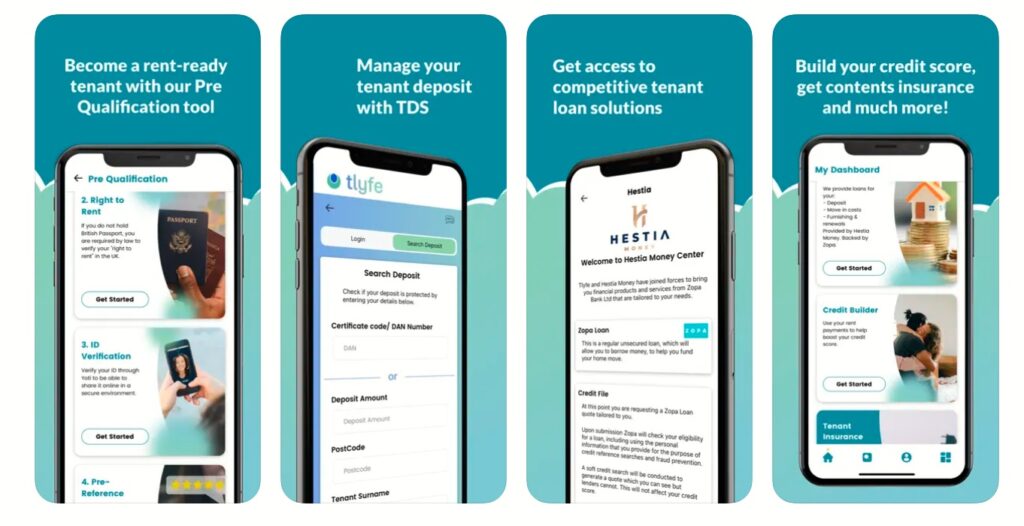

For anyone who has not seen or heard about tlyfe the ‘the UKs tenant lifecycle App which takes the stress out of the move in process and making move-in day that little bit more special!’ I will go over what it does for tenants looking to be front of the queue. The App covers:

Pre-Qualification – Giving tenants the best chance of securing their next rental property by using a Pre-Qualification tool to become a ‘Rent Ready’ Tenant. They then can share the results with lettings agents to secure priority viewings!

Improving tenants credit score – Through the App tenants can keep an ongoing digital record of all their rental payments and, provided they pay on time, helping to build their credit score.

Deposit Protection with the Tenancy Deposit Scheme – Tenants can download the protection certificate and manage the return of their deposit at the end of your tenancy, with the Government backed Tenancy Deposit Scheme.

Tenant Insurance – Tenants can avail themselves of Tenant Contents Insurance.

Verified digital ID – They can verify their identity digitally in a secure environment without having to leave their home or risk losing ID documents in the post. Quick, safe and simple verification that works. And the data sits with tenant until needed.

Tenant Loan solution – The tlyfe App also can help tenants with a helping hand for move-in costs, or even a deposit.

So far tens of thousands of tenants are using the tlyfe App, and it makes commercial sense that tenants are prequalifying themselves as it helps all stakeholders, including very much the letting agencies who have to sieve through multiple possible would-be tenants. It also enfranchises tenants who want to be front of the queue.

On a personal level Adam & Shahad and the rest of the Openbrix/tlyfe family really are a very friendly, approachable and lettings centric business. Who fully understand the trauma and pressured environment that is the daily merry go round of the lettings industry, they are here to help, so just reach to them – you will be pleasantly surprised with the results.

UK rental market sees slowing inflation amidst easing demand

The UK’s rental market is experiencing a slowdown in inflation, according to recent data. Nicky Stevenson, Managing Director of Fine & Country notes that while supply has seen a modest improvement, the gap between demand and supply remains a significant factor influencing the market.

Easing Demand “Rental growth has moderated to +7.5%, a decrease from +9.8% recorded a year ago. The cooling trend in rental inflation is evident across the UK, with London witnessing the most substantial deceleration. Despite a slight uptick of 0.9% in rents in March, based on Hometrack data, rental demand has diminished by a fifth over the past year. Contributing factors include the waning effects of the pandemic, a slowdown in the labour market, and enticing lower mortgage rates for first-time buyers, as reported by Zoopla,” Stevenson comments.

Supply Dynamics In a positive turn, the supply of rental properties is on the rise. Propertymark’s latest Housing Insight Report reveals a 29% surge in available rental properties, marking an 18-month peak. Yet, the persistent demand-supply imbalance suggests that rental prices are likely to sustain their upward trajectory.

Prime Markets According to Stevenson, February saw a reduction in the average void period to 18 days from 22 days in January, marking an 18% decline. All UK regions, barring the South West, observed shorter void periods, as per Goodlord data.

She notes that since the pandemic, rents have escalated by an average of 29%, pushing a significant number of properties into higher price brackets. Currently, over half (51%) of rented properties in the UK are located in areas where the average rent exceeds £1,000 per month – nearly double the figures from five years ago, according to Zoopla. In the prime rental segment, the average rent stands at £3,950, reflecting a 2.1% year-on-year increase. The South West emerges as the frontrunner in prime rental growth, witnessing a robust 14.7% annual surge.

Stevenson comments, “The evolving dynamics of the UK’s rental market underscore the resilience and adaptability of the sector amidst changing economic landscapes. The moderation in rental growth, combined with a significant increase in supply, offers a glimmer of relief for tenants. However, the persistent demand-supply imbalance remains a dominant force, ensuring that the upward pressure on rents persists. As the market continues to mature post-pandemic, we anticipate further adjustments to cater to evolving tenant needs and preferences.”

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X