BREAKING PROPERTY NEWS – 19/12/2022

Daily bite-sized proptech and property news in partnership with Proptech-X.

Generation Rent: Paying rent is biggest concern for private tenants as half face hike

Half of private renters have faced a rent increase in the last year, Generation Rent research finds today, as it calls on the government to impose a rent freeze to fight the cost of living crisis.

More private renters have been asked to pay a higher rent in the latest survey than in July, and were more likely to have been asked to pay more than £50 extra per month. Since the summer, paying rent has overtaken paying utility bills as the biggest concern of private renters.

After the government acted to cap social rent increases, and improve the terms of Support for Mortgage Interest, private renters remain vulnerable to unaffordable rent increases that could force them out of their homes. Generation Rent is calling on the government to freeze rents, suspend no-fault evictions and link Local Housing Allowance (LHA) to market rents.

In a survey of Generation Rent supporters, half of private renters who had lived in their home for longer than a year (50%) had been asked for a higher rent in the previous 12 months. This is up from July, when 45% reported the same.

The size of rent increases has also increased, with 46% of rent increases worth more than £50 per month, up from 42% in July.

Anxiety about paying rent has increased. Asked what their biggest concern is in relation to the cost of living, 41% of respondents said it was paying the rent, up from 26% in July. Utility bills have fallen as a concern, with 40% of respondents saying it was their biggest concern, down from 46% in July.

One in five private renters (21%) now report that they have cut back on spending in order to pay rent, up from 17% in July.

Generation Rent asked respondents what reason they were given for their rent increase. The most common answer was “higher market rents” (40%), followed by “cost of living” (19%) and “letting agent advice” (17%). Despite recent interest rate increases, just 11% of respondents said their landlord had blamed “higher mortgage payments”.

According to Zoopla, rents on new tenancies have increased by 12% in the past year, which appears to have fuelled a rise in dodgy practices in the letting process, causing extra stress for people moving home. One in three respondents who had moved in the past year (36%) attended a viewing at the same time as other people – this was up from 19% for people who last moved 1-3 years ago and 8% for people who last moved more than 5 years ago.

The most common experience for people moving in the past year was being asked for a guarantor, with 41% being asked for this – though this had already been relatively common, with 26% of people who moved 5 years ago or more reporting the same.

One in five people who moved in the past year (20%) were asked to bid for tenancies – i.e. offer the highest rent they could afford in competition with others. This was double the proportion who moved in 2019-21 (11%) and far more than the 2% of those who moved 5 or more years ago.

With inflationary pressures not going away, Generation Rent is calling on the government to protect renters from in-tenancy rent increases by freezing rents on existing tenancies, suspending no-fault evictions, and relinking LHA with market rents, to ensure people who rely on benefits can find somewhere to live and avoid homelessness.

Alicia Kennedy, Director of Generation Rent, said:

“Despite the support package around utility bills, private renters are becoming increasingly anxious about paying their rent. While it is possible to negotiate, renters know in the current climate landlords have them over a barrel. Landlords can ask their tenants to pay the going market rent or use a no-fault eviction to force them into the ultra-competitive lettings market.

“Without emergency government support, renters will face dilemmas which will result in ill-health, as a result of the stress of finding a new home, eating less or turning the heating down.”

Search Acumen partners with fellow proptech business – adoor – creating the first unified platform for all parties and advisors involved in a property sale

By Legal Futures Associate Search Acumen

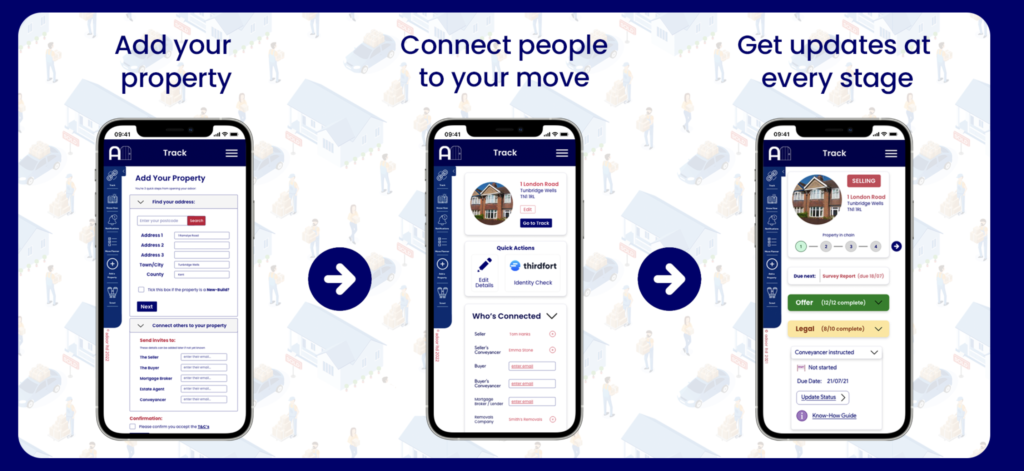

- By adding Search Acumen’s property search data, the partnership means adoor is the first app to bring together all parties involved in a house purchase, creating a single unified platform for conveyancers, local authorities, estate agents, mortgage brokers, and the buyers and sellers they represent.

- The app is engineered to reduce the number of unnecessary enquiries in the transaction process, improving efficiency and saving over seven hours a week for lawyers alone.

- Search Acumen’s input gives conveyancers and their clients access to over 75 data layers in one place, through the adoor app.

- Latest data shows 40% of property sales are falling through before completion – a 9% increase over the past three months, evidencing the need for improvements and efficiencies in the purchasing process.

- Linking every stage of the moving process for consumers, adoor is positioned as the ‘Deliveroo’ for homebuying.

Property data, insight and technology provider, Search Acumen, has partnered with innovative homebuying app, adoor, to help improve the property transaction experience for homeowners and buyers through time saving, efficiency and a better customer experience.

The partnership sees Search Acumen add over 75 property search datasets into the adoor platform, datasets which Search Acumen has digitised in an effort to drive down delays caused by lawyers having to request and review paper property records on behalf of their clients.

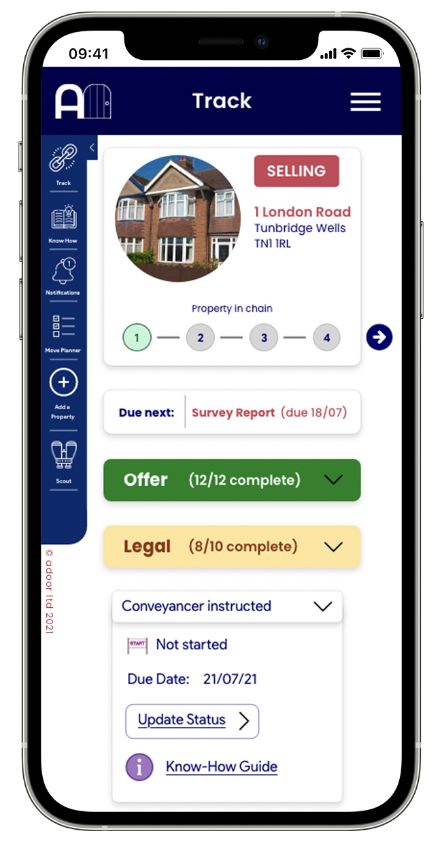

Adding Search Acumen’s digital search data means adoor now has the capability to let homeowners, buyers and their team of advisors access all data relevant to a transaction, from searches to legal information, and data held by estate agents, conveyancers and mortgage brokers. adoor is the first and only app on the market where all parties involved in a transaction can come together via one consolidated digital platform to track the process of a property transaction at the touch of a button.

This functionality positions adoor as the ‘Deliveroo for homebuying’, creating a much simpler, more efficient experience for sellers and buyers, and giving property services businesses a new digital platform that speeds up transactions, provides easy access to vital data from a variety of related businesses, and creates opportunities to drive customer service improvements across the board.

Another important aspect of adoor’s functionality is that it can automatically track the progress of other house sales connected to a chain, giving greater oversight and transparency to every party involved.

Search Acumen and adoor estimate that the addition of further analytics and property search datasets will save conveyancers over seven hours of time each week, by significantly reducing the volume of client calls and transactional administration. These are time savings that ultimately get passed on to the buyers and sellers who instruct them.

This is further supported by data from Moneypenny revealing that property solicitors receive up to six enquiries per case per week on average, with each interaction taking 15 minutes. Similarly, a survey of property solicitors found dealing with irrelevant enquiries (36%) is the biggest bugbear conveyancers face during the home buying and selling process, followed by communication with estate agents (34%).

The need for speed in an uncertain market has never been more acute than it is now. Latest figures show the time it takes from a buyer instructing a conveyancing firm to exchanging on their new property is now 90% longer in some parts of the country than in 2007, despite greater digitisation, with a national average of 132 days per transaction. Overall, 40% of residential property sales are falling through before completion; a 9% rise in the past three months alone as economic pressures mount. Potential homeowners are paying over £2,000 in associated costs when this happens, meaning around £750 million is being spent on fees without moving at all.

Andrew Lloyd, Managing Director at Search Acumen, says:

“Despite the pace of innovation over recent years, the timeline for the average home move is only increasing and more sales are falling through than ever before as mortgage offers expire and rates rise. This situation has real consequences for burnt out advisors, stressed homeowners, and, in difficult economic times, it can have severe financial implications for everyone involved. It is down to the industry to innovate and apply technological advancements to transform our antiquated transaction system and get sales times down, while giving buyers and sellers a much better experience of modern house buying. A property purchase should be a wonderful milestone to celebrate, not a process to survive.

“Accessibility of data for homeowners, buyers and the multitude of businesses that support property sales, really is the silver bullet. Whilst next day conveyancing may be some way off, huge efficiencies are possible today by just applying technology we have available already. That’s why we’ve partnered with adoor, which is aligned with our ethos around a simpler, faster, less stressful process for property professionals and their clients, driven by digitisation and technology.

“We already have tools to digitise historic datasets, automate processes and deliver analytics through AI to improve decision making. Better collaboration between the range of parties involved in a transaction is a huge area for future efficiencies. adoor’s platform is pioneering in that respect, allowing us to integrate our digital conveyancing tools into the wider eco-system of a transaction and giving us another way to provide critical data to the property and legal sectors to improve the housing market.”

Michael Wadsworth, founder at adoor, comments:

“We’re delighted to be partnering with Search Acumen to offer its industry-leading search platform within the adoor ecosystem. We’re excited to grow and expand our partnerships, to continue to further our goal of bringing together more of the agent and conveyancers’ workday into one place.

“adoor is uniquely positioned to benefit conveyancers as the only app to have all stakeholders in one platform – no one else tracks the entire process from mortgage to moving day. The widespread integration with other software and technology layers, like Search Acumen, also makes adoor highly functional for every stakeholder involved. This all works together to help make reduce enquiries for conveyancers and estate agents.

“This far more holistic approach can impact the bottom line too. For conveyancers, if 15 minutes of repetitive enquiries for each 30 cases were saved per week, 7.5 hours would be saved – and that’s just the minimum. We know time is money for estate agents too, losing an average of £4,123 for every property sale that falls through and doesn’t relist. If we can expedite the process and reduce the chance of a transaction collapsing, we are saving lots of people lots of money.”

This integration with adoor supplements Search Acumen’s conveyancing market offering, which offers lawyers end to end digital management of the conveyancing process. adoor offers another way for conveyancers to access this whilst also being able to track the entire transaction process for their clients for even greater oversight.

Search Acumen provides users with a wealth of essential property data including 75 digital property search layers, and removes the risk of duplications or double keying by instantly updating existing case management systems via the adoor platform. Upfront material information such as AML, source of funds and property screening can be purchased for vendor disclosure, and legal searches can be acquired to satisfy each of the conveyancing requirements. By accessing these automation tools, the time taken to produce key reports can be reduced from hours to seconds.

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X