Breaking Property News – 22/03/24

Daily bite-sized proptech and property news in partnership with Proptech-X.

Bank of England hold rate at 5.25%

‘The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 20 March 2024, the MPC voted by a majority of 8–1 to maintain Bank Rate at 5.25%. One member preferred to reduce Bank Rate by 0.25 percentage points, to 5%.

Since the MPC’s previous meeting, market-implied paths for advanced economy policy rates have shifted up. In the United States and the euro area, inflationary pressures have continued to abate, though by slightly less than expected. Material risks remain, notably from developments in the Middle East including disruption to shipping through the Red Sea.

Having declined through the second half of last year, UK GDP and market sector output are expected to start growing again during the first half of this year. Business surveys remain consistent with an improving outlook for activity. The fiscal measures in Spring Budget 2024 are likely to increase the level of GDP by around ¼% over coming years. As the measures will probably also boost potential supply to some extent, the implications for the output gap, and hence inflationary pressures in the economy, are likely to be smaller.

Reflecting uncertainties around the ONS’s Labour Force Survey, the Committee is continuing to consider a wide range of indicators of labour market activity. The labour market has continued to loosen but remains relatively tight by historical standards. Although still elevated, nominal wage growth has moderated across a number of measures. Contacts of the Bank’s Agents continue to expect some decline in pay settlements this year and to report greater difficulty in passing on cost increases to prices.

London Co-Living Specialist Acquires ProCo-Living

Co-living specialist Built Asset Management (BAM) today announced its fourth competitor acquisition in under three years with competitor ProCo-Living joining the BAM business portfolio with immediate effect.

ProCo-Living’s shared ethos of providing high-end accommodation options to young professionals in London was aligned to the fast-growing BAM brand, which operates over 1500 rooms across the capital.

Founded in 2018, ProCo-Living gained a solid reputation for quality of accommodation and service, while keeping a strong focus on sustainability and improving the carbon footprint of London homes by enabling multiple residents to share the energy output of a single property. Following the acquisition, ProCo-Living will continue to trade under its own ProCo-Living brand.

This latest acquisition solidifies BAM’s strong presence in the growing co-living market as it remains the largest co-living operator of its kind in London, responsible for operating over £350M worth of London real estate. It follows the acquisition of competitor Capital Living six months ago and two prior acquisitions–Kingdom Houses and Stanley Rose Houseshares–in 2021 and 2022, respectively. It is BAM’s ambitious growth strategy in the sector has already doubled the business’ revenue in under three years.

Alex Gibbs, Co-Founder and Director of BAM, said the following about the acquisition:

“The co-living sector in London continues to grow rapidly and the demand for high quality, affordable accommodation in the capital has never been stronger. We have been hugely impressed by ProCo-Living’s management team and its focus on maintaining strong relationships with all of its business stakeholders.

The acquisition marks the fourth for BAM in under three years and has been a natural fit for our growth strategy in the sector. We are very excited to be adding ProCo-Living’s properties to our existing portfolio.”

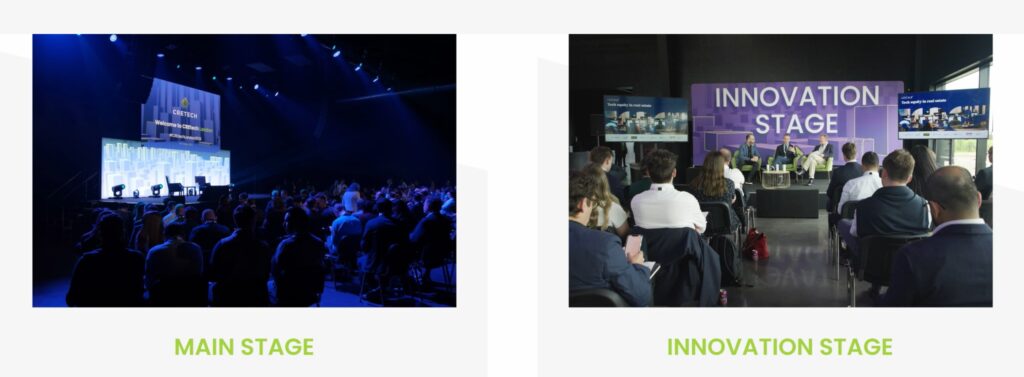

Reimagine the Built World at CREtech London on the 8th & 9th May 2024

Welcome to the future of the built world! No other conference brings together the world’s leading technology providers, real estate companies, government officials, advisory firms, and venture investors like CREtech London. You won’t want to miss this extraordinary journey into the future of the built world at the intersection of innovation, sustainability, and real estate.

And Proptech-X as the official media partner for this event fully endorses this collaborative event, where networks are formed and strenghtened, wisdom is gained and the impossible suddenly becomes the ‘norm.’ If you want to be in the crucible of what is really happening in the built world environment then book 48-hours out of your diary, get along and meet Michael Beckerman and old and new friends, as we guarantee that the return on investment will propel you through the next year and beyond.

As the industry evolves, so does CREtech. With an emphasis on the real estate companies and development projects that are outperforming the industry, CREtech London offers a blueprint of how the built world must evolve to meet today’s extraordinary marketplace challenges.

The Only Must-Attend Real Estate Event in 2024

CREtech London 2024 will gather 2,000 real estate professionals to network, experience, and learn about how innovation and technology are transforming the built world. This year, expect to share the room with some of the biggest names you never thought you’d meet, including landlords, developers, occupiers, tech providers, investors, service providers, government, industry thought leaders, and media.