Breaking Property News – 29/01/24

Daily bite-sized proptech and property news in partnership with Proptech-X.

Proptech MYNE – Managed Co-Ownership platform expands into Sweden

Berlin|Stockholm, January 2024 – The Berlin-based company MYNE is further strengthening its position as the European leader in Managed Co-Ownership of high-quality vacation properties. Following its success in Germany, Austria, Italy, Spain and France, the company, founded in 2021, is now expanding its offerings to include premium vacation homes in Sweden.

German buyers can now invest in shares of vacation properties in Sweden. The offering initially includes properties in the Stockholm Archipelago and the largest ski resorts in the northern part of the country. Ola Mattisson has been appointed as the General Manager for Sweden.

Initially, MYNE will offer four properties located in the exclusive Stockholm Archipelago and popular ski resorts in the northern part of the country. By taking this step, MYNE becomes the first shared ownership platform to offer real estate in Sweden. To lead local business development, Ola Mattisson, a native Swede with a track record in luxury real estate and technology, has been appointed as the General Manager. In addition to expanding its real estate offerings, MYNE is taking this step to tap into a market that is known to have a high affinity for sharing and vacation homes.

Nikolaus Thomale, Founder and CEO of MYNE, stated, “Sweden is an engaging market with significant potential for various reasons. Firstly, there are many overlaps between our existing real estate portfolio in Southern Europe and the preferred travel destinations for Swedish citizens, particularly Spain, Italy, and France. Additionally, Sweden is well-known year-round versatile vacation destination with excellent infrastructure.”

Even Thomales’ family has owned a vacation home in Sweden for 25 years, but nowadays, due to the high costs in comparison to limited usage, they would not consider acquiring it in exclusive ownership, “Under the current economic conditions with high interest rates, inflation, and significantly increased maintenance costs, vacation homes in full ownership simply don’t make sense any more for the majority of people. Few are willing to invest a lot of time and effort in maintenance and management, especially when paying the full price for a property that is only used a fraction of the year”, Thomale adds.

Digital platform solutions enabling co-ownership of vacation properties have gained traction in the European market. Since its launch in 2021, MYNE has experienced substantial growth and has successfully sold several hundred shares in vacation properties across Europe. Currently, MYNE offers approximately 40 properties in six European countries.

Zoopla – ‘Despite the rebound in activity, it remains a buyer’s market’

Press Release London 29th – Strong seasonal bounce back in sales market activity – boosted by pent-up demand from the end of 2023 and mortgage rates dropping below 5%. UK buyer demand is up 12% and sales agreed are up 13% year on year – sales agreed are higher than a year ago across all regions and countries of the UK. London has led the rebound in new buyer demand (+21%). Housing affordability in London is the best since 2016 but housing in London remains expensive with house prices standing at 13x earnings.

Supply of homes for sale is 22% higher than a year ago – evidence of renewed confidence amongst sellers but also boosting choice for buyers. Despite the rebound in activity, it remains a buyer’s market – a fifth of sellers are still accepting more than 10% below the asking price to secure a sale

A return of pent-up demand and mortgage rates falling below 5% have boosted the start of the year for the housing sales market in 2024, Zoopla’s latest House Price Index reveals. Sales agreed – which is a key measure of market confidence and activity – are up across all regions and countries of the UK in the first three weeks of 2024.

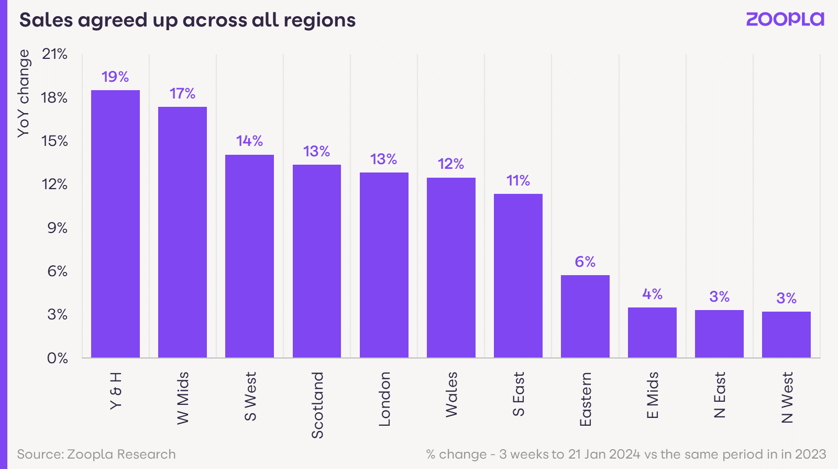

Sales agreed up across all areas – led by Yorkshire and The Humber

New sales agreed are up across all regions and countries of the UK averaging a 13% increase in comparison to this time last year*. Yorkshire and The Humber (+19%) and the West Midlands (+17%) are leading the improvement in new sales. This is evidence that buyers and sellers are becoming more aligned on pricing. One key trend over 2023 was sellers cutting asking prices to attract buyer interest – this has continued into 2024.

The overall supply of homes for sale is also growing – indicating more confidence among sellers. The overall supply of homes on the market is 22% higher than last year*, while the average estate agent has 28 homes for sale, boosting choice for buyers and a trend that we expect to keep house prices in check.

Higher levels of sales activity in early 2024, following on from the final weeks of 2023, are evidence of greater alignment between buyers and sellers on pricing. There is less need for house prices to fall much further to support sales. Zoopla’s House Price Index shows that annual UK house price falls have moderated again and stand at -0.8% (end December 2023), an improvement from the -1.4% low recorded in October 2023. House price falls are greatest in the East of England (-2.5%), while annual price growth is still positive across Scotland, Northern Ireland and the three northern English regions.

A turn of fortunes in the London housing market?

London (+21%) has led the rebound in new buyer demand in 2024* – the increase in buyer demand across most other regions is in line or slightly ahead of this time last year.

In London, this increased demand* is evident across the market, with inner and outer London, alongside core commuter areas all registering increased demand for homes. This may be an early sign that the tide is turning for the London sales market after seven years of lacklustre activity compared to the rest of the UK.

London house prices have risen just 13% since 2016 – compared to 34% at a UK level. This underperformance was down to tax changes, the Brexit vote and the global pandemic which hit demand and working patterns. This was compounded by higher borrowing costs which hit higher value markets harder than lower value areas. The affordability of homes in London – as measured by a simple price-to-earnings ratio – is at its lowest since 2014 – however, London remains expensive compared to the UK average with house prices standing at 13x earnings, down from a high of over 15x in 2016.

Positive start to the year but we remain in a buyer’s market

While the start of the year has been positive for the sales market, it’s important not to get carried away by the outlook for the rest of 2024. We remain in a buyer’s market with plenty of choice for would-be movers. Zoopla’s data shows a small but not insignificant number of sellers continue to cut asking prices to ensure homes attract sufficient interest, continuing the trend from the second half of 2023.

Over one in five sellers are still having to accept more than 10% off the asking price to secure a sale. This is close to one in four across London and the South-East and rising across the rest of the UK. It is evidence that while deals are being agreed, home buyers remain price-sensitive and focused on value for money.

Sellers must continue to price realistically if they are serious about moving in 2024. Improved market conditions will boost the chances of a sale, but sellers shouldn’t expect to secure interest if they list at a higher asking price and should be willing to negotiate.

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X