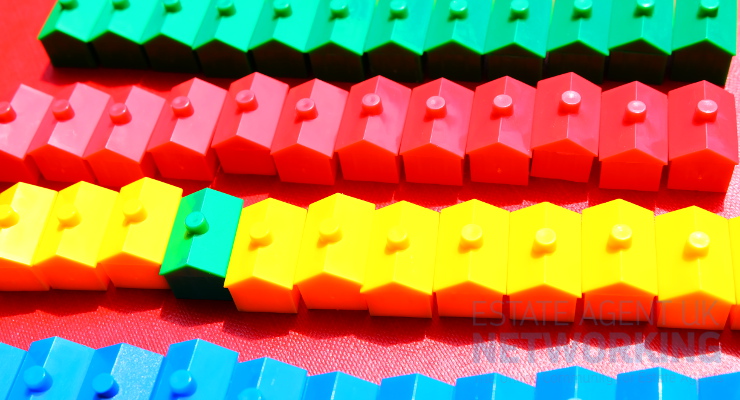

Buyers with smaller deposits growing in number says e.surv

The latest Mortgage Monitor for February from e.surv Chartered Surveyors headlines ‘Strong performance continues for small deposit buyers’.

Small deposit buyers continue to grow market share and make up a fifth of the market for all new mortgage approvals – a significant increase in the past year.

In January 2017 small deposit borrowers took 18.7% of the market and in February 2016 they represented 15.7% of house purchase loans. The North West was the small deposit hotspot in February.

Richard Sexton, Director, e.surv chartered surveyors, comments: “Buyers with smaller deposits are growing in number as more people get themselves onto the property ladder. The new year started in a positive fashion and this trend has continued into February.

“This may be because mortgage lenders are now more receptive to first-time buyers, but also could be the number of government housing schemes helping people save for their deposit to buy a home.

“Despite this positive performance, the market for first-time buyers and those with small deposits still needs support. These buyers are the key to housing chains, allowing others to sell on and move up the ladder. It will be interesting to see what trends develop as the year progresses”.

The full Mortage Monitor report February2017 can be seen on lslp.co.uk/news