Can I Sell a House on Social Media? Yes… Here’s why:

Social Media has been with us now for 20 years, can you believe, the major today platform LinkedIn being founded back in 2002. Sixdegrees was the first of social media platforms launched in 1997 so we could be looking at a quarter of a century already! Our younger generation will have been brought up using social media, a world without would be something quite impossible for them to think about (let alone a world without the internet!).

From the days when I was pushing social media to estate agents (around 2010), back when I was getting feedback that the likes of Facebook was simply there for people to share where they are having a cup of coffee with friends, I have seen a tremendous increase in estate agency usage. Nearly all estate agents today will be engaged in one way or another with social media, from a basic company page presence to actively sharing daily property updates to include property video presentations on YouTube.

Example of how Estate Agents are using YouTube today

Can you sell a house on social media? Yes has to be the answer as there aren’t any rules saying that you can not. How well you will fair is another debate and will be all down to how well you use which ever of the platforms you use and what size of audience you can get in front of.

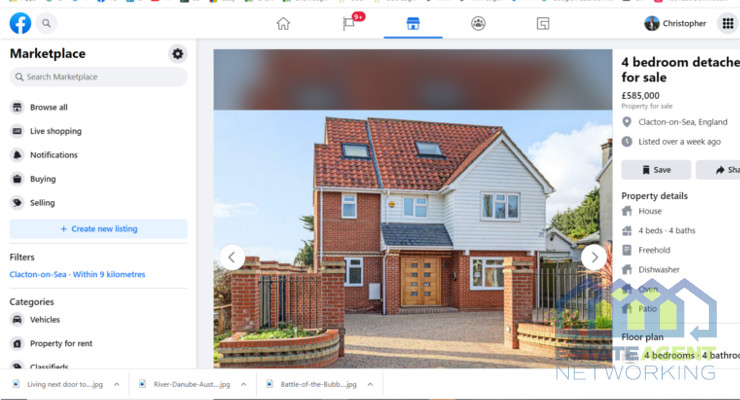

For those saying that you can not, I ask you can you them tell me why the likes of Facebook are full of property listings on ‘Marketplace’? I will also say that thanks to a Facebook property listing we found the estate agent who would find us the house we recently bought. For me, social media works when it comes to buying and selling of property.

The internet is where most of us initiate our property searches and yes, the likes of Rightmove and Zoopla take most of this traffic, but do not under estimate the time we spend on social media, especially younger generations. Interesting facts include that People spend an average of one billion minutes on Rightmove every month vs Facebook with 2.7 billion monthly active users spending a total of 2.835 trillion minutes. Facebook alone has over 1,000 times more traffic.

Now of course, I totally get the difference between traffic and target traffic, the value of the traffic to Rightmove will be vastly more specific to those interested in property from the nosey browsers to those seeking to sell or purchase that new house or secure that new rental.

As more and more time is spent on social media then the likely hood that users will engage more with pages / groups / accounts / videos / podcasts and more will increase as will the usage of these platforms by the estate agents themselves.

We can simply try and sell a property ourselves on social media, people do put out ‘sell it yourself‘ style posts (especially private listings from Spain / France / Portugal and beyond). As time increases then the popularity of doing so will increase and the results in turn will follow suit