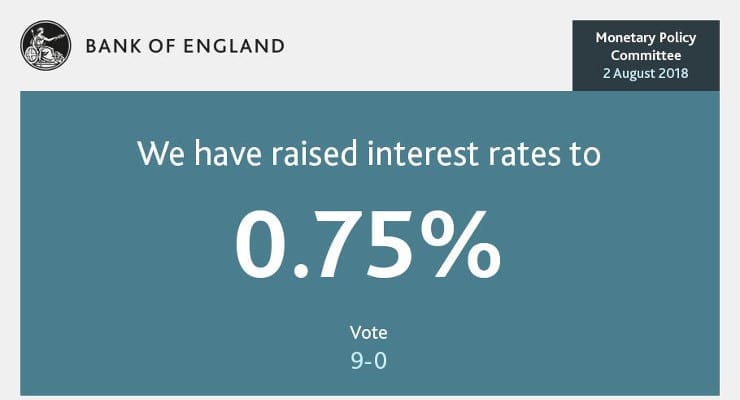

Chestertons comments on Interest Rates Rise to 0.75% by Bank of England

Guy Gittins, Managing Director, Chestertons

“Today’s increase in the Bank of England’s base rate from 0.5 per cent to 0.75 per cent has been largely anticipated for the last six months and therefore the impact on the property market is likely to be minimal.

“86% of new mortgages taken out in the last two years have been fixed-rate deals and around 60% of mortgage balances outstanding are on a fixed rate so the majority of homeowners will therefore not be immediately affected by this small increase.

New buyers who have not secured a rate are likely to see some impact but, as the banks have been pricing this rise into their mortgage products for some time now, that impact will be modest and is unlikely to alter their decision to buy.

“However, with mortgage rates slowly trending upwards, it is possible that this latest rate rise will inject a little more urgency to those looking to make a move and wanting to secure a mortgage while lending remains incredibly cheap.”

Henry Knight, Managing Director of mortgage broker, Springtide Capital, adds:

“The mortgage market had already partially priced in a rate rise, but it is likely we will see further increases as a result of this announcement. Anyone with a tracker mortgage will see payments automatically rise and we can expect lenders to increase their standard variable rates at the same time, which will affect clients paying a variable rate mortgage.

“We would not expect to see rates rise again any time soon, certainly not until the outcome of Brexit negotiations are made clear. Developments regarding the United Kingdom’s withdrawal from the European Union remain the most significant influence on the economic outlook, therefore raising rates now offers some “wiggle room” should they need to be brought back down in the future.”

Shared by: Helen Evison – Helen@theinhouseway.co.uk

Title image from: http://positivemoney.org/2018/08/bank-of-england-raises-interest-rates-positive-money-response/