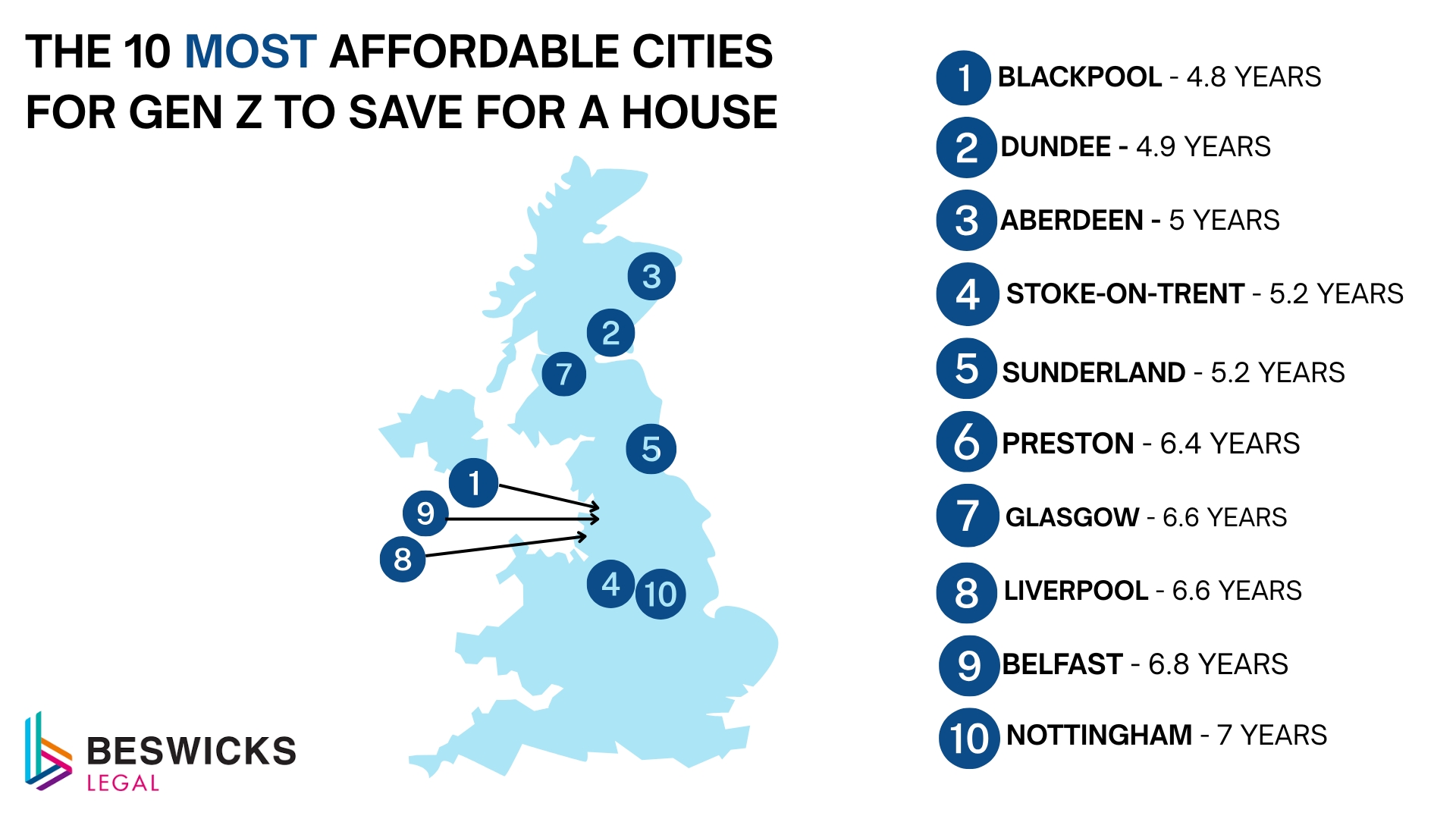

Gen Z could wait until 2044 to buy a home

Getting on the property ladder has never been tougher, and, for Gen Z, it could take up to 18 years to save a deposit in the UK’s least affordable cities, according to new research from Beswicks Legal, comparing 40 urban centres.

The figures reveal that in places like Cambridge and London, Gen Z buyers may be unable to afford a deposit until well into their 30s. In contrast, cities in the North East offer some of the shortest saving times, with young buyers in Blackpool needing under five years, highlighting a deepening North-South divide in housing affordability.

Since 2007, average house prices in England have risen by 243%, while wage growth has fallen behind. The ONS reports that in 2023, only 7% of local authorities had homes costing less than five times the average salary, down from 88% in 1997.

A separate study found Gen Z are likely to face mortgage repayments twice as high as those of older millennials, and The Times recently reported only 1 in 10 under-44s can now afford to buy a home.

Beswicks Legal’s study reveals how long it will take Gen Z to save for a 10% deposit in each city, based on average local salaries and Emma Millington, Property Lawyer, shares her expert advice on how to shorten this time and prepare financially and legally.

Full ranking of cities

| Rank | City | Region | Years To Save | Year Saved By | Average Deposit | Average Gen Z Salary |

| 1 | Cambridge | East of England | 18.6 | 2044 | 52100 | 28002 |

| 2 | London | London | 17.7 | 2043 | 56700 | 32110 |

| 3 | Oxford | South East England | 16.6 | 2042 | 47000 | 28282 |

| 4 | Brighton | South East England | 14.6 | 2040 | 41400 | 28282 |

| 5 | Bristol | South West England | 13.2 | 2038 | 36000 | 27326 |

| 6 | Reading | South East England | 12.3 | 2037 | 34800 | 28282 |

| 7 | Milton Keynes | South East England | 12.1 | 2037 | 34200 | 28282 |

| 8 | Southend-on-Sea | East of England | 11.5 | 2036 | 32200 | 28002 |

| 9 | York | Yorkshire and the Humber | 11.3 | 2036 | 30800 | 27144 |

| 10 | Edinburgh | Scotland | 10.2 | 2035 | 29100 | 28548 |

| 11 | Luton | East of England | 10.2 | 2035 | 28500 | 28002 |

| 12 | Cardiff | Wales | 10 | 2035 | 27300 | 27300 |

| 13 | Leeds | Yorkshire and the Humber | 9.1 | 2034 | 24700 | 27144 |

| 14 | Manchester | North West England | 9 | 2034 | 25000 | 27742 |

| 15 | Portsmouth | South East England | 8.7 | 2034 | 24700 | 28282 |

| 16 | Birmingham | West Midlands | 8.5 | 2034 | 23400 | 27502 |

| 17 | Norwich | East of England | 8.3 | 2033 | 23200 | 28002 |

| 18 | Newport | Wales | 8.3 | 2033 | 22600 | 27300 |

| 19 | Southampton | South East England | 8.3 | 2033 | 23600 | 28282 |

| 20 | Leicester | East Midlands | 8.2 | 2033 | 22700 | 27560 |

| 21 | Coventry | West Midlands | 8.1 | 2033 | 22300 | 27502 |

| 22 | Sheffield | Yorkshire and the Humber | 8.1 | 2033 | 22100 | 27144 |

| 23 | Plymouth | South West England | 7.9 | 2033 | 21600 | 27326 |

| 24 | Newcastle | North East England | 7.8 | 2033 | 21000 | 26962 |

| 25 | Wolverhampton | West Midlands | 7.6 | 2033 | 20800 | 27502 |

| 26 | Huddersfield | Yorkshire and the Humber | 7.5 | 2032 | 20300 | 27144 |

| 27 | Swansea | Wales | 7.5 | 2033 | 20500 | 27300 |

| 28 | Derby | East Midlands | 7.5 | 2032 | 20600 | 27560 |

| 29 | Northampton | East Midlands | 7.3 | 2032 | 20100 | 27560 |

| 30 | Nottingham | East Midlands | 7 | 2032 | 19200 | 27560 |

| 31 | Belfast | Northern Ireland | 6.8 | 2032 | 17000 | 25068 |

| 32 | Liverpool | North West England | 6.6 | 2032 | 18300 | 27742 |

| 33 | Glasgow | Scotland | 6.6 | 2032 | 18700 | 28548 |

| 34 | Preston | North West England | 6.4 | 2031 | 17800 | 27742 |

| 35 | Sunderland | North East England | 5.2 | 2030 | 14000 | 26962 |

| 36 | Stoke-on-Trent | West Midlands | 5.2 | 2030 | 14400 | 27502 |

| 37 | Aberdeen | Scotland | 5 | 2030 | 14200 | 28548 |

| 38 | Dundee | Scotland | 4.9 | 2030 | 14000 | 28548 |

| 39 | Blackpool | North West England | 4.8 | 2030 | 13300 | 27742 |

“Buying your first home can feel overwhelming, especially in today’s market”, says Emma Millington, Property Lawyer at Beswicks Legal.

“Renting while saving for a deposit is one of the toughest financial balancing acts for young people today. Add in rising living costs, and it’s no wonder saving timelines are stretching.”

But she’s optimistic. “With early planning and the right support, Gen Z can absolutely get on the property ladder, even if it takes longer than previous generations.”

She shares her practical advice to help Gen Z prepare financially and legally for their first step onto the property ladder:

Make the most of government support

Emma recommends young buyers explore the Lifetime ISA, which offers a 25% government bonus on savings up to £4,000 a year, and Stamp Duty relief for properties up to £625,000. Schemes like the Mortgage Guarantee also allow first-time buyers to access mortgages with just a 5% deposit.

Explore flexible buying routes

“Shared ownership and income booster mortgages can open up options that feel out of reach otherwise, especially for buyers with limited savings or single incomes,” says Emma.

Start preparing early

“A good credit score can make a big difference. Build your credit history now, and don’t wait to speak to a solicitor or mortgage broker. Early advice helps you set realistic goals and avoid costly mistakes.”

Factor in hidden costs

Beyond the deposit, first-time buyers need to budget for legal fees, surveys, mortgage setup costs, and Stamp Duty (if applicable). “These additional expenses can delay buying by up to a year if they’re not planned for,” she warns.