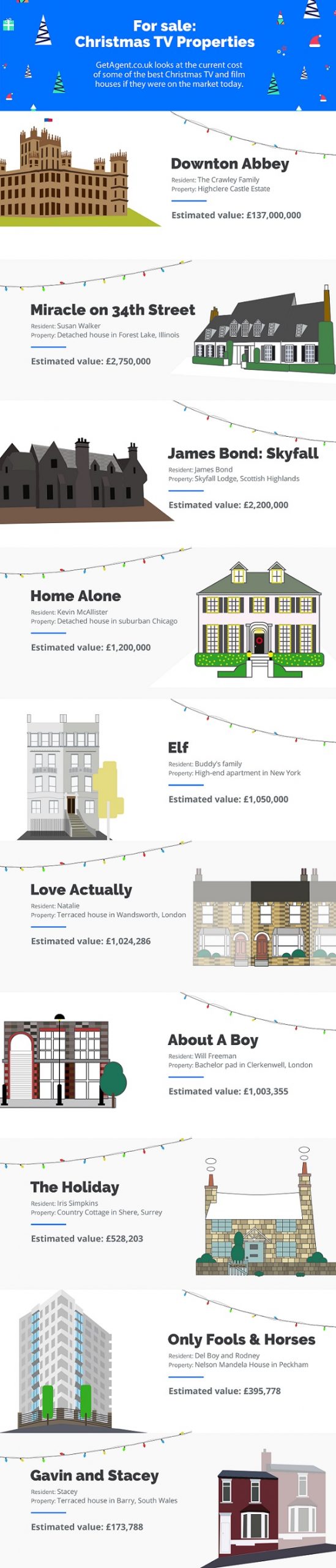

Graphic: Christmas TV House Prices in Today’s Market

Christmas is a time to collapse on the sofa and watch your favourite TV shows after eating yourself into a coma and GetAgent.co.uk, the estate agent comparison website, has looked at the cost of some of the more memorable properties featured on our screens at Christmas.

When looking at TV properties they don’t come much pricier than Downton Abbey’s Highclere Castle estate, which would be worth an estimated £137m today if it was to be listed for sale.

At the other end of the spectrum and with Gavin and Stacey due to return to our screens this Christmas, a terraced house in Barry in South Wales would set you back around £174,00 today, while Harry Potter fans would have to fork out £348,000 for the Dursley residence of 4 Privet Drive, Surrey.

Higher cost

Properties on the higher end of the price spectrum include Susan Walker’s dream family home, as featured in the Miracle on 34th Street. The detached house at Forest Lake, Illinois in the USA, would cost around £2.75m if listed today.

James Bond’s family home, Skyfall Lodge, a countryside mansion in the highlands of Scotland, would cost around £2.2m despite its remote setting.

Cottages

In The Holiday, the cottage where Iris Simpkins resided would cost £528,000

The Vicar of Dibley’s windmill cottage in Turnville would cost £580,000.

Home Alone and Elf

Looking across the pond, a suburban detached house in Chicago, as featured in Home Alone, would cost £1.2m.

Meanwhile, a New York apartment, as featured in Elf, would cost £1.05m.

London property

Closer to home, it would cost just over £2.7m to purchase Sherlock Holmes’ flat, 221 Baker Street.

It would also cost more than a pretty penny to buy Edina Monsoon’s Holland Park Avenue house in Absolutely Fabulous, costing £2.25m.

Also in the capital, Bridget Jones’s Borough Market flat would cost £1.44m.

Although a tad cheaper, Will Freeman’s (Hugh Grant’s) bachelor pad in About A Boy would cost just over £1m, while Natalie Wandsworth’s terraced house in Love Actually would cost £1.02m.

These are all cheaper than the Del Boy and Rodney’s home in Only Fools & Horses. ‘Nelson Mandela House’ in Peckham would have an estimated value of £396,000.

Founder and CEO of GetAgent.co.uk, Colby Short, said:

“The cost of famous Christmas TV properties range from the absurdly expensive to the slightly more affordable but it’s the properties featured in both London and major US cities both tend to be far above the norm.

Only the terraced house in Gavin and Stacey can be truly considered reasonable and who would have thought that Del Boy and Rodney’s flat in Peckham would be worth nearly £400,000. Not quite miwwionaires, but not a bad return.”

|

TV-Film

|

Resident

|

Property

|

Estimated value

|

|

Downton Abbey

|

Crawley Family

|

Highclere Castle Estate

|

£137,000,000

|

|

Miracle on 34th Street (1994)

|

Susan Walker dream family home

|

Detached house – Forest Lake, Illinois

|

£2,750,000

|

|

Sherlock

|

Sherlock Holmes

|

221b Baker Street

|

£2,703,857

|

|

Absolutely Fabulous

|

Edina Monsoon

|

Holland Park Avenue House

|

£2,250,000

|

|

James Bond Skyfall

|

James Bond

|

Bond’s Family Home (Skyfall Lodge)

|

£2,200,000

|

|

Bridget Jones Diary

|

Bridget Jones

|

Borough Market Flat

|

£1,438,757

|

|

Home Alone

|

Kevin Mcallister

|

Chicago suburban detached house

|

£1,200,000

|

|

Elf

|

Buddy’s Dad and Family

|

New York apartment

|

£1,050,000

|

|

Love Actually

|

Natalie

|

Terraced house Wandsworth

|

£1,024,286

|

|

About A Boy

|

Will Freeman

|

Bachelor pad, Clerkenwell

|

£1,003,355

|

|

Vicar of Dibley

|

Village cottage

|

Windmill Cottage – Turville

|

£579,815

|

|

The Holiday

|

Iris Simpkins

|

Country Cottage, Shere

|

£528,203

|

|

Only Fools & Horses

|

Del Boy and Rodney

|

Nelson Mandela House, Peckham

|

£395,778

|

|

Harry Potter

|

Young Harry Potter

|

The Dursley home (4 Privet Drive)

|

£347,786

|

|

Gavin and Stacey

|

Stacey

|

Terraced house (Barry, South Wales)

|

£173,788

|