House prices – Leaving a misery for a generation?

Lots of reports recently about the crazy hike in house prices over 20 years, ie a report from CityAM, what some would refer to as a an unbelievable increase in prices within just one generation. Looking back at homes I have lived in through the years and remembering what my parents paid and sold for, indeed house prices today are at such peeks that I would say it is scary and though I am no financial expert, it is what has obviously kept the country afloat now for many years.

What would have been a reasonable priced home 20 years ago which a young couple could have aspired to have with two average salaries behind them and an agreement of 15 or 20 years mortgage (wasn’t that the way we were brought up to think) has now become unattainable and merely something that can only be rented out with some subsidies from the government to make up the high costs of basic living these days.

Today’s generation are, I feel, left in misery and are paying out for the generation before them who, if they had purchased their property, are not only seeing their mortgages now coming to an end, but also seeing that their initial asset has gone on to increase in value 5 or even 10 times. This would be all fair game if average salaries had increased in equal folly amounts, but they have not which quite literally means that those looking for property in today’s market are not only needing a miracle mortgage approved for no doubt longer periods, but also needing governments tax credits help even more to get buy and as we are seeing these days, help from the government to even buy the over priced property in the first place by ‘help to buy scheme’.

I not only read the articles about house prices increasing I also researched via Rightmove recent trends and it is clear that house prices have on average increased around 400-500% though not always an upwards spike during that period as there are sold prices that show otherwise – Maybe this will be the case very soon as many predict a collapse of house price values here in the UK and even an interest rate hike that will sting many of those who have borrowed and borrowed on the back of increasing house prices:

Red dots showing house price falls in recent years.

When I see adverts today and the emails coming through to my inbox regarding property, in most cases it is themed on the likes of ‘Your short term property investment strategy‘ which tells us what we think of the old word ‘home’ these days… No longer is searching for the house or flat to be your new home, it is weather or not this is a good investment going forward and if this property is prime for a buy to let.

Though dated in 2012, this report from the Office for National Statistics shows that from 1986 to 2011 that wages increased by 62%… Here is another fact that shows house prices are just simply too high or obviously were massively undervalued a whole generation ago. I know some so called property experts believe that house prices can and should still increase, but surely wages vs house prices is somewhat out of proportion today? Yes, UK, especially London, is not the only country to see property/land prices increases, even out in India places are out of reach for many.

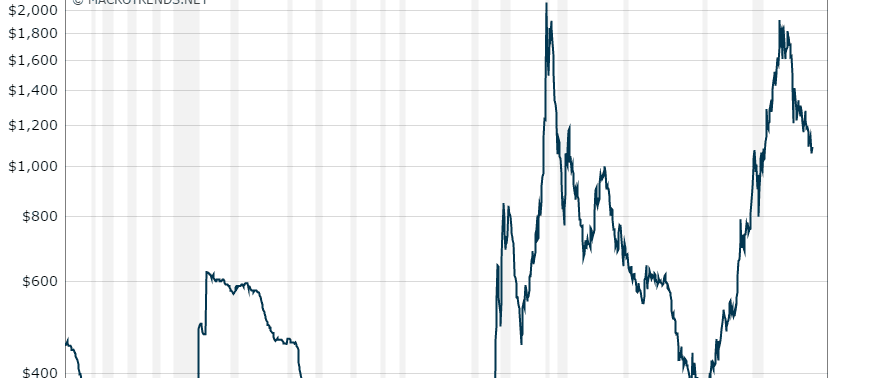

House prices of course are just like commodities, they go up and down, though mostly up on average. Gold has also seen incredible spikes in recent generations, $360 per ounce in May 2001 then upto $1,700 in September 2011 (big change saw gold at $220 in Oct 1970 to $2,000 in Feb 1980).

Silver is also up and down… So could this be true to what will soon happen to UK property prices or does too much of the economies strength depend on house prices staying at all time high values?

I do think house prices are really too high, especially having lived in the UK and across Europe too. Certainly, major town and capitals will always be high priced, through history the likes of Mayfair in London as an example has always been where we believe millionaires live, but when I look at prices where I lived before as an example in France, the prices are still very reasonable. Only the other day I looked at a property in the local market town, where young people have work in shops, factories, supermarkets etc and the price of the property to modernise was just 12,000€ – Yes, we are not in France, we are living in the UK, but there is such a drastic difference in living standards and lifestyles.

The mad rush and urgency to find anything undervalued can clearly be seen, especially of course in London where we have seen the ocmmencement of people selling off land beneath their buildings and potential room to build on their roof tops… Soon we’ll be judging whether or not we can squeeze a studio flat soon on the end of that flag poll that offers great views down Regents Street?