How to find #PropTech Investors

Finding an investor is the dream for some business start-ups and many others in established concepts too within the world of #proptech. Speaking from experience and I hope many will agree with me, when you are building your own start-up you become very passionate about it and see it as the next big thing wishing upon everyone you tell that they should take it up and use it. You sleep, eat and drink your concept.

For those that have progressed beyond the creation of an idea and you are now up and running along with establishing clients you may very well realise that a big dollop of money injected in to your business could take you much further in a speedy fashion. If #proptech is your theme then you are in a very well established and vibrant market though at the same time quite flooded with others just like you… How do you find investors in the #proptech sector?

“Keeping as much ownership of your business is vital, ie try not to give away too much percentage in the early stages. This is a lesson I wish I had installed me in my early days of seeking investment.“

I wish to share with you some ideas that enabled me to acquire over a six figure investment sum in various concepts over the years and I am one of those that created businesses on the front room table stories and started off with zero connections in each sector I ventured in.

Below is a list of how you can find property technology investors:

- Family and Friends: Though we are familiar with the quote about not lending money to family and friends as so many relationships are lost this way, the best way to initiate searching for investment money is via those closest to you. Be very open that you are looking for investment, do not spring it on people, depending on the wealth of your family and friends you may find that you can secure a very small round of investment to get some of your long term plans underway. Even at this early stage treat the set up of your business professionally and make sure you have required legal paperwork in place regarding distribution of shares and receiving of monies.

- Loans: I do not personally like this route though you can seek to gain money in to your business via loans from banks to once again family / friends. This may very well require of you some security against the loan and with in mind that most start-ups fail you should take serious consideration of what you are prepared to lose should yours fail also.

- Networking: I have business networked for years starting from the lower levels of BNI breakfast meetings up to private events on board yachts. You should be open to networking and to do so at target events which there are many property themed that usually take place at major cities across the UK and especially London.

- Google Campus: I use the Google campus as an example for what it was back then, a vibrant shared working space of start up and established businesses. Down in the basement was where I took to working and did so alongside many other hopeful start ups – As much networking and chatting over ideas was done alongside actual ‘work’. What these kind of coworking places do is not only increase your motivation and gained feedback from other start ups, it grows your network and as it did for me, formulated new business relationships and partners. Most importantly though it also attracted investors, I mean what better place to find undiscovered gems than in an incubator style dedicated start-up space. Investors used to be seen wondering around asking people what their start up was and pitching it to them (see title image).

- Crowd Funding / Kick Starter: If you are able to put together the perfect pitch that will require of you a lot of time, effort and sometimes money, then why not consider such crowdfunding or kick-starter options as GoFundMe or Crowdfunder. The beauty of these concepts is that they have a ready made audience for you thus increasing your chances of raising the capital you need, though remember that you will be up against many others looking for the same thing. I did try once a crowdfunding project and I was unsuccessful in raising money (I did eventually get funding in to the business via another route).

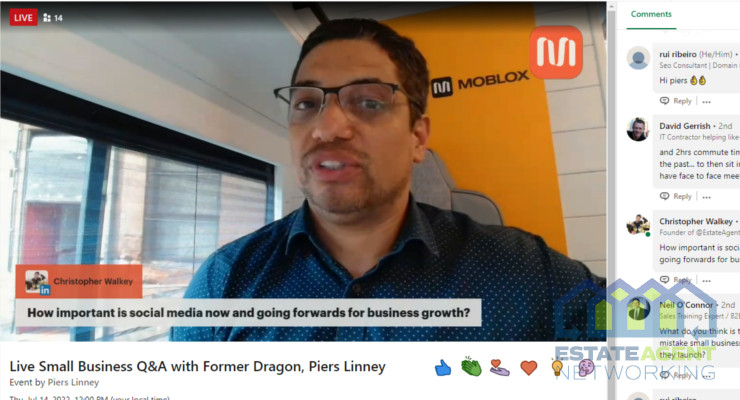

- Social Media: If you have a great concept then you might just need to tell people about it. You should already be on social media with your start up business so I suggest using these accounts to let others know you are seeking investment. Hashtags are the way to go for this especially #PropTech #Investment #crowdfunding etc. The other important bit of advice here is that investors also use social media, especially LinkedIn, so what is stopping you from reaching out by shouting out from the rooftops about your business and how it might just make them a bit of money if they invest? I remember once via my LinkedIn account that James Caan (ex Dragons Den) investor had looked at my account, this led me to then take the opportunity to visit his office in London and personally drop off one of my funding packs for my company – Did it work? No. Though this is the attitude you need so spend time on social media researching the people / companies who might just be interested in investing. Many investors sometimes go live on social media so try to catch them if they do and tell them about yourself.

Piers Linney (ex Dragons Den) social media – I managed to connect with Piers during his live broadcast

- Events: Throughout the year there are countless property themed events taking place from industry awards to annual trade shows – You should be at these events connecting with people. Have you enough money to take a stand, how about to do a talk or maybe even sponsor some part? Here you will have target people in the property sector and remember than not all investors wear red braces and Rolex watches, sometimes it is other businesses that invest in concepts looking to adopt new technology in to their brand. If you choose to just walk around an event and network, think about not only wear that sharp looking suit, but wearing branded clothing highlighting your business (I saw once a guy who was frequently stopped and questioned, he had ‘I am looking for investment‘ printed on the back of his t-shirt).

- Pitch your business idea events and pitching / accelerator companies: I was a big fan of Dragons Den during my early years of business creation and this fondness for the show actually got me working for the day in the background and I did also pitch one of my businesses to a few dragons! Though back to pitching as a subject, look out for events that enable start ups to pitch. A few years back I created a #proptech pitching company called TeqDen which towards the end (I sold the concept to Life Ventures) become highly popular – A handful of property technology companies looking to raise money were able to pitch to a selection of investors and an audience that averaged around 100+ (These took place at the Google Campus). There are also dedicated companies online that are there for you be supported from development of your start up to gaining investment – An example here is Nurtur Group.

One big bit of advice is to prepare yourself for rejection. To not be despondent should you continuously get a no from those you were hoping might invest – If you can, gain feedback to know why you were refused and take this is in to serious consideration. Do not give up, go for it tooth and nail from emailing to getting your face known at the right events. Just because you did not get a reply first time does not stop you reaching out again – evolve your pitch and take it with you wherever you go and that includes your social events, sometimes just standing in the pub could lead to someone knowing of someone who might be interested.