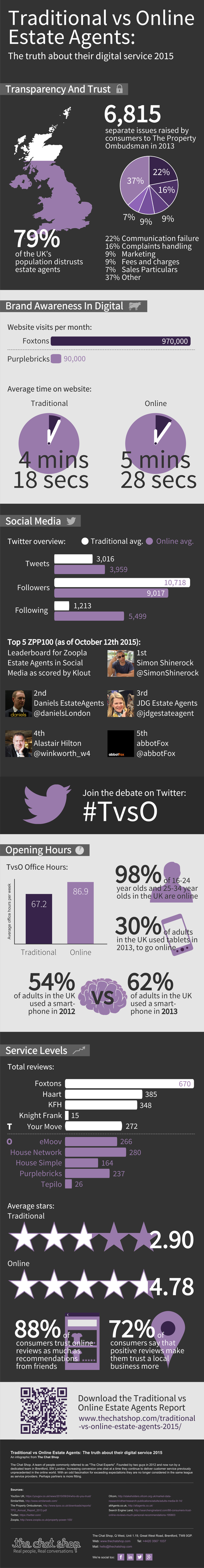

Infographic: Traditional vs Online Estate Agents 2015.

Buying or selling a home can be a life changing process. It’s a stressful time, when you need good advice and support from a trusted estate agent.

Choosing the estate agent that will guide you through your transaction can be a big decision in itself – never mind which school you’d like to be close to or how many bathrooms you need. You want to choose an estate agency who will bring exposure to the house you are selling, who will help you to find your next home and who will not overcharge.

In the UK property market, there are plenty of estate agents to choose from but there is also a clear divide. On one side of the market there are traditional estate agents and on the other, online agents.

The battles and debates between traditional and online estate agents have been fierce. As both sides vie for the market they try to persuade homeowners and buyers to choose their respective services.

The infographic below outlines some of the key battle areas for online and traditional estate agents – with some of the statistics taken from our most recent property report.

We know that the ongoing debate isn’t slowing down in its ferociousness – our infographic and 30 page report attempts to find out exactly what the differences between traditional and online estate agents are, in terms of their digital service.

Both materials add real data to the traditional vs online estate agents debate. Check out the infographic below now and download the report for our full analysis on 5 top traditional estate agents and 5 top online agents to see, from a digital perspective, who’s coming out on top.

Download a copy of the report here and join the debate on Twitter with #TvsO. Do you believe that, in terms of brand awareness in digital, online agents will prevail in the long run? What are your thoughts on the traditional vs. online estate agents digital service debate as a whole? Let us know in the comments below.