Is a Dining room a Bedroom? Or is it just ‘Click Bait’ marketing?

Being on the look out for a new property I have been rather tied to checking Rightmove/Zoopla etc for something of interest. Now when you start to spend time on property platforms (OK some wasted time I have spent as you do get tempted in to property way above your price range just to have a nosy) you really get to see just how far apart estate agents are with their marketing. Some agents are simply handling things wonderfully well from full details, floor plans, professional photography, video tours and in today’s market, realistic valuations – Others are quite the opposite and to call them an estate agent is quite an offence to the industry.

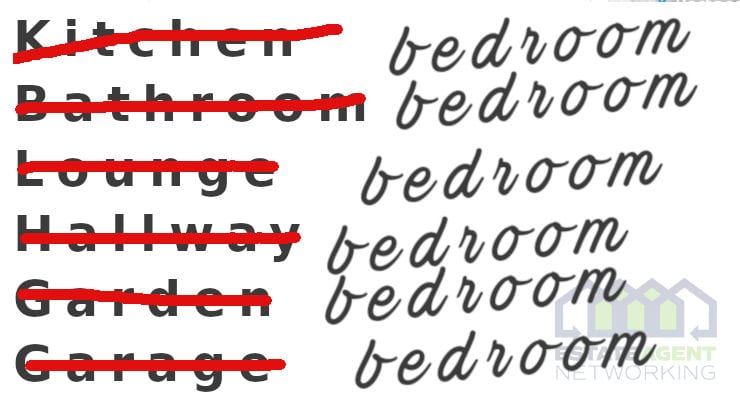

Now one repeated click bait I would call it is the way in which some estate agents (both great standard ones and lesser so) bump up the bedrooms of a property purely by classifying what would normally say be a dining room / living room etc as a bedroom. Understandable if the house is very large and has multiple spare rooms of which one / two rooms downstairs can easily be classed as an annexe potential / bedrooms, but a normal three bedroom house has suddenly jumped up to a four bedroom, nothing to do with an extension of conversion, but just because we class the front room as a bedroom – Is the housing situation in the UK that bad that any room other than the bathroom/WC should be classed as a bedroom? I know that Harry Potter might have something to say on this subject from his cupboard under the stairs, but come on!?

An example property is here from Durrants Estate Agents, a three bedroom house (two OK sized bedrooms and one box room) is a four bedroom property listing in their eyes as the dining room has been also classed as a bedroom. Now home buyers are not silly, they can see this is a typical three bedroom sized property and not a four, we can decide when we purchase the property if we want to make the kitchen, sitting room and garden in to bedrooms and feel good in ourselves that we own a 6 bedroom house surely…

There are numerous more examples that I am coming past from different agencies on what normally would be 3 or 4 bedroom homes that have been bumped up a bedroom such as this one here from Scott Shen & Partners. Here is another smaller three bedroom house marketed by Hamilton Piers that if you do not want the dining room and you can put up a new wall to divide it from the lounge then hey presto, you have a four bedroom semi detached property now – Let us stick on another £15,000 or that or at least not succumb to recent property price falls and keep it priced above what it should reasonably be valued at… I don’t believe it!