Is Social Media taking over everything?

Maybe a slightly hard title, but when we stop to think about it, is social media motoring forward by filtering in to nearly every aspect of our day to day lives?

We mustn’t forget that the internet once started with just an idea and many thought it wouldn’t last or at least it wouldn’t capture the imagination of the broad mass of the world’s population. Today, more and more people are very used to carrying around a mobile phone, checking their emails or watching the latest on Netflix. Our older generation are getting fewer whereas as younger population continue to grow in numbers. Just the other day I sat round a friends house and watched as their 3 year old child used the family’s iPad to watch videos of Batman on Youtube.

What does this all tell us? Children are being brought up understanding that by touching a screen they can access entertainment and their favourite characters are all contained within these miniature flatscreen devises. Most of the younger generation today will have been brought up with touch screen technology, with checking their Facebook or Instagram timelines or catching up with friends via Skype. As we continue to move forward with technology and our younger generation enters the job world, we will see that the skills they bring with them means near future inventions and business ideas will most certainly all involve a mixture of what they were brought up with.

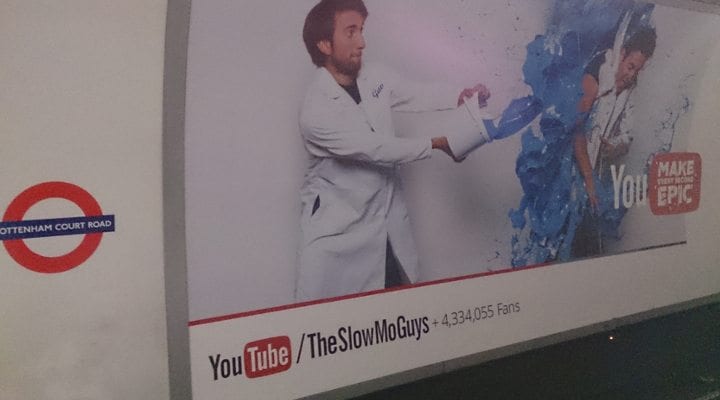

Just the other day, whilst in between meetings in London, Youtube channel adverts were everywhere from London buses to front page of the Evening Standard. This will not just be a random occurrence as the importance of business social media channels increases as they understand more and more how to engage their captured audience and the increasing amount of children growing up to be ‘purchasing/buying aged adults/ increase.

Can we really say that social media is taking over the world and that we should be concerned, that it is either get on board or get left behind? In the past businesses have survived without the need to take out an advert in the Yellow Pages, nowdays I know of businesses that have no presence on the internet neither an email address and I am sure there will be businesses that refuse to embrace social media and still do OK.

What we must not rely on though is still thinking that our older generation do not get social media and that there will always be an audience outside of social media for as mentioned previously, an unfortunate statistic for us all is that the older generation to us is a figure that is always in decline and that new life is always being created so those who are too old to embrace technology will soon be replaced by those that embrace it. Social media can be put in to the same bracket as radio, television and the internet and these were all new at some point in their life and developed in the same way, but stats will show that they never grew as fast in popularity and usage as social media has.

Mobile internet accessing device usage is increasing, internet speeds are increasing, social media usage is increasing… This must tell us something about the immediate future and how we will be communicating with one another and how we will be leading our lives and I have not even touched upon the likes of Google Glass and the enormous virtual world that opens for us.