London House buyer enquiries decline.

A recent report out by The Royal Institute of Chartered Surveyors highlights a decline in the number of new buyer enquiries in December as compared to November last year, Estate Agents expect this weakening of demand in the capital to lead to a drop in house prices of around 5% average during 2015. Many would see this drop as entirely predictable, acknowledging that government policy is now filtering through, gone are the days of high multiple borrowing, with stricter mortgage lending rules now in place, borrowing limits have been set at 4 times income instead of the irresponsible 7-8 times, also add to this new taxes for foreign buyers and CGT for them for the first time.

Realistically we may ask is London a place for wage earmers? as in some parts of the capital property prices hold no relationship to income whatsover, especially in some of the suburbs, if the buyers are foreign as many reports seem to suggest will we see less of them as we move into this year? The high house price inflation in London can be supported by the fact many properties are bought and put out to rent and in many cases for multiple occupation, more at risk are the highly priced flats and/or appartments which are less likley to be multiple occupied but will depend on income to repay mortgage, or is it that such desirable properties in desirable areas are just the target of the wealthy overseas buyer who tend to use them rarely or leave them vacant all the time, buying simply as an investemnt.

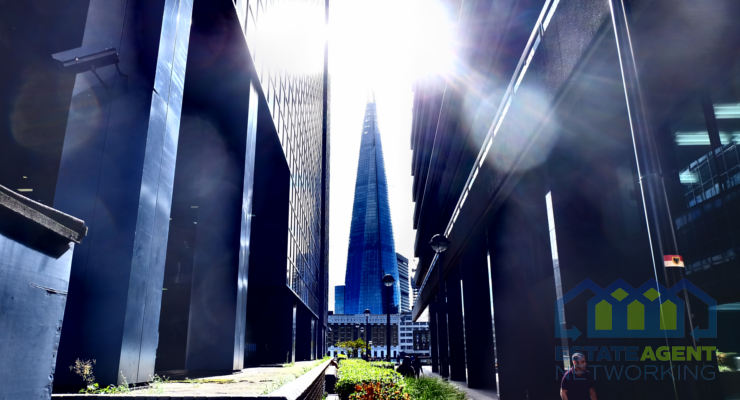

London probably is one of the most desirable capital’s in the world to live or own property in of any type, a strong economy contributes enormously to this along with a reasonably safe multicultural way of life, so the desire by many to be in or close to the capital I feel will not be declining in the medium to longer term, however we will probably see a little stagnation in the run up to the election, the outcome of which will be anyones guess at the moment.