MSN Scaremongering again? Property Market Crash reports

We all know, or at least by now should be waking up to, that MSN delivers mostly inappropriate / fake news and are countless times accused of political agendas when it comes to reporting on what’s going on in the world. What newspaper can refuse a controversial headline these days regardless to how legitimate the story might be? If it is dangerous heatwaves burning down houses (fact: compost fire got out of hand) to floods caused by the heatwave (blocked drains) picking up whatever national rag you favour you are likely to be presented with over inflated headlines so why should be pay attention to those that include property prices?

Let’s be honest, negative headlines towards property prices including words such as crash, decline, fall, drop, stumble, slowdown and more do not always tie up with the actual facts. We must consider the following and what of the following the MSN writer has bothered to investigate:

- Property asking prices

- Property sold prices

- Regional stats

- National stats

Does the article refer to property prices in that they are:

- Slowing down in the speed of increase

- Declining in value

- Asking price declining

- Sold prices declining

Currently the market is still increasing in value though the amount of increase is declining so headline could be ‘Property prices declining‘ as much as it could be (and should be) ‘The pace of property price increases is slowing‘. Property prices can only really be measured when it comes to them being sold and these stats, unless mentioned otherwise, should be what any journalist focuses on so to get a true picture of the situation. The best place to get facts on property prices in the UK is directly from the government website, ie here are the details of property price data for June 2022: https://www.gov.uk/government/news/uk-house-price-index-for-june-2022

“Another important factor to consider is over what period stats are referring to. Over the year house prices might be up whereas over one month house prices might be down. As an example, the first nine months of the year could show a 10% increase in house prices though the last three seeing a drop of 3% – This would mean that house prices have increased by 7% there about though headlines could read that house prices have dipped by 3%. Also, journalists sometimes forget to ease back on their stories such as the reported 1.3% fall between July and August 2022 is in line with drops seen in the previous past 10 year months of August as it is the quieter ‘holiday’ season.”

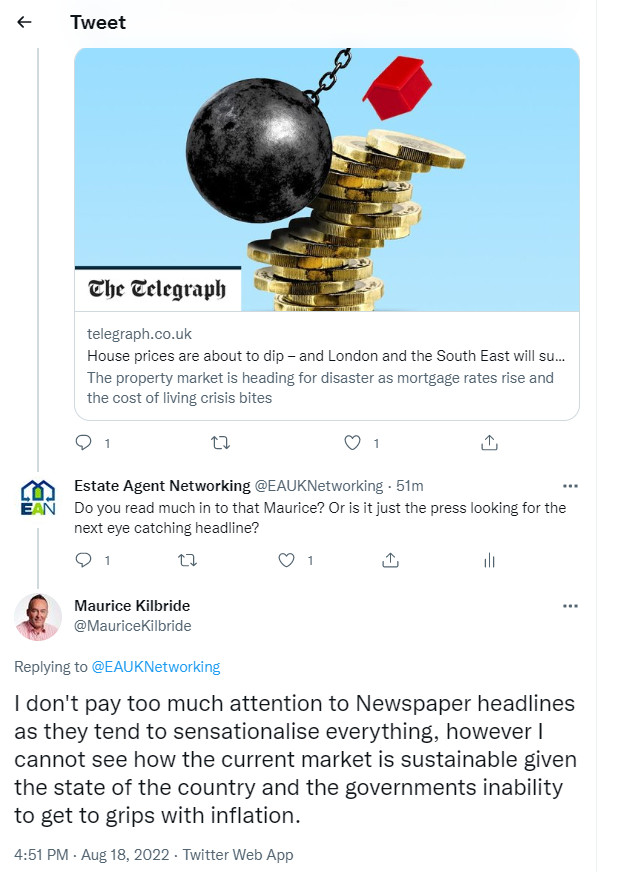

Recent headlines such as that from The Telegraph (House prices are about to dip – and London and the South East will suffer most) as well as (‘Tsunami of repossessions’ will hit house prices) thrive on impact hitting words to entice readers whereas other media outlets see things another way such as (House prices on average £20,000 more expensive today than 12 months ago) from SkyNews. One writers interpretation can be very different to another, both being poles apart in opinion and drama level behind their headlines.

Supply and demand will always determine what property prices do and currently circumstances favours more property prices rising or standing firm over falling. The UK and especially main cities in England remain a popular destination for people coming to live and work from abroad and let us not forget the recent 100,000 people from Ukraine having arrived in the UK under the Ukraine Family Scheme and Homes for Ukraine Scheme. Outside the box facts also effect demand on property ie life expectancy for U.K. in 2022 is 81.65 years, a 0.15% increase from 2021.

Positives:

- Continued immigration / illegal immigration / refugees in to the country

- Increased building material costs

- Continued new build quotas not being met

- Cheap interest rates

Negatives:

- Increasing inflation including utility in coming months

- No confidence in the government and economy

- Global unrest (WEF)

Many will desire a fall in property prices whereas many more will want the opposite with probably a majority in the middle quite happy that property prices remain stable thus owning a property an achievable dream for everyone.

Maurice Kilbride Reply on Telegraph Headlines

Estate Agent Maurice Kilbride shared some words via a tweet with us towards the recent Telegraph headline: “I don’t pay too much attention to Newspaper headlines as they tend to sensationalise everything, however I cannot see how the current market is sustainable given the state of the country and the governments inability to get to grips with inflation.”

To be honest, we think he has more or hit the nail on the head…