New Research Reveals Time to Sell a Property Has Halved while Property Prices Have Almost Doubled Over The Last Five Years

New research from TwentyEA shows that over the last five years, property prices have seen an annual growth rate of 6.3% nationally, almost doubling during this period, while the time to sell properties has halved since 2019.

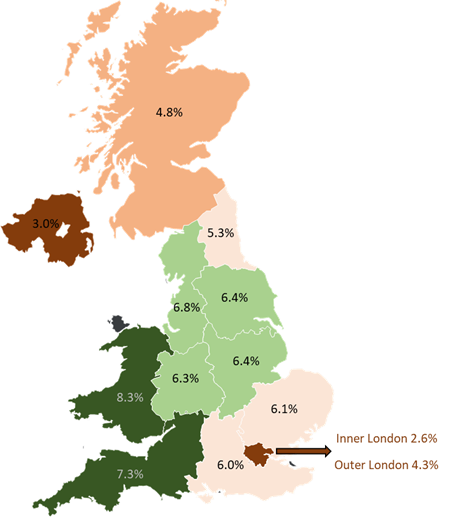

While the average asking price in the UK now stands at £417,000, there are large regional variations with price growth much slower in London, Scotland and Northern Ireland. The research reveals the strongest regions for price growth are Wales and the South West, with demand also strong in the rest of England (outside of London). Demand is not as strong in London, Scotland, and Northern Ireland.

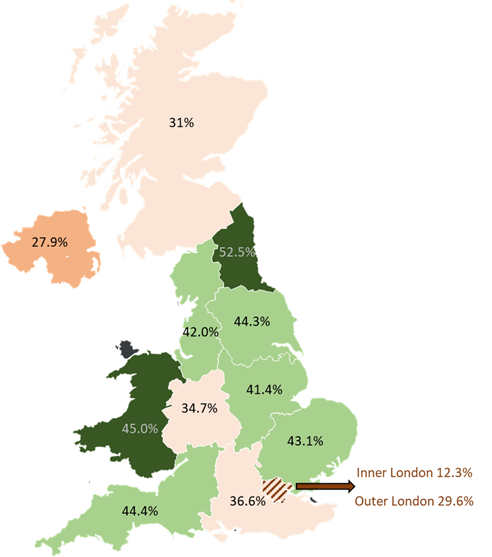

The average time to sell has gone from 75 days in 2019 to 47 days today. The area with the most change is the North East and it is the only region of the UK where the average time to sell a property has more than halved since 2019. Inner London is the least changed region, where it currently takes 80 days on average to sell a property.

There is plenty of evidence of a continued ‘flight to green spaces’, with more remote areas in the UK experiencing the highest growth in prices, and in many cases, the largest shortening in time to sell.

Property Price Analysis

The following map displays in orange those regions that experienced lower price growth and green for those that experienced higher price growth:

Time to Sell Analysis

Currently 50% of all properties sell within 16 days (instruction to sale agreed). Again, without exception, all main regions of the UK realised improvements in the time to sell throughout this period, but some of them were a lot lower than the 37% average and some higher.

The most improved area is the North East, as this is the only region of the UK where the average time to sell a property has more than halved since 2019 – moving from 98 days in 2019 to 47 days today. Wales is also very strong with a 45% improvement in time to sell.

Inner London is the least improved region, where it currently takes 80 days on average to sell a property. In fact, this is the slowest region of the UK to sell a property, followed by Northern Ireland at 67 days.

The map below shows in orange those regions that experienced lower reductions in time to sell and green for those that experienced higher reductions in time to sell. For the avoidance of doubt, green is good!

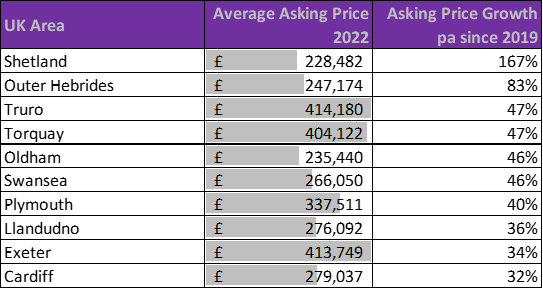

House Price Growth

Looking at postcode areas, asking prices are growing fastest in Shetland, where prices have more than doubled since 2019. The average property there will now cost you £228,000. Whilst this seems very reasonable by today’s standards across the UK, it was only £143,000 in 2019.

The Outer Hebrides is close behind, with a price growth of 83%, but both areas of course have a much lower volume of sales. Of the top 10 areas of price growth in the UK, four of them are in the South West – Truro, Torquay, Plymouth, and Exeter.

In addition, we should not forget Wales, which boasts three areas in the top 10 – Swansea, Llandudno, and Cardiff. In the worst 10 areas of the UK for price growth, seven of them are in London!

The top 10, with current average prices, are listed below:

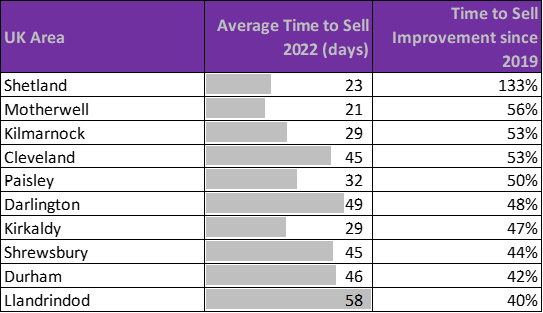

Northern Sales Speed

Again, above anywhere else in the whole of the UK, time to sell has fallen fastest in Shetland, where the average property now sells in just 23 days, whereas in 2019, it took 186 days to sell the average property.

Scotland features heavily in the time to sell improvement top 10, where five in the top 10 are in this country. The North East is also well represented, boasting three areas in the top 10.

The top 10, with the current average time to sell, are listed below:

Katy Billany, Executive Director of TwentyEA comments: “Our analysis shows, based on real-time, whole of market data, that over the last few years, prices have nearly doubled whilst the time to sell properties has halved.

This is perhaps not surprising given the buoyant market we’ve seen over the last two years, but looking at the detail at a regional and local level is particularly interesting.

“The most recent Nationwide House Price Index for June has indicated that while property prices are continuing to grow, the growth rate seems to be dropping so it will be interesting to see whether that trend continues throughout the second half of the year.

“Whilst high property prices are good news for sellers, we’re seeing many potential purchasers in lower price brackets priced out of the market and the cost of living crisis is not helping with the chronic lack of stock.

“Even if house price growth does continue to slow throughout the rest of the year, it’s unlikely that it will be at a significant level as demand remains high.”

TwentyEA are experts in the UK home mover market, providing smart, specific and intelligent home mover data and insight to help agents better understand the challenges of the industry – and crucially how to apply this knowledge to leverage brand power. TwentyEA holds the UK’s biggest and richest resource of factual life event data including the largest, most comprehensive source of home mover data compiled from more than 29 billion qualified data points.

TwentyEA’s customer intelligence and engagement solutions leverage data and technology on agent’s behalf, enabling them to connect with target consumers using unique data insights into the key life events that stimulate customer demand. TwentyEA is part of the TwentyCi group of companies who use data science to improve commercial outcomes for clients.

For further information please visit https://news.twentyea.co.uk or email enquiries@twentyea.co.uk