Real Estate Marketing: Combining Print and Digital

The property market has seen a lot of growth in the last year. Despite the economy contracting by 10% since the start of the pandemic, UK house prices have soared, with the Land Registry’s UK House Price Index revealing that property prices increased by 1.2% month-on-month and by 8.5% year-on-year in December.

People are buying at these increased prices, too. This is probably largely down to the Stamp Duty holiday being extended to June 2021. This suspension of the tax has been in place since last year and is considered one of the main reasons behind the flurry of interest from buyers.

However, while business is booming for estate agents, marketing should still be a priority – especially as it’s time to look to what happens after June when Stamp Duty returns. How estate businesses market their services is important, not just now, but in the future. Here’s a look at some of the options available.

Print marketing

Print is a form of offline marketing that has always worked well for estate agents. As most high street agents are based in residential areas, there is a feeling of familiarity by having these property professionals right on the doorstep. Therefore, print marketing is likely to work well here, as the estate agent is a local brand.

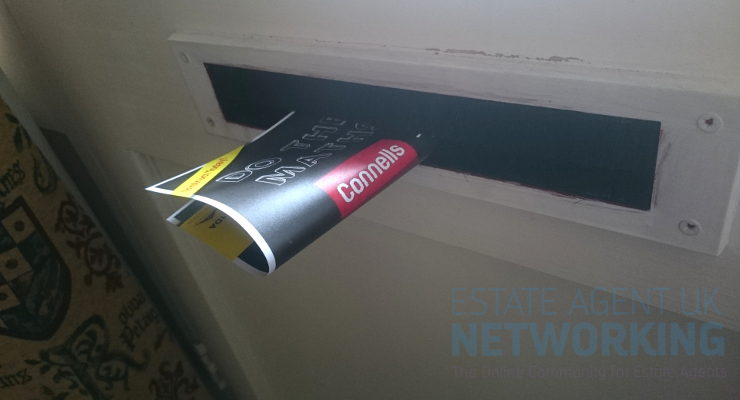

Newsletters detailing current services and properties on the market are a great way to generate interest. Dropping these through the doors of residents in the area means exposure. Plus, there’s the chance that, even if the homeowner wasn’t thinking of selling before, they might be swayed if they see what’s available in the area for their budget.

Similarly, brochures are a great way to showcase what’s on offer. These are a more involved roundup of properties on the market and are well placed in estate agent shops where potential buyers can pick up the latest brochure and look through the different properties in their own time.

Staying in-store, banners are an eye-catching way of drawing attention to the business. Perhaps there’s a deal on to shout about? Or maybe it’s a tool to showcase new branding? A banner adds a sleek look both in the window of the estate agent and also further inside the branch.

Flyers are a snappy way of getting your message across, too. Many estate agents are creating leaflets asking homeowners if they’re thinking of moving and if so, to consider the estate agent for the sale. This is a clear, concise way to get the message across.

Online marketing

Offline marketing works well, but it’s even more effective when combined with a great online campaign. From flyers to brochures, banners to newsletters, it’s worth pointing customers to the website, too. Here, estate agents can reinforce the messaging on the print materials, from detailing the latest deals to showing off the current properties.

Additionally, the site can introduce team members, adding to the feeling of familiarity and reminding customers that the nearest branch is just down the road. Blogs work well, too. Here, the estate agents can discuss local and national property news, cover current updates and information about the branch, and make the content relevant to customers.

Perhaps most importantly, the site will need contact details. How will customers get in touch about the property they’ve seen? What’s the best way to book a viewing? Laying all of this out online will help potential buyers and reflect the business in a good light.

So, by combining print and online marketing, it’s possible for property businesses to attract potential buyers and maintain a great reputation in the area.