Should you be using floor plans?

I am constantly amazed by the number of agents that still don’t use floor plans, especially for lettings!

In my previous life before working with PlanUp, I was often disappointed that most of the properties I was interested in renting didn’t have a floor plan. I had no idea how they were made or produced or at what cost in time and money, and I didn’t really care; I just wanted to get an idea of the size and layout before I wasted both my and the letting agent’s time in going to see a property I was never going to be interested in.

I don’t think demand has ever been higher than today’s market, and so often rental properties go without a viewing. So to me it makes sense having good pictures and a floor plan – the letting agent wins because the people enquiring know what they are after so are more likely to be interested, and I win because I can get straight to the properties I’m interested in.

Instead, I viewed as many properties as possible just in case it was the right one! I must have wasted hours of everyone’s time looking around properties that didn’t really interest me, purely because I had three or four photos to base my decision on whether to view or not.

I now find myself in a position to see the market from the other side, and what amazes me is how many agents don’t use plans.

Having plans may mean that you get less viewings, but the viewings you do get are much stronger leads.

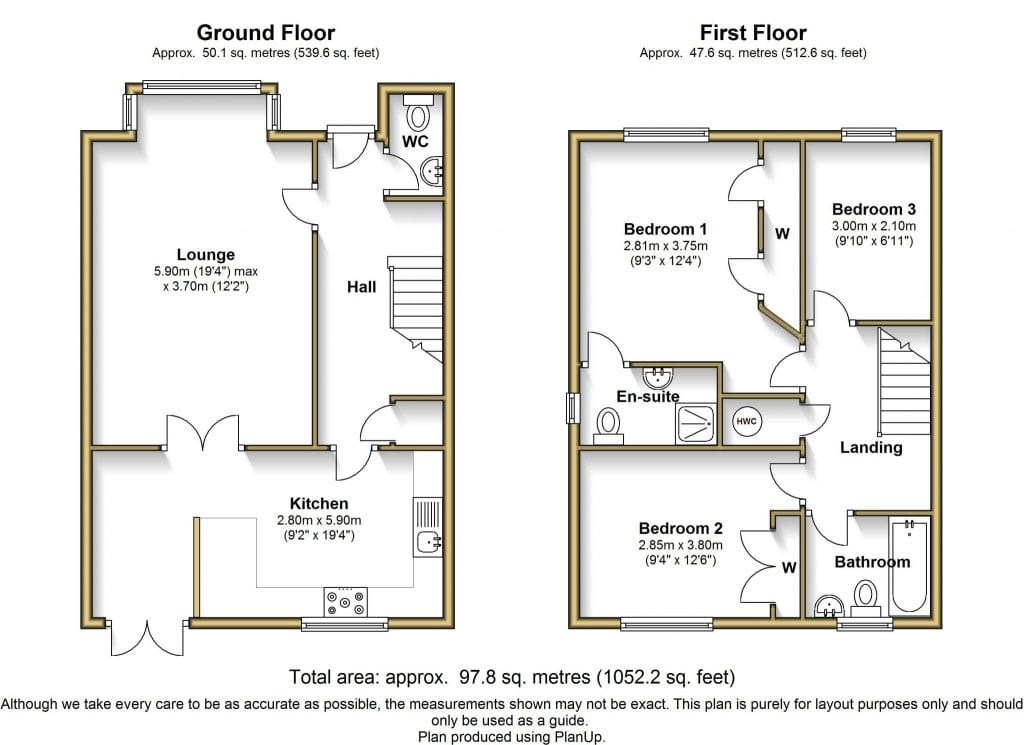

http://www.planup.co.uk/planexample_2d.aspx

Would you rather waste time showing people around a property that they were mildly curious about, or spend fifteen minutes on a floor plan and show people around a property that they are genuinely interested in?

Two years ago Rightmove did a study which revealed that 78% of sellers rated the importance of having a floor plan when selling as 7 out of 10 or higher, while 1 in 5 potential buyers or tenants said they would either “ignore the property advert completely” or “only re-visit it if nothing else caught their eye”, if a floor plan was not published.

That means that 20% of potential buyers/tenants would skip past your property listing, for the sake of drawing a floor plan!

Not only are floor plans an obvious essential in today’s market, but the software to create them yourself is getting ever more simple to use. My company PlanUp, along with others, offers training and remote desktop support included in the cost. It isn’t complicated to learn, it doesn’t take long to do, and with some software packages you can even draw the plan while you are at the property!

To shamelessly plug my own company – PlanUp not only allow you to create a floor plan, but it will do your descriptions, help out with EPC calculations and directly import into your back office systems.

Buyers and tenants want to see floor plans, and vendors and landlords want to see you using them. So if you are not currently using floor plans on all of your lettings and sales properties, then maybe now is the time to start!