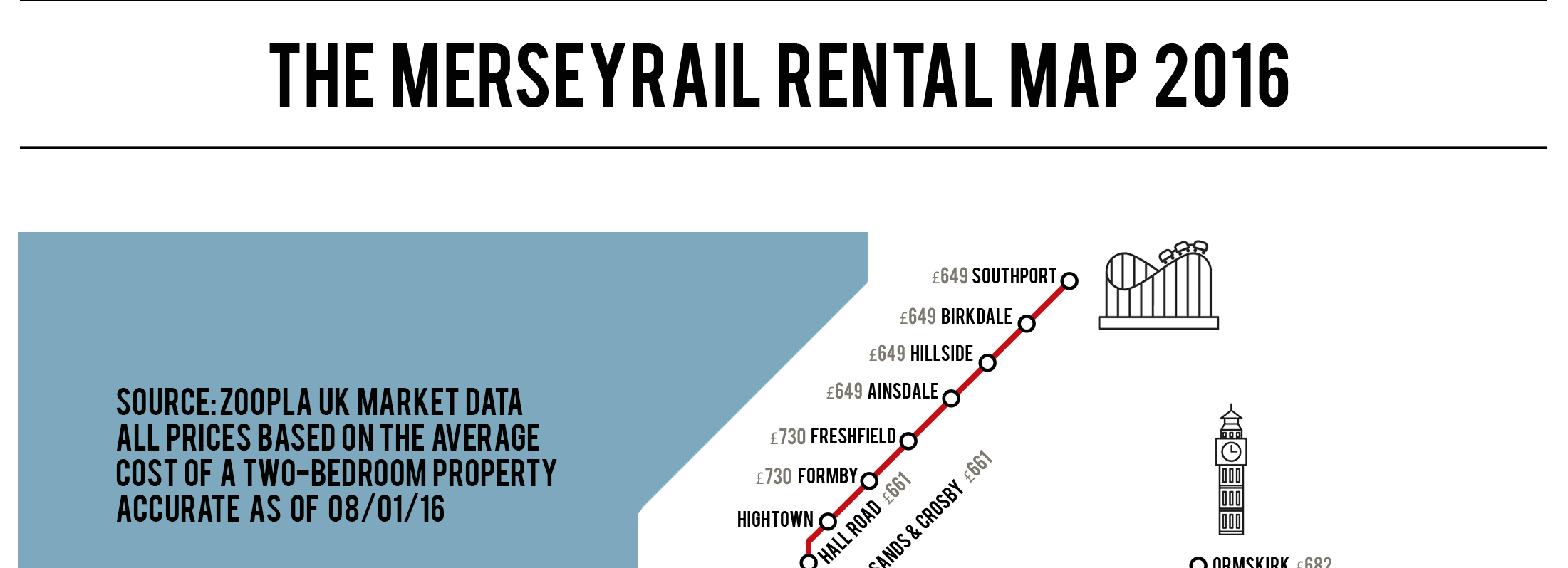

The Merseyrail Rental Map 2016.

You may remember that back in November we featured the ManchesterMetrolink Rent Map from the Digital Media Team. Two months later they’re at it again, this time turning their hands to Merseyside. Using the Merseyrail network they’ve listed the average monthly cost for a two-bedroom property based on the postcode of each station. You can view the image in full by clicking through to it below, or keep scrolling for a full list of the prices by area.

Do you live in rented property in Merseyside? Do the figures match up with your experience? We’d love to hear your feedback, so feel free to leave a comment below and let us know what you think.

As with the previous creation, information was compiled using Zoopla UK market data, relating to properties that are currently available to rent. The data is accurate as of 08/01/15.

Yellow Zone

Birkenhead Central – £447

Green Lane – £447

Rock Ferry – £441

Bebington – £650

Port Sunlight – £566

Spital – £566

Bromborough Rake – £566

Bromborough – £650

Eastham Rake – £566

Hooton – £635

Capenhurst – £798

Bache – £698

Chester – £787

Little Sutton – £635

Overpool – £635

Ellesmere Port – £528

Pink Zone

West Kirby – £620

Hoylake – £687

Manor Road – £687

Meols – £687

Moreton – £516

Leasowe – £516

Bidston – £506

New Brighton – £547

Wallasey Grove Road – £547

Wallasey Village – £547

Birkenhead North – £447

Birkenhead Park – £447

Conway Park – £447

Hamilton Square – £447

Green Zone

Brunswick – £614

St Michael’s – £698

Aigburth – £698

Cressington – £634

Liverpool South Parkway – £634

Hunts Cross – £730

Black Zone

Moorfields – £750

Lime Street – £909

Central – £909

James Street – £750

Red Zone

Southport – £649

Birkdale – £649

Hillside – £649

Ainsdale – £649

Freshfield – £730

Formby – £730

Hightown – N/A

Hall Road – £661

Blundellsands & Crosby – £661

Waterloo – £576

Seaford & Litherland – £449

Bootle New Strand – £454

Bootle Oriel Road – £454

Bank Hall – £454

Sandhills – £487

Blue Zone

Ormskirk – £682

Aughton Park – £682

Town Green – £682

Maghull – £682

Old Roan – £367

Aintree – £461

Orrell Park – £461

Walton – £461

Kirkby – £461

Fazakerley – £461

Rice Lane – £461

Kirkdale – £454