The Nation’s New Build Hotspots – Where are buyers snapping up the most new build homes?

Research by the new home specialists, Stone Real Estate, has revealed where across England and Wales home buyers have the biggest appetite for new build properties.

Stone Real Estate analysed hundreds of thousands of transactions from the Land Registry to see where so far in 2019 is home to the highest number of new homes sold as a percentage of all sales.

So far this year…

Across England and Wales, 11% of sales already this year have been attributed to new build properties, climbing to 13% within London.

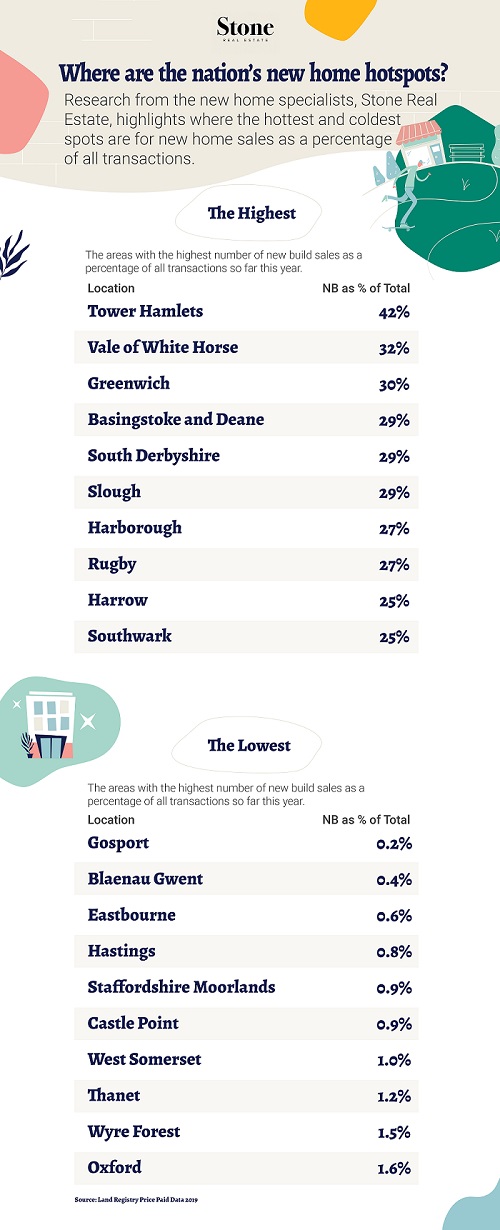

So far in 2019, the borough of Tower Hamlets in London tops the table, with 42% of all transactions being new build properties. But the capital is far from dominating the new build sales scene and the Vale of White Horse ranks second. The commuter hub sits between Swindon and Oxford and has seen 32% of all sales attributed to new build properties in 2019 to date.

Greenwich ranks third with 30%, while another commuter hub, Basingstoke and Deane has seen 29% of all transactions attributed to new builds.

South Derbyshire (29%), Slough (29%), Harborough (27%), Rugby (27%), Harrow (25%) and Southwark (25%) are also amongst the top 10 hottest spots for new build sales in 2019.

Looking at London only, Barnet (23%), the City of London (23%), Hackney (21%) Islington (19%), Newham (19%) and Kingston (13%) join the rest in the top 10.

The area with the lowest percentage of new builds is Gosport with just 0.2% of sales attributed to the sector.

Founder and CEO of Stone Real Estate, Michael Stone, commented:

“As a nation, we’re in desperate need of more housing stock and while the Government’s delivery of this has been inadequate at best, it’s good to see that there are pockets across the nation where new build properties are hitting the market and being snapped up by buyers.

Help to Buy has played a big part in fueling this demand and over the last six years, we’ve seen the new build sector perform consistently as a result, despite the wider doom and gloom of the UK property market.

London, in particular, continues to hold its appetite despite a wider downturn and this is being driven by second and third rung buyers as much as it is first-time buyers.

New build developments are now providing a lifestyle that appeals to numerous segments of the market, whether it be young professionals or families and more. These tailored living environments are taking it above and beyond a roof over your head which resonates amongst buyers and should see the popularity of new build homes continue to climb.

However, more must be done to incentivise the big housebuilders to continue delivering these homes as in some areas, the level of new build stock is almost non-existent.”

|

National New Build Hotspots in 2019

|

|

|

ENGLAND AND WALES

|

11%

|

|

Highest number of new build sales as a percentage of all transactions

|

|

|

Location

|

NB as % of Total

|

|

Tower Hamlets

|

42%

|

|

Vale of White Horse

|

32%

|

|

Greenwich

|

30%

|

|

Basingstoke and Deane

|

29%

|

|

South Derbyshire

|

29%

|

|

Slough

|

29%

|

|

Harborough

|

27%

|

|

Rugby

|

27%

|

|

Harrow

|

25%

|

|

Southwark

|

25%

|

|

Lowest number of new build sales as a percentage of all transactions

|

|

|

Location

|

NB as % of Total

|

|

Gosport

|

0.2%

|

|

Blaenau Gwent

|

0.4%

|

|

Eastbourne

|

0.6%

|

|

Hastings

|

0.8%

|

|

Staffordshire Moorlands

|

0.9%

|

|

Castle Point

|

0.9%

|

|

West Somerset

|

1%

|

|

Thanet

|

1%

|

|

Wyre Forest

|

2%

|

|

Oxford

|

2%

|

|

London New Build Hotspots in 2019

|

|

|

LONDON

|

13%

|

|

Highest number of new build sales as a percentage of all transactions

|

|

|

Location

|

NB as % of Total

|

|

Tower Hamlets

|

42%

|

|

Greenwich

|

30%

|

|

Harrow

|

25%

|

|

Southwark

|

25%

|

|

Barnet

|

23%

|

|

City of London

|

23%

|

|

Hackney

|

21%

|

|

Islington

|

19%

|

|

Newham

|

19%

|

|

Kingston upon Thames

|

13%

|

|

Lowest number of new build sales as a percentage of all transactions

|

|

|

Location

|

NB as % of Total

|

|

Richmond upon Thames

|

2%

|

|

Havering

|

3%

|

|

Merton

|

3%

|

|

Kensington And Chelsea

|

3%

|

|

Bexley

|

3%

|

|

Enfield

|

4%

|

|

Barking and Dagenham

|

5%

|

|

Sutton

|

5%

|

|

Bromley

|

6%

|

|

Haringey

|

7%

|