WEEKLY NEWS ROUNDUP – 01/04/2022

A roundup of the week’s top property and proptech news stories in partnership with Proptech-X

- The Blockbuster to Netflix Evolution: Is the estate agency sector finally having its moment with new Foxtons approach?

- VTUK acquired by iamproperty Group in strategic tech consolidation move

- Meet Parker launches mortgage website plugin to help brokers

- Property Deals Insight makes it onto the REACH UK accelerator

The Blockbuster to Netflix Evolution: Is the estate agency sector finally having its moment with new Foxtons approach?

Since 2017, like a prophet in the wilderness I have been proclaiming that estate agents with tech are losing market share to other agents who do not use it. Property technology when utilised correctly automates processes, but more importantly with data science and machine learning, big data becomes liquid gold. With it, the C-suite can quite literally predict the future by tapping into what is happening right now.

Foxtons has just announced that it has been utilising the services of DataRobot, an American VC-backed data analytics and modelling outfit that creates bespoke machine learning models for its clients. Its tech scours millions of data points to find the hidden patterns of consumer behaviour, giving the agency insight into who is the best type of customer and what they are going to do next.

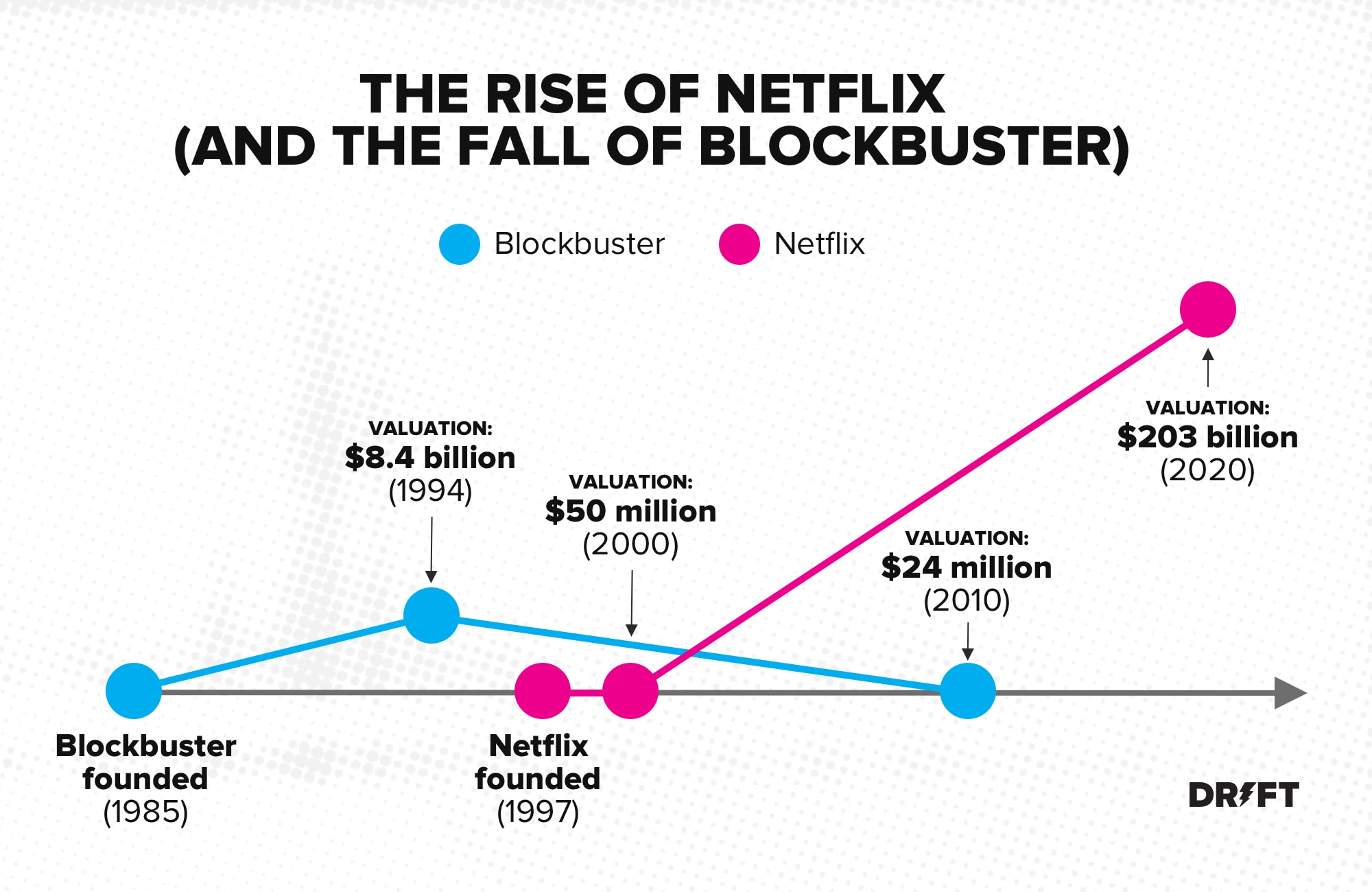

Remember Blockbuster, a huge American video rental company? It grew to over 9,000 branches all across the world, with the majority in America. It was the undisputed king, then in 2000 its revenue started to go backwards, and by 2010 it ran out of money. Finally, in 2011, its last remaining branches were sold off.

Netflix, which itself had started as a video rental business and was at one point poised to take over the video rental chain, did something very different. Instead of thinking it was in the video leasing and video gaming business, it realised it was in the servicing people business, the user experience business.

It spent a large amount of cash and put data intelligence behind its operation, analysing the data to see what its customers were doing and were likely to do. Whilst Blockbuster was pouring cash into advertising and carrying on as before, the agile Netflix began to see patterns of behaviour. For example, they could see who rented what and could target two different clients in the same household by marketing to them in two different ways.

They could do all of this as they drilled down into what the client wanted and when, then they used that intel to be ahead of the game, focusing on the high growth, high-value strategies. Whilst Blockbuster ploughed on, failing to see that technology could have been its saviour. Netflix became the victor and Blockbuster went the way of the dinosaurs, consigned to history.

Now, it is understood that Foxtons has been looking at the propensity of which potential vendors might be looking to list with a similar strategy, a key route to unlocking revenue. Machine learning can unlock all the mysteries of the real estate marketplace.

That is where the now-defunct Countrywide PLC, the assets of which are inside Countrywide Ltd owned by the Connells group, went wrong.

Instead of signing marquee hires like Alison Platt, who drove the company into the ground, they should have spent those eyewatering salaries on new tech. With the vast amount of transactions taking place in that company, the ability to monetise great data insights would have been unstoppable.

For any agency that needs a clear strategy to de-risk themselves from their analogue based DNA, I am more than happy in my day job as CEO of PROPTECH-PR to give advice on what you should be doing on a consultancy basis.

I will not sell you shiny new software solutions as I am not in sales, but I will show you what the future is and how to best prepare to make a lot of profit from it. Having met over 500 property technology and fintech founders I have a pretty shrewd handle on what real estate in the 2030s will look like.

Using technology is not easy, cheap or quick, but the alternative is to often wake up one morning and realise that your local competition has eaten your digital shorts, and their software is producing predictable profit day after day after day. And you are just doing your analogue groundhog day, because it is what you do.

Amazon is a $1.7 trillion valued company, its profits rising by 40% during the pandemic. Why? Because we were locked down? Partially, but the other part is they understand user experience, they read our minds digitally and provide a smiling cardboard box the next day.

Real estate can be like this too if companies use tech to get smart. These kinds of companies retain clients.

VTUK acquired by iamproperty Group in strategic tech consolidation move

As we predicted, 2022 will see a number of mergers and acquisitions in the proptech and fintech verticals, with residential and lettings leading the charge. So it comes as no great surprise that Ben Ridgway, MD of the iamproperty Group, an extremely switched on individual who I last met earlier this month, has announced the group’s acquisition of VTUK.

For those unfamiliar with VTUK, it is in some ways the elder statesperson in the technology stakes, which has pivoted its focus on what solutions it brings and to what sectors. In recent times though it has been servicing a large number of real estate facing businesses. So iamproperty in this strategic move obtain two things, more clients overnight and a vehicle that will be useful to develop new solutions.

The deal is also a great move for VTUK as Ben Ridgway and his c-suite team has a modern agile mindset, and super huge businesses are now being created by corporate bodies that have a vision of growth, and ways to execute that growth.

Peter Grant, who has been at the helm of VTUK for over three decades has built up a business that generates over £1 million in profit annually, and it’s a good time to pass the baton on, as in my analyst opinion with the resources of the iamproperty group, a five-times revenue should be achievable if the correct levers are operated.

As Peter Grant puts it: “A great deal of planning and care went into finding the right partner to take the business forward; we have built our product and service portfolio for over 30 years and know this move will create a bright future for VTUK and our team, allowing the company to accelerate with the dynamic support and innovation that is synonymous with iamproperty.”

In real terms, it will be business as usual, with the VTUK operation continuing as before, but it will now be part of a much bigger animal so its ability to scale up will be greatly enhanced.

Ben Ridgway comments that, “This is a great opportunity for our staff and customers, creating synergies that will benefit our mutual Partner Agent Network. Where we can add real value is through our support functions, to help accelerate growth and product innovation. For agents who want to continue to build their partnership with us, this will allow us to service even more of their day-to-day needs.”

Meet Parker launches mortgage website plugin to help brokers

As many people know, I am a great advocate for proptech and fintech companies. I even get behind those who are not my clients, but are doing something to really help the property industry.

One of my favourite non-clients businesses is Meet Parker, specifically Freddie Savundra, their founder and CTO. Meet Parker supports mortgage brokers by enhancing their website lead generation and customer engagement with AI.

Meet Parker has just launched multiple website plug-ins specifically designed to level-up mortgage intermediaries and support their drive to rid the industry of mortgage ‘best buy’ tables. This latest innovation to the Parker AI product lineup will offer two brand new lead generation and customer-facing plug-ins.

As explained to me, it will provide a brand-new and exciting way for brokers to engage with customers, capture leads, provide indicative borrowing amounts, book appointments and champion the broker’s brand. Both the new Web and Chat Apps will come with various branding, colour and lead flow options. Built specifically for advisers, brokers and agents and providing a fast, affordable and engaging way to turn your website into a digital mortgage offering.

Managing Director, Phil Bailey said: “The mortgage industry is littered with dull, boring and often pointless web pages, product lists and enquiry forms. Here at Meet Parker, we have taken the step to offer intermediaries an extremely affordable way to instantly enhance their website, customer interaction and lead handling.

“The digital and robo-advisers of the past few years did wonders to showcase ‘how’ customers may wish to engage via your website. Digital offerings like this should not only be limited to those with the deepest pockets or biggest funding rounds.

“Our goal is to offer a similar website & lead handling proposition, one that will enhance any mortgage broker, from digital to traditional in a matter of minutes.

“With the pace and cost at which lenders and the wider Financial Services industry is embracing technology, especially though UX design, I believe it’s time to support those existing intermediaries with the right tools to complement their businesses, without the price tag or mediocre tech offering usually associated with some of the typical mortgage website plugins.”

The Web App plug-in provides a graphical form with more use of buttons and clicks, while the Chat App offering resembles a conversational chat flow to capture information and provide indicative borrowing amounts. Both plug-ins will capture lead details, contact information, borrowing amounts, book appointments/calls and notify the brokerage of their new lead.

And if this is not enough, the team is working on further solutions with both Property and Insurance versions also nearing completion, expected to follow the initial launch in a matter of weeks.

Property Deals Insight makes it onto the REACH UK accelerator

I am extremely proud to announce that Nitin Aggarwal, the founder of Property Deals Insight, has made the grade and has been accepted into the 2022 cohort of the REACH UK accelerator program.

With my other hat on as the CEO of Proptech-PR, a consultancy for proptech founders, Nitin is one of our star clients. He’s done well to make it to the cut out of several hundred who applied.

Last year, REACH UK’s inaugural year, Steve Rad and James Taylor of InventoryBase, also clients of Proptech-PR, made it into the original cohort. I know that they found the experience helped them move their business on significantly, so I am sure that Nitin and the ten other founders will really benefit from the program this year.

I am not just a mentor on the program, but for some years I have known Valentina Shegoyan the Managing Partner and she does an exceptional job, together with her right-hand lady Natasha Terinova and of course Paolo Rigutto.

The reason that I support the program is that it pushes forward the digital transformation of real estate for all. I firmly believe the sooner analogue turns to digital the easier it will be to ensure that any businesses that touch the property asset, in the plan, build, sale, lease or operations verticals, have a very profitable future.

Good luck to all the founders and SMEs that have committed to the program.

Visit the link below to view the full official press release and an outline of the eleven businesses who made it onto the program.