Weekly News Roundup – 19/04/24

Ascendix deep dives into the world of the AVM

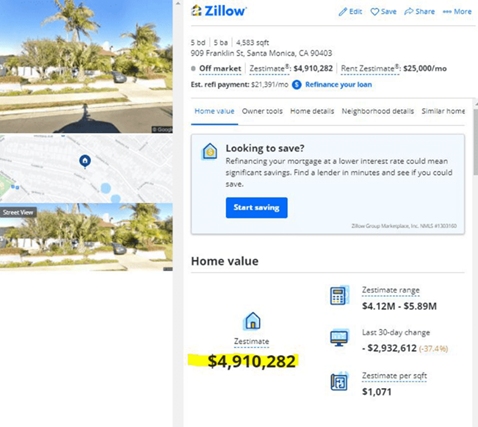

This month Yana Yarotska from Ascendix gives some thought leadership on the operational world of AVM’s and how Artificial Intelligence plays into the mix.

‘AI property valuation refers to the application of artificial intelligence, such as machine learning and automated valuation models (AVMs), to determine the property value. AI analyses vast sets of data including features of the property, like its location, condition, and number of rooms, and estimates property’s worth.

Property valuation AI capabilities include predicting property price for sale, lease, or evaluating the house price for rent and other investment. In our article, we delve into the details of machine learning algorithms used for developing AI appraisal app from scratch, as well as present a complete and comprehensive guide on how to create and train the machine learning model for your own AI valuation tool.

AI Valuation Process: What It’s Usually Like

Talking about AI in real estate valuation, consider the likes of Zillow’s Zestimate or Airbnb’s property valuation tool. Both are property marketplaces and both aim to inform landlords about potential sale or rental values while providing the same insights to buyers or tenants. Here’s the usual workflow of such an AI valuation tool:

Data input. The user inserts the information about their property, such as the address, square footage, number of rooms, age, type, and others into the tool.

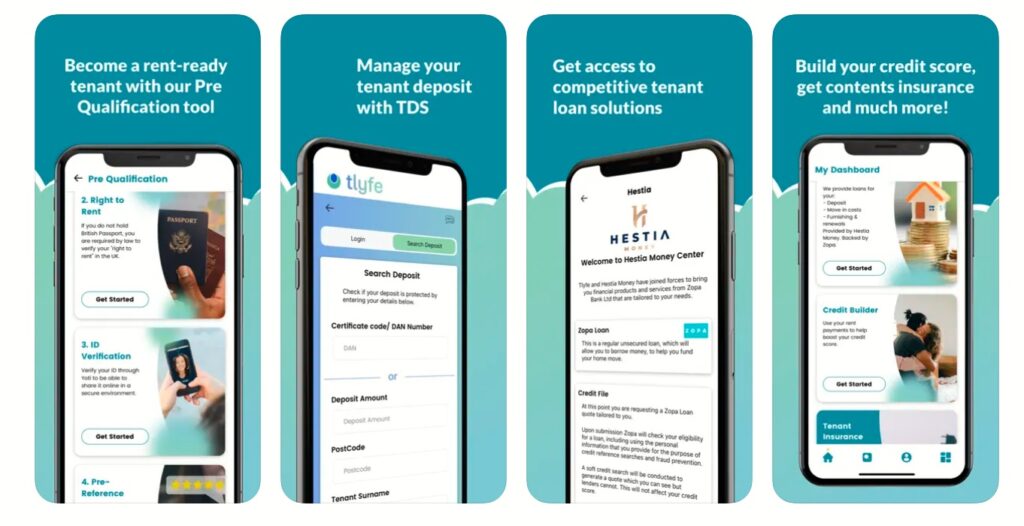

CEO Adam Pigott on tour in Norfolk with tlyfe App

Full disclosure CEO Adam Pigott and his team are one of my earliest clients, so it is always a pleasure to hear what they have been getting up to. And this week they were at a Propertymark conference in Norfolk, where Adam no doubt in his ‘tango’ polar shirt was wowing the delegates with the virtues and upside of supporting the use of the tlyfe App.

For anyone who has not seen or heard about tlyfe the ‘the UKs tenant lifecycle App which takes the stress out of the move in process and making move-in day that little bit more special!’ I will go over what it does for tenants looking to be front of the queue. The App covers:

Pre-Qualification – Giving tenants the best chance of securing their next rental property by using a Pre-Qualification tool to become a ‘Rent Ready’ Tenant. They then can share the results with lettings agents to secure priority viewings!

Improving tenants credit score – Through the App tenants can keep an ongoing digital record of all their rental payments and, provided they pay on time, helping to build their credit score.

Deposit Protection with the Tenancy Deposit Scheme – Tenants can download the protection certificate and manage the return of their deposit at the end of your tenancy, with the Government backed Tenancy Deposit Scheme.

VTS Activate Multifamily launches

Press Release – LONDON – April 16, 2024 – VTS, the industry’s only technology platform that unifies owners, operators, brokers, and their customers across the real estate ecosystem, today announced that it has launched a revolutionary new resident experience technology offering, VTS Activate Multifamily. The announcement builds upon the proptech leader’s momentum with the launch in May 2023 of VTS Activate – the industry’s leading tenant experience solution for commercial real estate, and comes after the 2021 acquisition of Rise Buildings – an established name in the multifamily resident technology space. VTS Activate Multifamily marks a pivotal moment in VTS’ corporate journey, as the proptech leader, known mainly for its innovation in commercial real estate, makes a significant investment in the multifamily space through this new resident experience technology offering.

This momentum for VTS in the multifamily space is solidified with the news that major residential industry players Lendlease, Habitat, and Stonehenge have all selected and deployed VTS Activate as their resident experience solution of choice for properties across their portfolio, resulting in a 400% growth rate for the multifamily platform. To date, VTS Activate Multifamily has a user base of over 250K residents, across 500+ buildings globally, making VTS Activate the largest resident and tenant experience platform in the world.

VTS Activate Multifamily provides owners and operators with a new solution to fully integrate and elevate their on-site experience in multifamily properties – increasing resident satisfaction and equipping teams to best serve them. With in-app resident and property insights, multifamily teams understand what resonates with residents and take action to strengthen their communities, increase efficiency, and secure renewals to generate and protect revenue.

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X