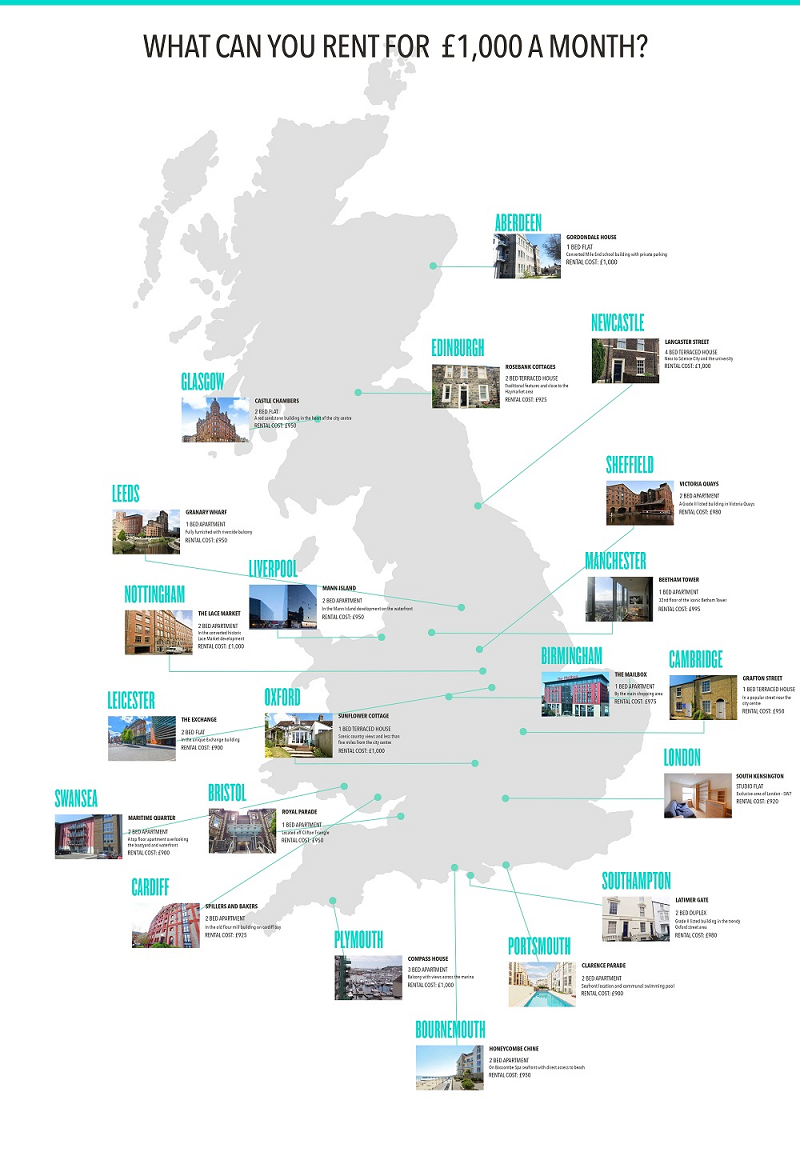

What can you rent across the UK for £1,000?

With the UK rental market as varied as the sales market when it comes to regional differences in cost and rental potential, innovative lettings platform, Bunk, has looked at what the average UK rent can get you in each major city across the UK.

With the UK rental market as varied as the sales market when it comes to regional differences in cost and rental potential, innovative lettings platform, Bunk, has looked at what the average UK rent can get you in each major city across the UK.

With the current average UK rent at £934 per month according to HomeLet, Bunk looked at what you can typically get for between £900-£1,000 and how it differs across the UK.

Studio flat, Brixton – £900 pm

Of course, £1,000 won’t get you much in London space-wise, but it will get you a studio flat in either South Kensington’s sought-after Gloucester Road, above Walthamstow’s famous Bell pub or in a gated Tudor style development in Brixton fit with a private pool.

One-bed terraced, Cambridge – £950 pm

In Oxford, you could secure a one-bedroom terraced house with scenic country views for £1,000 and in Cambridge you could also pick-up the same sized property for £50 less a month.

One-bed apartment, Granary Wharf, Leeds – £950pm

If you prefer apartment living, you can snap up a one-bedroom apartment in Gordondale House in Aberdeen, the Royal Parade in Bristol, the Mailbox in Birmingham, Granary Wharf in Leeds or the 32nd floor of the 47-storey Beetham Tower in Manchester.

Two-bed apartment, Mann Island, Liverpool – £950pm

If you’re looking to up your property potential and add another room, a budget of £1,000 can secure you a two-bed apartment in Liverpool’s waterfront Mann Island development, Nottingham’s historic Lace Market conversion, Sheffield’s Victoria Quays, the unique Exchange building in the heart of Leicester, Clarence Parade in Portsmouth, a sea-front view in Bournemouth’s Honeycombe Chine, Cardiff’s old flour mill building Spillers and Bakers, Castle Chambers in Glasgow or Swansea’s Maritime Quarter.

Two-bed duplex, Oxford Street area, Southampton – £980pm

Or, a similar budget would secure you a two-bed duplex in a grade-II listed building in Southampton’s trendy Oxford Street area, or a two-bed terraced with traditional features in Edinburgh’s Rosebank Cottages.

Four-bed terraced house, Lancaster Street, Edinburgh – £1,000 pm

Finally, for a budget of between £900-£1,000, you could rent a three-bed apartment in Compass House, Plymouth, fit with balcony and view of the marina, or a four-bed terraced house in Newcastle, close to Science City and the university.

Co-founder of Bunk, Tom Woolard, commented:

“The UK rental market is home to a wide and wonderful variety of properties to suit all styles and it’s interesting to see just how the stock available differs when you take the same monthly budget and apply it to the various regional cities across the nation.

Of course, you get a lot more property for your money when you look to the more affordable areas but that doesn’t mean you can’t find something with a bit of personality even in the likes of London, Oxford and Cambridge.

All too often, the speed at which property can let means that many tenants will settle for the first thing they find and are able to put a deposit on, but it can make a real difference to your life satisfaction in the rental market if you are able to find a property that you love to live in, rather than one you just choose to live in.”

|

Location

|

Example Property

|

Monthly Rent

|

Property type

|

|

London

|

£920

|

Studio flat

|

|

|

£900

|

|||

|

£900

|

|||

|

Oxford

|

£1,000

|

1-bed terraced house

|

|

|

Cambridge

|

£950

|

||

|

Aberdeen

|

£1,000

|

1-bed flat/apartment

|

|

|

Bristol

|

£950

|

||

|

Leeds

|

£950

|

||

|

Birmingham

|

£975

|

||

|

Manchester

|

£995

|

||

|

Liverpool

|

£950

|

2-bed flat/apartment

|

|

|

Nottingham

|

£1,000

|

||

|

Sheffield

|

£980

|

||

|

Leicester

|

£900

|

||

|

Portsmouth

|

£900

|

||

|

Bournemouth

|

£950

|

||

|

Cardiff

|

£925

|

||

|

Glasgow

|

£950

|

||

|

Swansea

|

£900

|

||

|

Southampton

|

£980

|

2-bed duplex

|

|

|

Edinburgh

|

£925

|

2-bed terraced house

|

|

|

Plymouth

|

£1,000

|

3-bed apartment

|

|

|

Newcastle

|

£1,000

|

4-bed terraced house

|