£50k deficit in property purchase power between top and bottom ethnic groups

Official data from the Office of National Statistics this week outlines for the first time a disparity in the average earnings of different ethnicities. With earnings having a direct impact on mortgage eligibility, leading estate agent comparison site, GetAgent.co.uk, has analysed what this pay gap means on a housing affordability level.

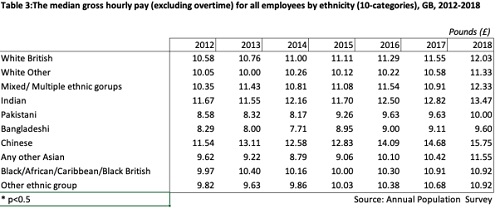

The data on pay differences highlighted the gap in hourly pay for ten ethnic groups, surveyed via the ONS Annual Population Survey.

The difference in pay is significant, especially between the highest and lowest earning by way of hourly rates, with the lowest hourly pay earned by the Bangladeshi community at an average of £9.60. This is some 39% lower than Chinese workers, the highest-paid.

The Chinese community have also seen their average hourly rate rise by 36% since 2012 whilst those that are Black/African/Caribbean/Black British have seen their wage rise by only 9.53% over the same period, almost half the average of all ten groups analysed.

This difference in earning also has implications when it comes to buying a home. Housing affordability a hot topic, and with prices continuing to climb while wages have generally failed to keep pace, the latest data highlights how the high cost of buying a home isn’t just a generational or gender issue, but also one impacted by ethnicity.

For instance, house purchaser is determined by income where mortgages are concerned and the general criteria in assessing the amount that a buyer can borrow is based upon, typically, a 4.5x multiple of salary (Source: Mojo Mortgages).

Therefore, there is not only a drastic gap in the earnings between one ethnic group and another but also in ‘home purchasing power’.

As a matter of fact, notwithstanding any deposit paid, the difference between the home buying power of, for instance, a Chinese buyer versus a Bangladeshi buyer is a whopping £50,369.

Founder and CEO of GetAgent, Colby Short, commented:

“The struggle faced by many millennials when getting onto the property ladder and the issue of the gender pay gap has been well documented but as this latest data shows, this gap in pay is also a problem across different ethnic groups.

In fact, the gap between the top and bottom earning ethnic groups is far bigger than any male versus female issue.

Of course, this gap has a direct impact on the ability for many to buy a home and in this day and age, this simply shouldn’t be the case. More needs to be done to level the playing field whether it be based on age, gender or ethnic background in order to ensure that everyone has the chance to become a homeowner if they wish to do so.”

|

Ethnic Group

|

Annualised wage*

|

Mortgage availability**

|

|

Chinese

|

£28,665

|

£128,993

|

|

Indian

|

£24,515

|

£110,318

|

|

White British

|

£21,895

|

£98,527

|

|

Any other Asian

|

£21,021

|

£94,595

|

|

White Other

|

£20,621

|

£92,795

|

|

Mixed/ Multiple ethnic groups

|

£22,441

|

£92,795

|

|

Black/African/Caribbean/Black British

|

£19,874

|

£89,435

|

|

Other ethnic group

|

£19,874

|

£89,435

|

|

Pakistani

|

£18,200

|

£81,900

|

|

Bangladeshi

|

£17,472

|

£78,624

|

|

*Method: Hourly rate x 7 hours per day x 5 days x 52 weeks

|

||

|

**4.5x annual wage

|

||

ONS earnings data