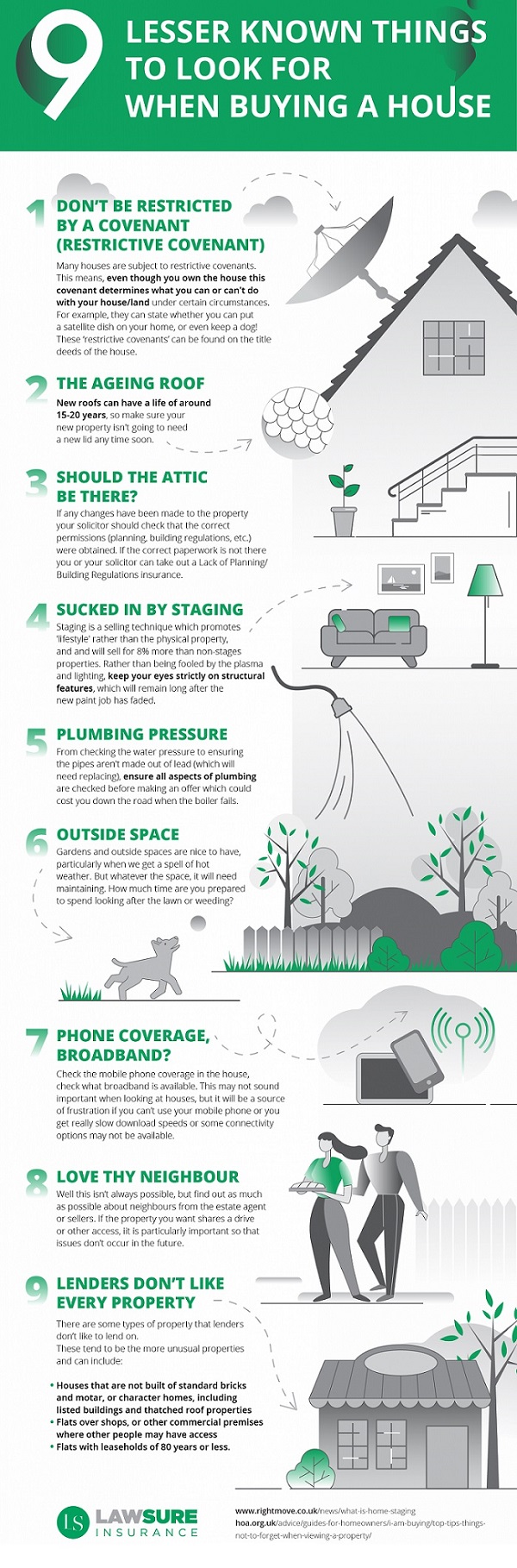

9 Lesser Known Things to Look For When Buying A House

No matter how experienced someone is on the property ladder, it is a daunting decision and one that should not be taken lightly.

Property is a considerable investment both financially and emotionally.

Lawsure have created a handy list of lesser known things to look for when buying a house make sure everyone is making the correct choice.

We have listed below some top tips for estate agent in relation to these to help make the conveyancing process smoother for all parties involved.

1. Restrictive Covenants

These are stipulations set out in the title deeds and can be applied to any kind of property. They prevent the buyer from certain actions within the freehold. These can be anything from no pets to forbidding the running of a company on the premises.

These are usually picked up at the start of the conveyancing process but it may be worth obtaining title deeds when the property is on the market so you can advise buyers during their viewing to prevent any offers being withdrawn.

2. The Roof

A roof’s lifespan is typically 15-20 years. If the vendor has recently replaced the roof, ask them to make sure FENSA certificates and guarantees are easily accessible so when this is brought up during enquires there is no delay in locating them.

3. Planning Permission

Similar to roofing documentation, planning permission documents are incredibly important. The new owner of any property is responsible for any repercussions if planning permission on the property was not obtained, even if this was carried out when they were not in ownership.

Make the vendor aware they will be required to provide this proof. If this has been lost, the buyers’ solicitor may request they pay for lack of planning permission indemnity insurance.

Also, see if there has been any permission granted for nearby building works and ask if your vendor has right to light insurance so no views will be ruined.

4. Staging

When showing prospective buyers around a new home, make sure they do not get sucked in by staging. Although this can help you make a sale, there can be a backlash after completion.

You can tactfully make buyers aware of structural issues without ruining your chance of an offer.

5. Plumbing

Encourage viewers to test plumbing of properties, a weak shower can really make an impact on the enjoyment of a home.

If this is their dream house, they are unlikely to not make an offer over this, but they can at least be aware when they do approach the vendor.

6. Outside spaces

Gardens are a huge bonus for any homeowner, but will the buyer be able to enjoy this? If it is a shared space, try to find out who has a right to access and if there is any prevention from certain items, such as bikes, being kept there.

These questions are often not raised when viewing but can delay the legal process, if all answers are laid out from the beginning it will keep everyone happy.

7. Connectivity

Promote the use of buyers’ phones during viewing. Not all networks cover all areas and we would all be annoyed if we found out we could not be contacted in our own home.

Speak to the vendor regarding their current broadband provider and the strength of their network so you can advise buyers on whom to obtain quotes from, especially in remote locations.

8. Neighbours

As an agent, you are in the perfect position to speak to neighbours and get a candid view on the location. They will sometimes be more honest with queries, especially with leasehold and share of freehold homes.

You can then relay this to buyers during viewings and use all positives to encourage a sale.

9. Lenders

Although buyers may have an offer in principle, this does not mean their lender is willing to lend it against any property.

If the property is particularly unusual, such as a thatched roof or a listed building make sure the buyers are aware they may have to shop around for a new mortgage.

If they can do some principle research, this will prevent any delays before exchange.