WHAT SHOULD HIGH STREET ESTATE AGENCY DO NOW?

I think it is fair to say, that it hasn’t been the best couple of weeks for the online budget agents.

First there were the revelations and well documented problems with the second largest online agent EMoov, who are seemingly in financial distress and looking for a buyer.

Only a few days before, the company’s visionary, but controversial chief executive, Russell Quirk openly admitted that the online model wasn’t working in its current guise and not sustainable and that it hadn’t made the inroads into the High Street market share that he and others had predicted.

Meanwhile, Purple Bricks, the largest of the budget agents has seen its share price drop over 60% from its peak around 6/7 months ago, whilst increasing its minimum upfront fee to around £1200 if you include viewings. It is even higher if you are in London

Who puts more money in house sellers pockets?

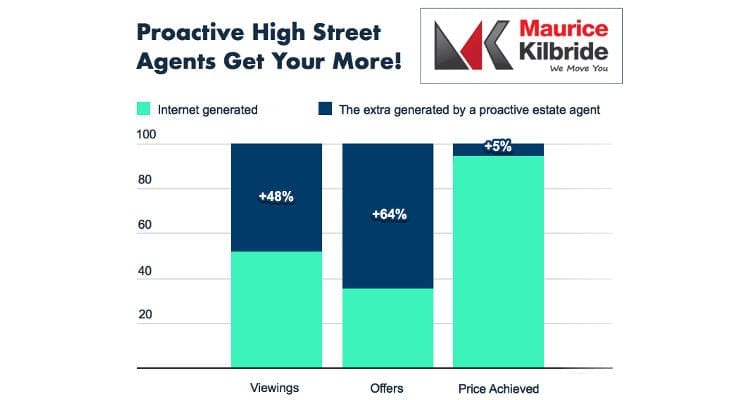

And now a new report from the independent property research group, the Advisory, has established that good high street agents in 73% of house sales are achieving a better selling price than pure internet- based agents and on average are achieving 5% higher selling prices for their clients, which equates to around a whopping £11,400 based on the current UK average house price of £228,000. It also established that the average percentage charged is just 1.18%, which in monetary terms is £2690.40. We can all do the maths and see who the cheapest agent is to sell your home with!

Now at this point, you might think this article is another “online v high street” post. We have seen plenty of those, I’ve written one or two myself over the last year or two, or you might think, like a number of comments I have read on various forums, that I am here to gloat or stick the boot into Russell, Emoov and others. Whilst I sort of understand the temptation, I personally do not agree with it, even if by his own admission Russell has said a few daft and inflammatory things! The fact remains, whether you like Emoov or Purple Bricks, they have to a certain extent disrupted the traditional model and high street agents would do well to not continue to bury their heads in the sand and take note, that there is clearly an appetite for change amongst the selling public that reflects modern attitudes and life styles in 2018.

High Street and Online agents feeling the pinch!

Therefore, rather than being smug at the difficulties of others and sitting back on our laurels, high street agents must now embrace change. There are currently the highest number of high street agents closing down every month as tougher market conditions bite – even one of the highest profile and most successful agents in the country, Foxtons have just announced several more branch closures on the back of shutting their flagship office on Park Lane, London. I feel that high street agents could take a look at the budget model and learn a few lessons to survive and thrive themselves over the coming years.

Online budget agents biggest failing is its inability to grasp that selling a home is a huge emotional commitment for most people and the importance they place on personal relationships with their agents and having somewhere to go whenever they need re assurance or to talk about their sale cannot be understated. This is the main reason, that despite the many outrageous claims and huge advertising campaigns, that in certain cases are often very misleading to the public, at best the budget agents still only have between 5-7% overall market share.

However, where the online agents have been excellent is in the use of technology to provide convenience for those, particularly younger computer savvy sellers, who are working and on the go permanently and is something high street agents need to embrace and combine better with their existing high standards of personal service.

I like the idea of clients being able to book viewings or valuations online from the comfort of their own homes at 10 pm at night and to have their own secure portal to tracks sales progress. From an agent’s perspective this could massively reduce administration time and non-productive telephone calls and free up staff to spend more time prospecting for new business.

A “one size fits all approach” won’t work in the future

I listened to Adam Day, the former owner of Hatched, one of the first online agents, being interviewed by the always excellent Chris Watkins last week and Adam made some interesting points. One thing I agreed with him on is offering choice to clients. I don’t think the one size fits all approach is right in today’s world. The market place is shifting and if the online model gets it right, there will be an inevitable shift, so perhaps high street agents need to create a hybrid style offering, maybe a modest up-front cost to cover advertising and marketing, with a lower completion fee to sit alongside their existing structure? Would be a viable alternative to the all up front fee, which even Adam admitted was a bit of a con! Where there is no incentive to sell at any price! Let alone achieve the best price – which brings me back to the findings of the Advisory!

There are other things, more creative advertising and marketing and not relying on the portals, more and better training for staff, more transparency and in some cases maybe moving to hubs/serviced offices off the high street which will lower costs and provide scope for agents to modestly increase their fees, by adding value to their service. There is certainly scope with the £11,400 agents are already putting into client’s pockets, but we have to be a damned sight better than we are currently before we can justify that and tapping into the budget models successes and failures can provide this.