BREAKING PROPERTY NEWS – 29/09/2022

Daily bite-sized proptech and property news in partnership with Proptech-X.

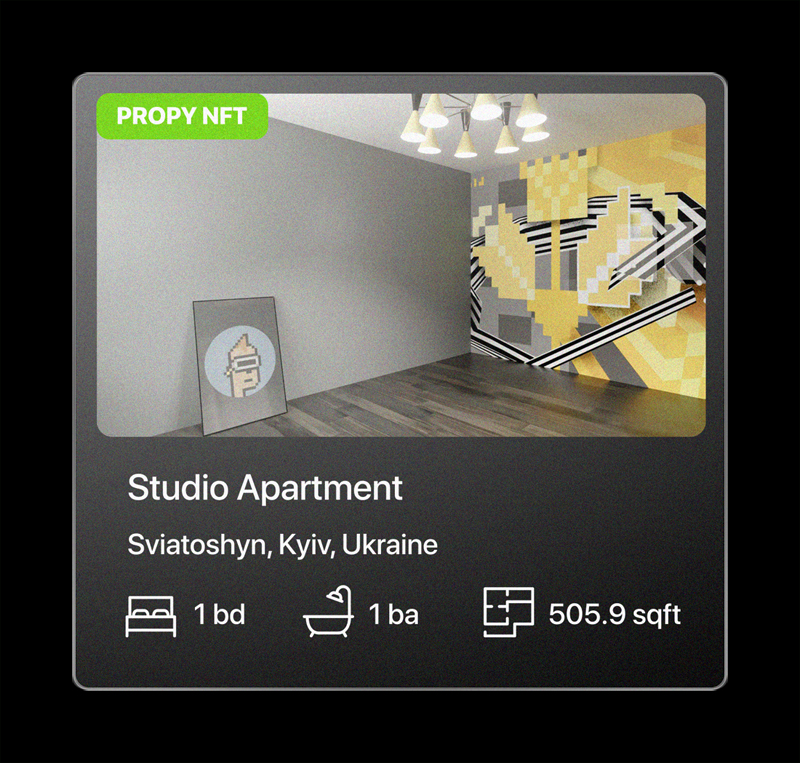

Propy Unveils “MetaAgent X Shredders” NFTs – Exclusive NFT Avatars for Real Estate and Metaverse Fans

MIAMI–(BUSINESS WIRE)–Propy, the Web3 real estate pioneer, is launching the first NFT (Non-fungible token) Avatars designed specifically for Real Estate and Metaverse fans. The limited-edition “MetaAgents X Shredders” NFTs were created by noted artist Dan Weinstein. The project’s advisors include real estate influencers and industry forward-thinkers Tom Ferry, Tony Giordano, Alvaro Nunes, Tony Edward, ThinkingCrypto, Zach Aaron, MetaProp, among others.

“It’s an endless open sea of creative NFT ideas out there and as usual, this is where Propy continues to stand out. If you love crypto and real estate then these NFT Avatars are right for you. With Real Estate becoming more crypto-friendly, adding one of these ‘MetaAgents X Shredders’ to your collection or used as your social media profile, will signal to the world and your tech-savvy peers that you are a visionary in a new digital world of real estate,” said Natalia Karayaneva, CEO of Propy.

Over 6,000 joined the waiting list in anticipation of the “MetaAgents X Shredders” drop on September 27, 2022 at 10:00am pacific time on seen.haus and can only be minted with PRO – Propy tokens. First come first serve and sold by lottery auction. Starting price 500PRO.

“These characters are THE RESISTANCE – shredding through the Metaverse, re-inventing the new future. The meta world created by the agents of change – fair, honest and empowering,” said artist and designer, Dan Weinstein.

The Propy NFT Avatars come with unique utilities like access to the Meta Agent educational course, owners become members of DAO (decentralized autonomous organization) and receive a ticket to the Web3 & Real Estate Summit coming up on October 27th in Miami. The Meta Agent certification and the Summit will help real estate fans navigate metaverses and Web3 proptech and apply the learnings to their daily business.

“Many agents and real estate investors are interested in crypto and NFTs. As more home buyers utilize crypto earnings to purchase property, displaying an avatar immediately identifies these agents as someone who understands how cryptocurrency and NFTs work,” said Tom Ferry, #1 US Real Estate coach.

Lincolnshire Housebuilder Encourages Homebuyers to Make Enquiries in Light of the Stamp Duty Cut

Stamp Duty Land Tax (SDLT) is a property transaction tax that is paid in increasing portions of the property price. Previously SDLT payments started after the first £125,000 of the property price for previous owners and £300,000 for first time buyers. The rate then went up proportionally based on the value of the property ranging from 2% to 12%.

As part of its mini budget the government has announced that the threshold for stamp duty has been increased to £250,000 of a property for previous owners, and £425,000 for first time buyers. The change is permanent and effective immediately.

The new policy means that as many as 200,000 people will no longer have to pay any stamp duty and many others will pay significantly less than they were before.

In the previous system, when moving home the total SDLT owed for a house priced at £250,000 would be £2,500. The cut means that that buyer will now pay nothing. Likewise, a first-time buyer purchasing a house worth £425,000 would owe £6250 in SDLT but will now save that figure.

Samantha Hart, Sales and Marketing Director at Allison Homes, said: “This change to the stamp duty is great news for homebuyers as it means that, if eligible, they can now save thousands of pounds on the purchase of their property.

“At Allison Homes we’re all about helping people find their dream home, which is why we would highly encourage property seekers to take advantage of this opportunity and start making enquires right away”.

US NEWS: Financial Verification Platform VeriFast Completes $3.5m Seed Funding Round Led by M3 Financial Group to Accelerate Expansion into Mortgage Underwriting

PRESS RELEASE: VeriFast, the AI-powered Verification-as-a-Service platform that automates financial analysis and decision making for tenant screening, mortgage underwriting, and other verticals, today announced that it has secured an initial funding round led by M3 Financial Group and noted real estate investor and HGTV star Scott McGillivray, Michael Sarracini of Keyspire, and “Millionaire Mom” investor Susan White Livermore.

VeriFast Co-Founder Tim Ray said, “Efficiently collecting and analyzing financial data is at the core of every business that requires underwriting approval of new customers. Our platform offers clients transparency with faster decisioning integrated into their existing workflows. VeriFast has multiple partnerships with leading proptech platforms in the U.S. and Canada to automate financial and KYC-ID verifications. We are also experiencing rapid solution adoption with mortgage lenders who want to digitize and streamline their pre-approval and underwriting processes, shaving labor costs and compressing approval cycles by up to 90%.”

VeriFast provides a single-source configurable API that empowers companies to seamlessly integrate biometric identity verification, banking data, payroll insights and tax transcript data to their existing process flows. The platform analyzes applicants’ real-time financial health via their digital banking data with advanced AI to verify their identity, income, assets, employment, past rent/mortgage payments, bill payments, ability to pay and other critical screening data points far beyond traditional credit checks. VeriFast securely automates the end-to-end verification process compressing rental and mortgage application processes from hours/days to minutes, at a fraction of the cost.

“VeriFast removes the guesswork from tenant screening and provides a non-biased, transparent view of an applicant’s full financial profile.”

Sarracini said, “VeriFast removes the guesswork from tenant screening and provides a non-biased, transparent view of an applicant’s full financial profile. This is a critical gap in the existing real estate market. VeriFast has a proven technology that solves an industry-wide problem that literally every property owner and manager faces.”

“Entrepreneurs at heart, we’re excited by VeriFast’s deep talent, technology and tenacity to move this industry forward,” said Michael Beckette, President, M3 Ventures. “Brokers and lenders across the ecosystem will benefit greatly by the platform’s transactional speed and easy integration to bundle and cross reference multiple borrower data. In this business, it’s always faster, easier and better to confirm information directly from the source. VeriFast enables brokers and lenders to do just that quickly and easily.”