BREAKING PROPERTY NEWS – 15/03/2023

Daily bite-sized proptech and property news in partnership with Proptech-X.

Lower Pricing Triggers Uptick in Demand

PRESS RELEASE: Lower prices and mortgage rates have piqued buyer appetite, according to Home.co.uk’s Asking Price Index for March.

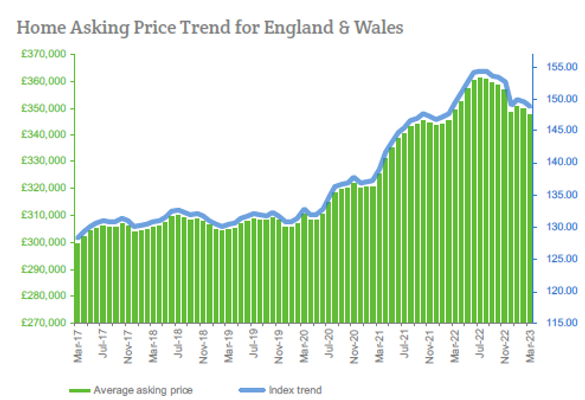

Returning buyer demand has reduced the Typical Time on Market by five days since last month and is a sure sign that the market is picking up pace in the wake of the Truss-Kwarteng debacle. This renewed momentum came at the cost of a price correction, effectively writing off all the gains of 2022 and a little more. However, with the froth of the COVID boom cleared from the market, UK home prices look set to consolidate over the coming months as demand and supply find a new equilibrium.

Fears of a flood of panic sales prove to be unfounded as supply remains restrained. In fact, the monthly rate of new instructions is slightly down on February 2022. Meanwhile, the total stock of unsold property on the market is still below pre-COVID levels despite having recovered significantly following the unprecedented buyer frenzy of 2020/21.

Rents are up significantly in all regions and most notably in Greater London and Scotland. The lettings market continues to be overwhelmed by demand and this has driven the mix-adjusted average rent up just over 17% overall. Since rental returns fundamentally underpin property values, this is clearly a very positive trend for the sales market.

The typical gross yield on a two-bedroom flat in London has risen to 7%.

Demand is supported by the mortgage market which currently offers many fixed-rate deals at 4% or less. Moreover, for those that can afford a deposit, real mortgage rates remain negative by quite a margin, irrespective of the measure of inflation (RPI or CPI) you prefer. Additionally, pay growth at 7.3% helps support lending based on earnings multiples.

The annualised mix-adjusted average asking price growth across England and Wales is now -0.5%; in March 2022, the annualised rate of increase of home prices was 7.4%.

Headlines

- Asking prices across England and Wales slipped a further 0.6% during February, making the year-on-year growth negative (-0.5%) for the first time since Dec 2019.

- The Typical Time on Market for unsold property in England and Wales dropped by five days during February to make the median 95 days, showing that the market is picking up pace as demand increases.

- Asking prices in February fell in Wales, Scotland and all English regions except the North West and West Midlands where there was no change.

- The total sales stock count for England and Wales increased in February by just 3,585 to reach 372,638, indicating that property remains scarce relative to the 10-year average of 422,668.

- The supply rate of new instructions remains subdued, dipping 1% last month compared to February 2022.

- The East of England shows a remarkable drop in the Typical Time on Market from 91 to 78 days, which is considerably lower than it was in February 2019.

- The Scottish property market falls into second place in terms of annualised regional price growth (4.0%), behind the North West at 4.1%.

- Rents across Greater London continue to rise, up 21.4% year-on-year. Low supply is still a persistent problem although the pace of the rent hikes in the more central boroughs has slowed somewhat over recent months.

- The current new growth leaders in asking rents are the outer London boroughs of Brent, Harrow and Ealing (+35%, +34% and +32% annualised respectively).

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X