Are 5,000 UK Agents Losing The Springett In Their Step?

This week Zoopla made a big show and dance about 100 agents returning from their flirtation with OnTheMarket.com (OTM).

There was no comment from OTM. Nothing about the 5 year tie-in agents have signed up to and whether OTM would hold agents to this. Just silence.

It is confounding how estate agents leave property journalists in a vacuum, allowing Zoopla and online agents to seem more important than they truly are.

You’d think all the great work put into the Agents’ Mutual ’cause’ would be carried on after launching OnTheMarket.com.

But there’s nothing of substance. So journalists write about 100 OTM agents (out of 5,300) returning to Zoopla. The same journalists who gave no importance to the 25% membership loss Zoopla suffered in the first place.

The cause for agents to band together is all but gone. Now they’re ‘just another portal’.

We’re six months into this new 3 portal UK market. This is my thesis on what Ian Springett should do next (to ensure OTM wins).

Introduction – What The ‘Cause’ Delivered

OnTheMarket.com (OTM) set out to split the memberships of the Rightmove and Zoopla duopoly. While the jury is still out on its chances of success, the start-up has definitely succeeded in splitting opinion.

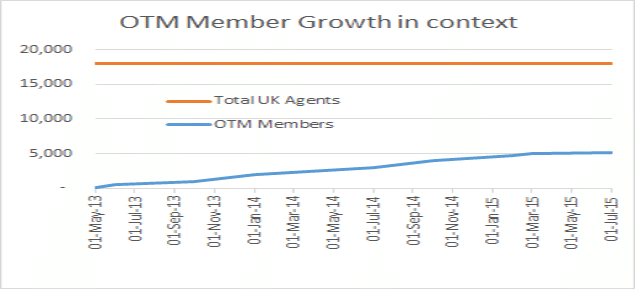

It is important to state as fact that OTM is a resounding success. Back in August 2013, they had a target of 1,000 branches to seed fund the portal.

A mere 2 years later they’ve hit 5,000. That, by any measure, is successful. Any other start-up would be celebrated for achievements such as:

- No (real) complaints about the tech.

- Building a meaningful and growing consumer audience.

- Nabbing 25% of Zoopla’s member agents.

- And picking a brand that works.

But there is a fly in the ointment. It seems the OTM train is stalling. And there’s a very simple reason why:

Agents’ Mutual was a cause*. OnTheMarket is a portal.

What Next For Ian Springett And Co?

The focus seems to be on ‘delivering audience and leads to member agents’.

I think that’s wrong.

Don’t get me wrong, the traffic to-date is very impressive.

But this isn’t a problem. Really. I’m not being sarcastic.

For me, this audience metric is secondary to agent sign-ups.

Agents determine the stock levels, revenue and true decline of the Rightmove/Zoopla duopoly. Audience is vanity, agents are sanity.

And that forms the crux of my thesis: agents have discovered they can do business without Zoopla. Those 5,000 OTM agents are never going back.

But they are scared of what happens if they leave Rightmove. They are ‘conservative business owners’.

OTM has one task: give agents the confidence to leave Rightmove.

Why Does OnTheMarket Exist

For anyone new to the UK portal scene, here’s a quick recap.

The majority of agents are independents which are run by business people operating in competitive markets.

They compete for each piece of work and have prices dictated to them by the market (both competitors and consumers).

They have sold their shop windows to online portals who dictate terms to them; albeit (arguably) providing a better ROI than traditional print media.

Resentment has grown as property marketing has become increasingly standardised with diminishing control over reach, placement and cost.

I believe that emotion drove customers (agents) to OTM and away from the two existing portals in increasing numbers.

25% of agents is a good start, but it needs to quickly pass the 50% mark. The trickle needs to become a flood. In a marketplace play the one who has all the stock wins.

Reignite The Cause

Beyond dictating increasing costs, Rightmove and Zoopla have allowed the rise of For-Sale-By-Owner services in the guise of online estate agents.

Agents are right to consider online agents the enemy.

But while online agents are tiny and uncompetitive, because their business model is wrong in its focus on low-fees as their product**, the high street needs to act.

The real enemy are the portals themselves.

Rightmove and Zoopla don’t sell homes, but the public thinks they do.

And that makes agents look bad. Or worse, it makes agents look incompetent.

And the fact that many agents are incompetent gives credence to the line “all agents aren’t worth the fees paid to them.”

If agents want respectability, Ian Springett is truly their last hope.

It was him that took OTM from a small band of Central London agents to 5,000+ branches across the country in under 2 years.

The battle isn’t over, but the focus needs to be on winning agents, not winning consumers.

If I Was Ian Springett, I Would…

Reignite the cause, paint a clear picture of Rightmove increases fees even more aggressively this year.

Take Zoopla out of the game – This needs to be done with data. And this needs to be loud so journalists cannot ignore it. Zoopla is the portal where buyers miss out on a home, because it has been crippled. Zoopla’s traffic, while high in quantity, is very low in quality. Get member agents to show how few Zoopla leads convert into sales (vs walk-ins, referrals and Rightmove). There’s a reason why so many found it easy to leave ZPG: it is irrelevant

Go local, town by town – using high profile outdoor advertising to support local members. The aim would be to recruit enough agents to make OnTheMarket the only game in town. Declare that town a Rightmove/Zoopla free zone. Use that momentum to recruit in the next town.

Good agents vs bad agents – There is still the issue of bad/no standards in the industry. OTM has the opportunity change this. By using data to demonstrate OTM agents are good agents, and that at being on OTM is an indicator of quality. The message needs to be “our member agents sell more homes for more money” than their local competition. It’s likely this data will embarrass online agents. Win-win.

A world without Rightmove – The OTM launch proved a psychological barrier exists on the importance of Rightmove in the minds of agents. The fact is most agents sell homes to buyers ‘on their books’. Use agents’ hatred for Rightmove, prove (again using data that) selling is done by agents and not Rightmove, and give agents the courage to market exclusively with OnTheMarket.

Good Agents United

Agent recruitment is everything to OTM’s success. It’s what allowed Agents’ Mutual to launch with such momentum. And it’s the key to the future of the venture.

This post-launch strategy switch from an agent-focus to a consumer-focus was mis-guided. And it is clearly not converting agents to sign up.

This is how I would run OTM agent recruitment:

– Make a list of all agents and allocate a score to them (based on quality and # listings).

– Meet every single one of the higher quality agents.

– Use the inevitable victory against Zoopla as a rallying call to the rest with a clear message of cost control – Zoopla is raising agent membership fees, as the stock market demands it; OTM will never raise fees.

– Make winning over the big corporate agents (Countrywide, Connells, LSL, Foxtons) a priority.

– Deliver local, outdoor advertising in the areas where OTM is strongest. Drive Rightmove and Zoopla out of those towns.

– Set and manage expectations (from agents and their clients) on consumer traffic. Rightmove allows links back to agent sites from listings. Make sure ALL OTM agents take advantage of this the way Foxtons does (3 links back to Foxtons website from every Rightmove listing).

– Only spend money on TV advertising once we have exhausted no cost and low cost ways to build traffic and links.

At the end of the day, agents need to see a light at the end of the Rightmove tunnel. And that isn’t currently on the table, so neither are the other 13,000 agents.

*Estate agents are being attacked from all sides. Online agents squeezing margins, Rightmove increasing advertising costs, journalists (proxy for the public) hating on agents every single week in every single major newspaper and of course the Government threatening legislation.

Note: important to make the distinction between online agents shining a light on agency fees and stealing market share - because online agents are certainly not taking much market share from high street agents; they are successfully squeezing agency margins. **Using 'cheaper fees' shows online agents do not understand their customers. Property owners care more about how much they can get for their property. That is all that matters. Service is secondary. Fees are tertiary. Which is why 'free valuation visits' are the only reason agents are allowed in your home. You can't control the urge to know how much your home is worth.