Posts by EAN Breaking News

New Rules on Pets and Discrimination: What Landlords Need to Know

By Allison Thompson, National Lettings Managing Director, LRG The Renters’ Rights Bill is set to introduce a wave of changes to the private rented sector, including new protections for tenants with pets, children, or those receiving benefits. These reforms aim to prevent blanket bans and create a more inclusive and transparent rental market. Landlords will…

Read MoreProperty sector benefits from additional £74M investment in the last year

New research has revealed that private investment in the UK property sector increased by £74.10 million last year – the fourth-highest surge of any UK sector. This comes as the UK Investment Association unveils new recommendations to unlock private market investment in UK businesses, potentially paving the way for future investment going forward. The business…

Read MoreLondon Rents Have Risen 39% in a Decade

London Rents Have Risen 39% in a Decade – But Just 0.7% When Adjusted for Inflation The latest research from London lettings and estate agent Benham and Reeves has found that while the average rent in London has climbed by 39.2% over the past decade, when adjusting for inflation, the real-terms increase is just 0.7%,…

Read More‘Difficulty securing a mortgage’ contributing to rise in number of property sales falling through before completion

41% of property sales fell through before completion in the second quarter of 2025, up from 32% in the first quarter. The data from Quick Move Now suggests that 45% of failed sales fell through due to difficulty obtaining a mortgage. Other reasons include chain break (18%), the buyer changing their mind (14%) and legal…

Read MoreSea View Homes Command 38% Premium

The latest research from Yopa has found that homebuyers looking to secure a sea view along England’s coastline can expect to pay a premium of up to 38%, with the average seaside uplift sitting at over £24,537,000 versus standard property prices. The research from Yopa analysed current property listings advertising sea views across 20 English…

Read MoreSMEs need a ‘Medium sized site’ without area thresholds

The Government’s ‘Planning Reform Working Paper: Reforming Site Thresholds’ proposes a ‘Medium’ sized site threshold of 10 to 49 homes, a definition which has won considerable plaudits across the small and medium sized (SME) housebuilding industry. However, the definition also includes a maximum area measurement of 1 hectare area size, which SME housebuilders express as…

Read MoreWhy more buyers are turning their backs on London and looking North

The shift in the UK housing market continues, according to Rightmove’s latest House Price Index data. Despite national declines in average asking prices, cities in the North of England and parts of Wales are bucking the trend with continued growth. This shift suggests increasing investor interest outside London, as buyers seek more affordable and promising…

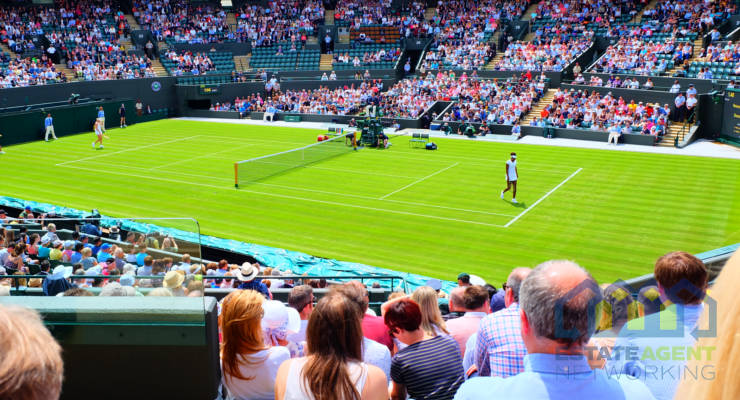

Read MoreWimbledon aces the competition where current market values are concerned

The latest property market analysis from London’s number one lettings and sales estate agency brand*, Foxtons and its award-winning mortgage advisor, Alexander Hall, has revealed that not only does Wimbledon continue to hold the title as the most expensive of the four global tennis majors in terms of average house prices, but it has also…

Read MoreThirdfort reports 48% increase in demand from estate agents as concerns mount about AI-generated ID fraud

Amid increasing concerns about AI-powered identity fraud, estate agents are seeking to implement more robust digital ID solutions. Client due diligence platform Thirdfort has reported a 48% year-on-year rise in the number of estate agents adopting its technology, as data indicates that AI-driven fraud is on the rise. According to Cifas’ Fraudscape 2025 report, AI-powered…

Read MoreLondon parking spot values revealed

London parking spot prices revealed as average cost hits £760,000 in one borough The latest research from Jefferies London has found that prime homebuyers in Islington paid an average of £760,000 for a parking space over the last 12 months, making it the most expensive London borough in which to secure a private parking spot.…

Read MoreALEP Welcomes the Next Stage of Leasehold Reform

But warns an increasingly complex legal environment impacts on both consumers and professionals In a further stage of leasehold reform, the government has announced a consultation (Strengthening leaseholder protections over charges and services) on service charge and buildings insurance transparency, litigation costs and regulation of managing agents. The consultation period runs until 26 September. The…

Read MoreThe Sun Continues to Shine on UK Construction

Glenigan’s July Index shows the industry continuing to bask in the glow of better performance Work starting on-site increased 49% during the three months to June, remaining 25% above 2024 levels Residential construction starts rocketed 76% compared to the preceding three months and rose 64% against 2024 figures Despite ending 3% down on a year…

Read MoreTenants with pets must pay extra damage deposit

The House of Lords has backed an amendment to the Renters’ Rights Bill to require tenants keeping pets to pay an extra deposit to cover any damage to a rented property. The Renter’s Rights Bill, which is currently going through the House of Lords, will allow tenants to request to have a pet, and landlords…

Read MoreDownsizing out of debt

The best way to become debt free in retirement The latest research from over-50s property specialists, Regency Living, reveals that over-50s can release themselves from financial debt, and all of the physical and mental health issues that can bring, by choosing to downsize to a park home. Financial debt is a common yet difficult burden…

Read MoreUK Property Market Bounces Back After Stamp Duty Slump

The latest research from GetAgent.co.uk reveals that the UK property market has already bounced back from the momentary slump that followed the expiry of the stamp duty holiday at the end of March, with transaction volumes climbing 42% in May, reversing a sharp -66% drop in April. The research from GetAgent.co.uk analysed Gov data on residential transaction…

Read More