Posts by Enness Private

Falling house prices forecast: what do they mean for London property?

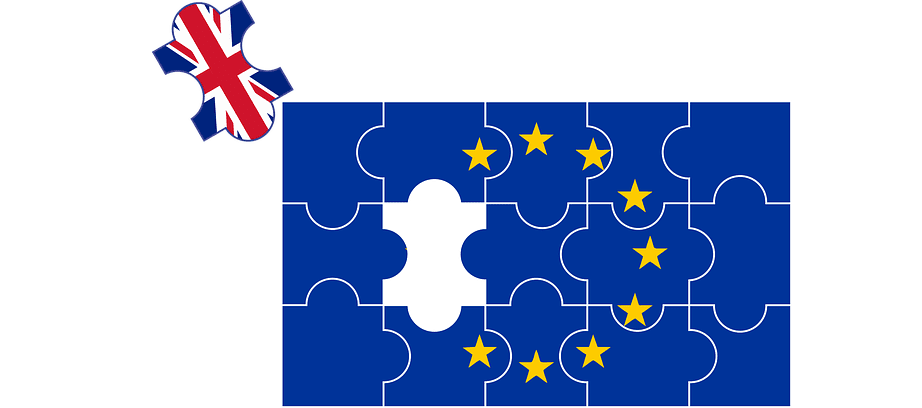

In wake of the Brexit vote, many experts have been publishing market reports and forecasts for the year ahead, with the likes of Knight Frank, Countrywide and Halifax, all indicating a fall in house prices. Lower prices tend to breed uncertainty among buyers, however, they can in fact be an excellent opportunity to access greater…

Read MoreHow to use your personal income to top up a buy to let mortgage

We have talked a lot recently about lenders tightening their buy to let mortgage criteria especially with regard to rental income requirements – this is set to continue under the Prudential Regulatory Authority (PRA) recommendations which are expected to be implemented later this year. For a quick recap – lenders a few years ago would…

Read MoreHow to secure a House of Multiple Occupancy mortgage

A House of Multiple Occupancy mortgage, or more commonly known as an HMO mortgage, is a great way for investors to maximise the rental income they receive from a property. It involves letting out as many rooms in a property as they can, to tenants who are not all members of the same family and…

Read More5 reasons why you should use a mortgage broker

Securing a mortgage has previously been likened to a rite of passage, being something nearly all of us have to pass through when becoming responsible homeowners. Despite this, the long journey to meeting that milestone can seem a treacherous one, for some more so than others. As the mortgage market continues to prove an unpredictable…

Read MoreUK interest rate cut: what does it mean for borrowers?

The long-expected UK interest rate cut – the first since 2009 – became a reality last week. The base rate now stands at 0.25%, a record low. Although the Bank of England was wary of acting too hastily in the wake of the shock Brexit vote, it was clear a cut was on the cards…

Read More5 reasons why you should use a mortgage broker

Securing a mortgage has previously been likened to a rite of passage, being something nearly all of us have to pass through when becoming responsible homeowners. Despite this, the long journey to meeting that milestone can seem a treacherous one, for some more so than others. As the mortgage market continues to prove an unpredictable…

Read MoreNew rules for buy to let rental stress testing

You may, or may not, be aware that the Prudential Regulation Authority (PRA) has been considering changes to buy to let rental stress testing recently, affecting buy to let mortgages across the UK. Responsible for the prudential regulation and supervision of lenders, the PRA have now proposed that banks should be operating a standard stress for…

Read MoreA Guide To The Changes In Buy To Let Mortgages

Last year, Chancellor of the Exchequer George Osborne announced a raft of new tax measures for the buy to let market, some of which specifically affecting buy to let mortgages. However, as the changes won’t actually start coming into effect until April 2017, you have time to adapt to them. Whether you currently have or…

Read MoreBrexit: business as usual?

It’s now been three weeks since Britain voted to leave the EU. Since then, many of the key political players have left the stage; David Cameron has resigned, Nigel Farage has stepped down and many leading Brexiteers have faded into the background. The pound has plummeted to a 31-year low and the stock markets have…

Read MoreHow to survive Brexit

As some of you may know, Enness was founded back in 2007. On the very day of our launch party, the run on Northern Rock happened and the market ground to a halt. Luckily, the only way was up; we have gone from strength to strength since then. All this is to say that, when…

Read MoreNationwide enters equity release mortgages market

As part of a revamp to its mortgage offering, Nationwide will be entering the equity release market, in line with its exploration into ways to help parents pass wealth onto their children and help homeowners unlock the wealth tied into their properties. The lender is currently planning to roll out its own ‘safer’ range of…

Read MoreMore lenders commit to older borrowers & high LTV rates gap closes

Following the recent announcement that many high street lenders, such as Nationwide and Halifax, had decided to increase their maximum lending age limits, Family and National Counties Building Society re-affirmed their own commitment to this sector quite considerably. While many have only recently started to ease their lending restrictions for borrowers past state retirement age,…

Read MoreThe future of buy to let mortgages

The future of buy to let has been a hot topic this week. In the wake of the Bank of England’s recent clampdown, prospective investors have been anxiously consulting brokers up and down the country. Lenders and borrowers alike have barely had time to draw breath since a host of tax changes were announced and, inevitably, the…

Read MoreKensington raises maximum loan size amid mortgage criteria changes

Kensington Mortgages has announced it will be increasing its maximum loan limit for both first time buyers and buy to let mortgages. Having raised the maximum loan on buy to let mortgages to £1.5 million from £1 million, first time buyer loan values have also now increased to a maximum of £1 million – up…

Read MoreMansfield extends maximum mortgage lending age to 85

Mansfield Building Society has revealed that it will now be extending its maximum age limit from 80 to 85 on its existing 2 year discounted rate product to 60% loan to value (LTV). Available for both purchase and remortgage deals with a maximum repayment term of 30 years, the maximum age limit of 85 is…

Read More