Boris Johnson hits the ‘Lock-Down’ button again

In a repeat of his actions back earlier in the year when he said we need to flatten the curve, Boris Johnson the UK Prime Minster is locking the country down again based on guesstimates and predictions of a slideshow of graphs.

So again it means a pause to the UK property industry and will also effect millions of small businesses across the country. Furlough scheme at 80% of wages is set to come in to play and the lock down commences on Guy Fawkes day… Millions will be only able to celebrate fireworks for ‘the plan that nearly worked to blow up the houses of parliament’ with members of their household.

Updates on the furlough scheme can be read via the official Government website here: https://www.gov.uk/guidance/check-which-employees-you-can-put-on-furlough-to-use-the-coronavirus-job-retention-scheme#history

The official Government page with regards to ‘advice on home moving during the coronavirus (COVID-19) outbreak’ remain un-updated as of time of writing this article – Check the following page should there be updates: https://www.gov.uk/guidance/government-advice-on-home-moving-during-the-coronavirus-covid-19-outbreak

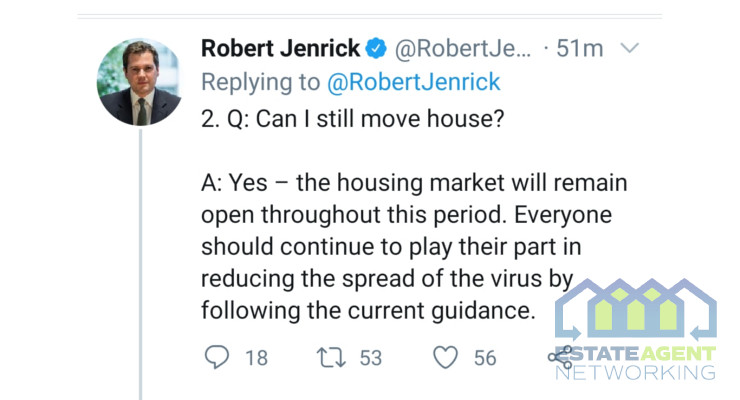

Tweets from the UK Housing Minister shows that it is business as usual though it is likely, but remains unknown, that this will involve same steps taken in previous lock down where accompanied views are not able to take place and the usage of video tours become a popular option. Mortgage payment holidays will also be extended and construction site worked are allowed to continue work as usual.

“The new restrictions will mean that in England pubs, restaurants, non-essential shops and gyms will all have to close for four weeks from Thursday (5 November), while holidays in the UK and abroad will not be allowed.” Money Saving Expert

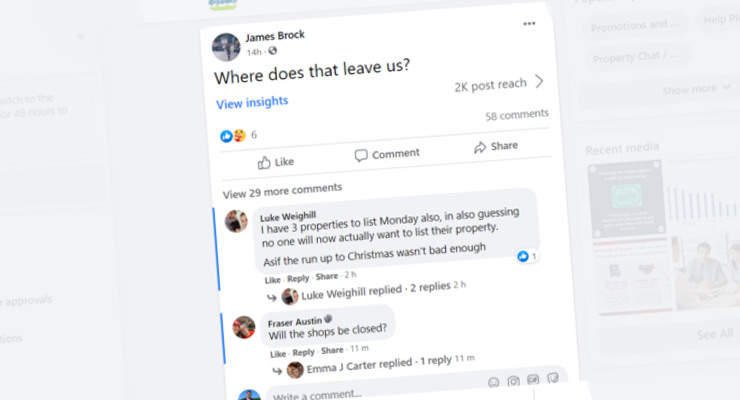

The Estate Agency Facebook page has been busy with comments, feedback and advice since the lock down news – Get involved today: https://www.facebook.com/groups/EstateAgency