Breaking Property News – 01/03/24

Daily bite-sized proptech and property news in partnership with Proptech-X.

Alto reveals ‘next generation’ of Lettings Progression

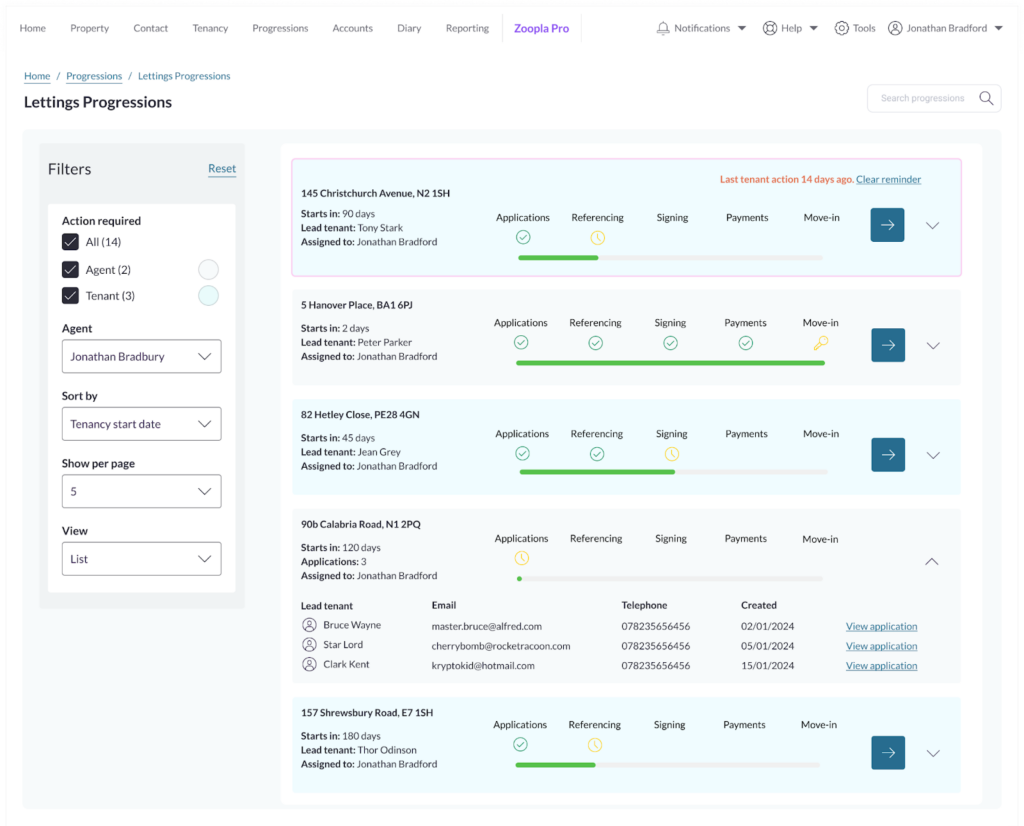

Alto, software for estate agents and part of Houseful, has revealed further information about the improvements being rolled out in 2024 to drive a step change in business efficiency for letting agents. Leading the way is a brand new Lettings Progression functionality which will roll out in the first half of 2024.

The new functionality will be an intuitive workflow to speed up and simplify the onboarding of new tenants. This new feature will enable tenants to easily access the tasks assigned to them to activate a letting such as signing documents, paying deposits and ensuring their details are up to date.

Even better for Alto customers – this upgraded Lettings Progression platform and the integrated eSign capability will be free for all letting agents using Alto’s core software offering. Many software providers charge extra for these capabilities and this investment underlines why Alto is the platform of choice for agents looking to drive efficiency with a partner focused on driving long-term value.

Other changes coming to Alto this year include a market-leading sales progression experience, that integrates agents and conveyancers, for a faster, less frustrating and more profitable transaction, in addition to new reporting dashboards that are unique to the user and can help them identify where they should focus their time e.g. on a particular vendor, applicant or transaction.

Alto is also investing in functionality to help agents prepare for valuations. Winning instructions is a critical part of an agent’s ‘day to day’ and Alto is committed to being at the core of supporting an agent’s success in this space. The newly launched property valuation tool provides agents with insights and information on both the property and the surrounding area. Agents will also be able to access this information while out and about via Alto’s ‘on the go’ offering.

Birchgrove and Hybr launch intergenerational living scheme

A unique partnership will see students, key workers and retirees live together at new north London retirement development. Birchgrove, the UK’s leading provider of rented retirement homes, and Hybr, the UK’s leading student letting platform, today announce an industry-first intergenerational living scheme which will see students and key workers live alongside retirees in the same purpose-built, privately rented retirement development.

Ayrton House is a new 60 apartment rental retirement community in Mill Hill, North London. When launched in October this year, 16 apartments across the third and fourth floors will be offered exclusively to trainee doctors and nurses from the local hospital, university post-graduates and graduate scheme students. The pioneering scheme has been designed to generate a vibrant community by harnessing the benefits of intergenerational living, with several pieces of research highlighting how the model is physically and mentally beneficial for both the young and elderly.

A 2019 UCL study highlighted how increased social contact for elderly people is associated with a lower risk of developing dementia, while an Ageing Research study has highlighted how intergenerational living benefits the elderly by giving them a greater sense of purpose and combatting loneliness, in turn leading to a greater life expectancy. Further research has also demonstrated how younger people benefit from living with elderly people – by enabling them to gain a deeper understanding of the older generation, and increasing their tolerance, empathy and understanding.

Laura Hamilton to present Guild Awards at the Annual Guild Conference

The Guild of Property Professionals is thrilled to announce that Laura Hamilton, renowned TV Presenter, Property and Travel Expert, and Entrepreneur, will be presenting the Guild Awards at the Annual Guild Conference and Awards Gala on 22 March 2024, at The QEII Centre in Westminster, London.

Titled “Sharing Success,” the full-day conference promises to bring together innovative and passionate Guild Members alongside industry pioneers for an event exclusive to The Guild’s network. The conference, spearheaded by Iain McKenzie, CEO of The Guild of Property Professionals, will focus on championing industry successes both within and outside the network.

McKenzie remarked, “This year’s Annual Conference will spotlight industry legends across sales and lettings, providing Members with invaluable networking opportunities and insights to navigate the evolving property market. We aim to equip our Members with practical knowledge and inspiration for the year ahead.”

Highlighting the accomplishments of Guild Members throughout 2023, despite market challenges, McKenzie emphasised the importance of recognising and honouring agents who have gone above and beyond for their clients and the industry. The presentation of the Guild Awards during the afternoon session will serve as a testament to these achievements.

If you have a view – please let us all know by emailing me at editor@estateagentnetworking.co.uk – Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X