Breaking Property News – 15/04/24

Daily bite-sized proptech and property news in partnership with Proptech-X.

Ascendix deep dives into the world of the AVM

This month Yana Yarotska from Ascendix gives some thought leadership on the operational world of AVM’s and how Artificial Intelligence plays into the mix.

‘AI property valuation refers to the application of artificial intelligence, such as machine learning and automated valuation models (AVMs), to determine the property value. AI analyses vast sets of data including features of the property, like its location, condition, and number of rooms, and estimates property’s worth.

Property valuation AI capabilities include predicting property price for sale, lease, or evaluating the house price for rent and other investment. In our article, we delve into the details of machine learning algorithms used for developing AI appraisal app from scratch, as well as present a complete and comprehensive guide on how to create and train the machine learning model for your own AI valuation tool.

AI Valuation Process: What It’s Usually Like

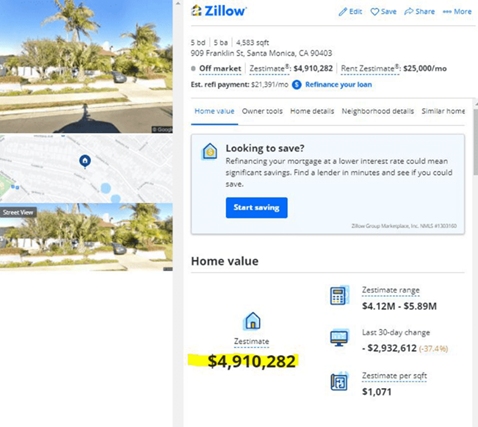

Talking about AI in real estate valuation, consider the likes of Zillow’s Zestimate or Airbnb’s property valuation tool. Both are property marketplaces and both aim to inform landlords about potential sale or rental values while providing the same insights to buyers or tenants. Here’s the usual workflow of such an AI valuation tool:

Data input. The user inserts the information about their property, such as the address, square footage, number of rooms, age, type, and others into the tool.

Data collection and analysis. The AI model, trained to evaluate the parameters entered by the user and analyse how they influence property price, collects the data inserted previously. Afterward, the real estate appraisal technology identifies the correlations between the inserted parameters of the real estate valuation data set and the property prices, assessing the approximate property worth.

Data output. When the data has been collected and analysed, the system can provide an estimated property value to the user.

The process of AI real estate valuation seems quite simple and straightforward, but behind it, a great deal of work has been conducted to train the AI model with machine learning for real estate and teach it to provide accurate and relevant results. The algorithm can be applied for both rent and property valuation sales assessment, which makes AI a suitable and optimal choice for both marketplace owners and real estate agents and brokers. The dataset and features used for training would still be different, though.

Why Does Every Property Marketplace Need AI Property Valuation Features?

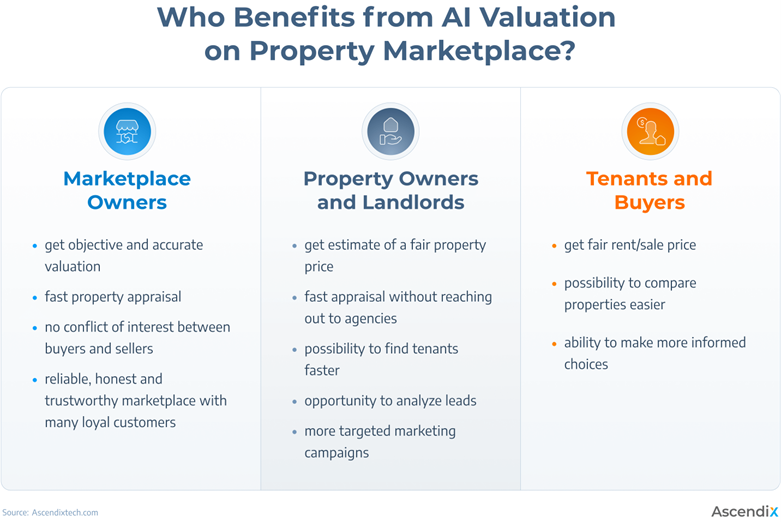

AI property valuation offers multiple benefits for all parties involved in property leasing, buying, selling, or renting. Marketplace owners who use AI real estate valuation provide objective, timely, and accurate property appraisals for all users of their marketplaces.

Moreover, using AI means the elimination of possible conflicts of interest between buyers, who want the lower price, and property owners, who want to sell at a higher price. AI valuation bases its price assumptions on data, which does not take sides and represents an objective and unprejudiced point of view. This increases the reliability and trustworthiness of the marketplace, therefore enhancing user experience and customer loyalty.

Property owners and landlords, who want to sell or let real estate, instantly get an estimate of the fair price. Machine learning real estate valuation technology saves their money for hiring real estate valuation agents while giving valuable insights into how much the property is worth. This also means the property would not stay empty for long, equalling even more saved finances and resources. Except for this, AI property valuation even gives the possibility to analyse the leads and generate more targeted marketing campaigns.

Tenants and buyers are sure they get fair rent or sale prices while using AI valuation. Furthermore, AI gives them the ability to compare property prices with similar ones, which ensures a more transparent and high-level user experience.

Why Train Your Own AI Property Valuation Model?

Developing and integrating a custom AI property valuation model into your marketplace may seem quite a difficult task. However, there are multiple benefits to doing it with machine learning real estate technology rather than buying a ready-made tool or integrating an already existing model into the marketplace.

Data security. Training and developing your own AI real estate valuation tool ensures the highest level of security possible, eliminating the slightest possibility of your clients’ or business data being sold, stolen, or just accidentally leaked onto the world web. Sensitive data stays under your control within the boundaries of the business, and it is used securely and confidentially only by the parties who have been provided access to it.

Moreover, Ascendix, as a software development company, has the security certification ISO 27001:2013, which means that the processes in our company, including both operational ones and software development, fit the standard and keep your data safe.

Valid and reliable predictions. If the real data from your marketplace is used, it ensures the highest probability of the estimation to be accurate and reliable. Large datasets give the best predictions, however, for businesses that have a smaller database data enrichment can be conducted, to ensure that the model has enough data to learn from. Adapted to your needs. The model specifically trained for your marketplace would fit your marketplace best so that it would be possible to integrate unique features or data points that are relevant to your user base.

Full control and accountability. Training your own model for machine learning real estate valuation means the tool will be fully adapted to the marketplace type: residential or commercial, rental or sale, short- or long-term stays, etc. Also, it gives the possibility to set your criteria for the properties being appraised and this way gain a unique competitive advantage.’

To read the full article which first appeared today in America or to find out more about Ascendix just click on this LINK.

Hodge launches innovative one-stop-shop for energy efficiency via Propflo

Specialist lender Hodge has joined forces with Propflo, an award-winning PropTech startup, with the aim of helping customers make their properties more energy-efficient and environmentally friendly. Propflo’s data-backed property platform ‘GreenVal’ has been designed to take the complexity out of retrofitting. Taking into account different property locations, types and budgets, the platform provides a simple, online view of improvement options a homeowner can select to achieve a more energy-efficient home.

GreenVal will be available to all new purchase and remortgage Hodge customers via intermediaries, offering a one-stop-shop where homeowners can:

1) View the short and long term benefits and costs associated with making a property more energy efficient.

2) Get quotes for a wide range of home improvements, from accredited local and national suppliers.

3) Explore low-cost and do-it-yourself improvement opportunities, available for direct purchase.

4) Gain insight into the impact a property can have on personal wellbeing, by rating contributing factors such as thermal comfort, air quality, and financial stability.

Amanda Davies, Proposition and Insight Manager at Hodge, said: ‘Having searched the market for ways to help our intermediaries engage their customers in energy-efficient solutions, we found many tools either had highly variable data quality, involved too many steps or required too much input from customers.’

‘When we saw the customer journey and capabilities of Propflo’s GreenVal tool, we were really impressed and are hugely excited to be launching it with our intermediary partners.’ Hodge Bank highly values the trusted role its brokers play in advising customers on all aspects of property ownership, and works hard to support customers in identifying and fulfilling long term needs.’

Luke Loveridge, Founder and CEO at Propflo, said: ‘I was very impressed by Hodge’s drive and ambition to tackle the challenge of decarbonisation and energy-efficiency. Hodge now joins a growing number of lenders and brokers using our technology to help them to focus on what they excel at – providing innovative products to help people protect their most valuable financial assets – while offering support to their intermediaries, mitigating risk and realising opportunities around the complex retrofit process.’

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X