Breaking Property News – 22/12/23

Daily bite-sized proptech and property news in partnership with Proptech-X.

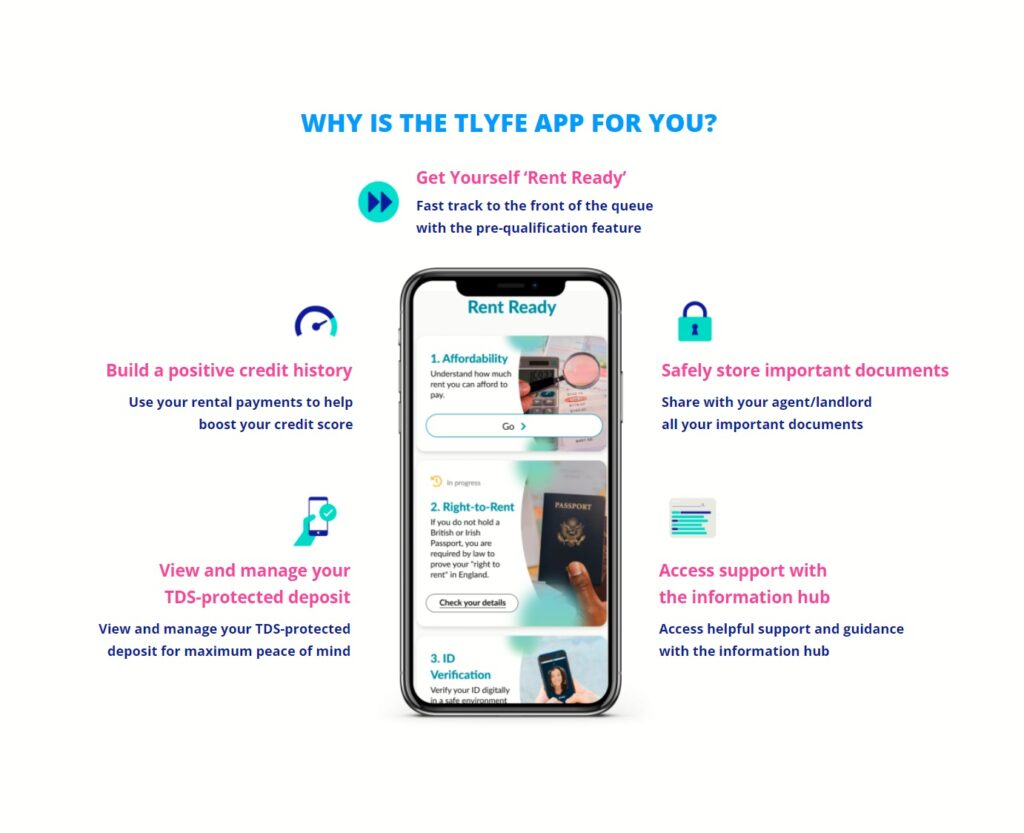

tlyfe offers Rent-Ready applicant tenants to agents for free, so everybody wins

tlyfe is the revolutionary Tenant Lifecycle App designed to redefine the rental experience. At tlyfe, they understand the challenges that both tenants and agents face in the rental market. That’s why they have now introduced industry first feature – Rent Ready. This innovative offering is tailor-made to assist agents by streamlining the tenant selection process.

The core of tlyfe’s Rent-Ready solution revolves around providing agents with fully verified, validated, and comprehensively referenced applicants. This means that agents no longer need to invest extensive time and effort into background checks and reference validation, as Rent-Ready delivers pre-screened, “ready-to-rent” applicants.

tlyfe is an App that tenants download and as Adam Pigott CEO of tlyfe (powered by Openbrix) comments, ‘By offering Rent-Ready applicant tenants to agents for free, so everybody wins. When I last checked tlyfe was the 75th most downloaded App in the UK. Given that there are 2.18m Apps in the UK….we are thrilled to have climbed so high so quickly!’

With a 21.5% drop in completed sales in 2023, will 2024 be a better time to sell your home?

Was 2023 a good year for vendors looking to sell and for residential estate agents in the UK, well the answer is no. Breaking it down the scores on the doors are pretty grim, in 2022 there were 1,124,765 completed sales. This year completions are likely to be 883,341, a minus of 241,424 properties for the year. A huge drop in the number of people moving.

It is not only the volume of sales that is dropping, in July 2022 house prices were up 16.2% on the previous July, but in July 2023 house prices were up by just 3.2% on the year before. With national house prices going backwards ending the year hovering around +2% to -1% against 2022.

So as a national average, agents completed on 21.5% less property and house prices declined, what then in 2024 will reverse this trend, or accelerate it? We are all about to find out.

PEXA Group completes acquisition of Smoove PLC

PEXA Group Managing Director and CEO, Glenn King, said: “PEXA and Smoove share the common goal of simplifying and enhancing the home moving process through digitalisation. The acquisition will help both companies significantly reduce transaction times, while simultaneously removing the pain points across the process. I am excited to welcome the Smoove team to the PEXA Group. This acquisition will further assist PEXA in bringing its world-leading technology to the UK market. Smoove’s position in the UK market will allow us to build additional scale and depth, while allowing the PEXA product suite to reach more customers.”

The acquisition of Smoove via a UK scheme of arrangement was overwhelmingly approved by Smoove shareholders on 14 November 2023. The acquisition was sanctioned by the court on 15 December 2023 (UK time) and became effective on 19 December 2023 (UK time). Smoove will be delisted from the Alternative Investment Market of the London Stock Exchange by 7am on 20 December 2023 (UK time).

The acquisition values Smoove at £30.8 million (A$58.6 million) on a fully diluted basis and has been funded through cash currently held by PEXA, which has been drawn down from its existing facility and a newly established facility.

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X